Copy Trading Guide

Copy trading is a simple method of investing. A user essentially replicates trader’s investments using automated tools and signals. Copy trading is widely used for forex assets, US stocks, and DeFi products like cryptocurrency. Importantly, it can be an effective strategy that suits both swing trading and day trading timelines.

This tutorial provides a complete 101 guide to copy trading and explains its definition, meaning, and process. We also give information on what to look for when choosing between copy trading brokers and platforms.

Top Brokers

The best broker for copy trading will depend on individual requirements, such as asset range, risk appetite, trading strategy and the degree of automation offered. With that said, some of the top brokers that accept copy trading in 2025 include eToro, Pepperstone, XM, NinjaTrader, Deriv, OctaFX, Coinbase and Binance.

What is Copy Trading?

Copy trading does exactly what it says on the tin. Investors choose a successful trader and place the same trades as them, either manually or automatically through trading robots. They “copy” the trades. Traders communicate their positions using software, which transmits signals via Telegram, websites, mobile apps, and other popular communication methods.

In most cases, investors pay fees to receive signals on brokerage sites like eToro and OctaFX. However, free services are offered on occasion, much like a demo account.

Copy trading is perfect for beginners, as it allows them to start investing without much knowledge of a particular financial market. However, as with any form of trading, it carries risk. The copy trades placed can be lucrative or costly, and investors should not expect every trade to be profitable.

eToro Platform

A Brief History

Copy trading first appeared on the scene in 2005. Investors realized the benefits of automated or algorithmic trading, and out of this developed copy and mirror trading. This was an automated investing system where traders would share their trading history for others to follow.

Tradency first proposed an auto trading system named Mirror Trader. An investor could host their trading strategy on the system with records that showed the strategy’s performance, and other users could copy it. Following this, traders could connect their personal trading accounts to the platform directly. This meant all trading actions were automatically uploaded to other users without the need for the master trader to log in to their account and submit quotes and trades.

Since 2010, copy trading has grown in popularity, with many online brokers offering easy-to-use systems.

How Copy Trading Works

Copy trading allows you to link part of your trading portfolio with another investor’s portfolio, open and close the same trades as them automatically or manually, and set the same stop-loss measures.

One of the key things to remember is to follow a trader whose investment style matches your own. If you are a conservative trader, you want to copy someone who follows a relatively risk-averse trading style. If your goal is to be a growth investor, you do not want to copy a trader who only looks at value or dividend stocks.

Once you have selected a trader to follow, you are ready to get started. If the trader invests in a Bitcoin CFD, you will also invest in the same CFD. Similarly, if they decide to short gold (XAUUSD), you will short gold as well. The trader essentially gives you tips to follow.

Here are a couple of detailed examples to bring the process to life…

Example 1: Copy Trading Long-Term Investment Portfolio

This example focuses on long-term shares and stocks investors:

- You identify an expert stocks investor on your copy trading platform

- You opt to invest $2000 into your copy trading account

- The selected trader has 60% of their portfolio in Microsoft stocks

- Additionally, the trader has 20% in Apple stocks and 20% in Salesforce stocks

Upon confirming your investment with your copy trading system, your portfolio would look like this:

- $1200 worth of shares in Microsoft (60%)

- $400 worth of shares with Apple (20%)

- $400 worth of shares at Salesforce (20%)

From the example above, it’s evident that it does not matter how much your chosen copy trader invests in the platform. Instead, your portfolio is graded like for like, depending on the percentage of stocks invested in specific markets.

Example 2: Copy Trading Forex Short-Term Portfolio

This example explores short-term copy trading forex portfolio (swing trading)

- You invest $2,000 into your copy trading software platform

- The chosen trader enters a purchase order on GBP/EUR at 1.1809

- Your selected trader risks only 3% of the capital investment with leverage of 1:30

- In that case, you will also put a purchase order on GBP/EUR at the same percentage of your capital. Therefore, you will risk $60

Upon entering the position above, your trade outcome will depend on the selected trader. If they make a profit, you will earn. Similarly, if the rates go against the chosen trader, you will lose.

Suppose after 4 days, the trader exits the trade when GBP/EUR is at 1.2045. In that case, the following will happen:

- This rate interprets to a 2% gain

- Based on the amount you staked, you gain a $1.2

- Like your copy trader, you made leverage of 1:30

- After closing your position, you will make a total of $36 in profit

Signals

Signals are what the trader often uses to provide real-time data to subscribers. The signals are triggers to buy or sell an asset. These are determined by the trades that a professional trader places, precisely mimicking what they placed and allowing the user to copy that trade manually or automatically. In most cases, the subscriber pays for this service.

Signals are important to the copy trading experience. Many platforms allow them to be sent directly and placed automatically, while other signal services can be sent via email, SMS, and Telegram. The key thing is to choose a platform that sends alerts via your preferred communication method.

Signals are sent, received, and implemented by a range of providers and trading bots. These include 3Commas, FBS, Royal Q, NAGA, Zignaly, and GitHub. There are online reviews and Discord pages discussing the best options. Many of these providers use third-party platforms, while some offer freely downloadable bespoke trading platforms.

Market Access

Copy trading can be conducted on almost any market, asset, and product. Forex currency pairs are among the most popular, but stocks on markets like the NASDAQ and the NSE are also prevalent, as well as indices and commodities. Recently, cryptocurrencies have grown in popularity. It is even possible to copy trade hedge fund investments, as well as crypto futures through exchanges like Binance.

Strategies

Investors should ensure that their trading goals align with the objectives of their chosen master trader. Some of the key considerations include:

- Markets: This relates simply to which markets you want to be active in. Decide whether you want to copy trade forex, indices, stocks, cryptocurrencies, commodities, or all of them, and select a provider that matches your appetite.

- Leverage: Trading with leverage allows you to increase potential profits with the same amount of capital. Trading with leverage can increase both winnings and losses, so ensure you take a careful approach to risk management.

- Risk: This is one of the most important factors to consider. Do you want to be following a lot of risky trades that offer big win potential, or do you want to follow conservative trades that may not return as much profit but will be successful more consistently?

- Fixed or flexible: A fixed system will copy all trades from your chosen master provided, either manually or automatically, while a flexible system gives you more control over the trades you choose to place.

- VPS: A VPS is not vital for copy trading. However, it means you can place and close trades all the time without your platform needing to be open. This can prove useful when swing trading.

Platforms

Brokers offer copy trading through different software or third-party platforms. Some providers may also offer additional tools through forums or TradingView. This section looks at a few popular terminals. This is not a top 5 list, as there are many great options—these are just some of the most popular.

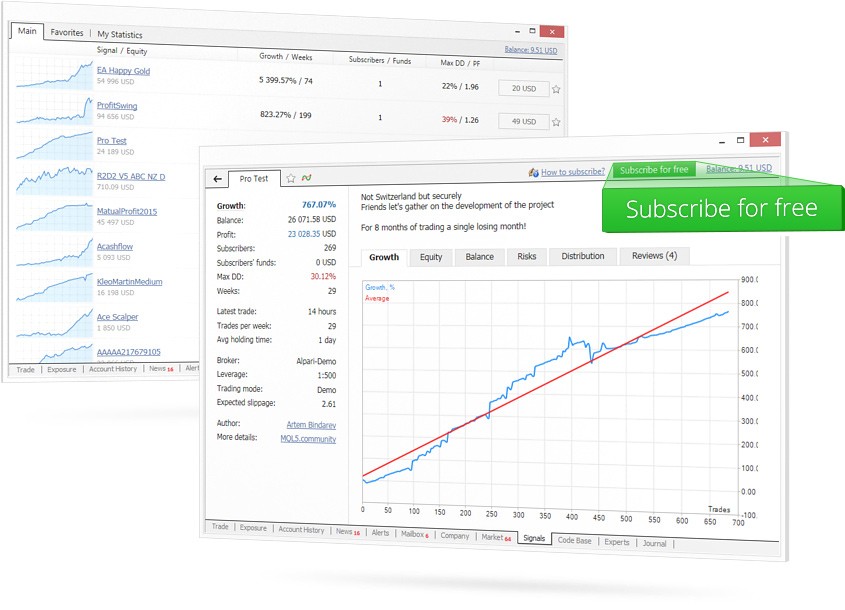

MetaTrader 4

Copy trading with MetaTrader 4 (MT4) is one of the most popular options. The platform is well established and used by many brokers for forex and CFD trading. MT4 is set up so that traders can copy the positions of successful investors.

Users can access over 3,200 signals from expert advisors (EA) and top forex providers. The signals are ranked according to their performance and strategy. This makes it easy for users to select the right provider for their goals. MT4 even allows traders to conduct copy trading inside a demo account, meaning users can get acquainted without risking real capital.

MetaTrader 4

MetaTrader 5

MT5 is the follow-up to the successful MT4 platform. Like its predecessor, it makes copy trading simple and easy, allowing users to replicate trades automatically. One enticing feature of MT5 is that the master trader and follower do not need to use the same brokerage, as the platform connects them regardless of this and location.

DupliTrade

DupliTrade is another popular platform. Users can set up the number of trades they would like to copy and select different assets, including forex, stocks, indices, and commodities. All providers are checked via an audit process, which ensures they provide safe and useful signals instead of scams.

Users are presented with heaps of data relating to the performance of signals before they sign up, allowing them to make educated decisions on which traders to follow.

cTrader

Copy trading with cTrader is also popular. Users can explore a range of strategies and compare fees, levels of risk, and the historical performance of different providers. Users also have the freedom to select what percentage of trades they want to back from a trader and how much they wish to stake. The platform even allows users to copy multiple providers at a time.

Pros and Cons

Pros

The key benefits of copy trading include:

- You do not need to spend time researching price trends

- You can diversify your investment portfolio

- Knowledge of the markets is not required

- Platforms are usually regulated

- Mirror successful traders

- Great for beginners

Cons

Disadvantages of copy trading include:

- You give up a degree of control over the trades you place

- You must trust another trader’s research

- Less control over risk levels

- No guaranteed returns

- Potentially high fees

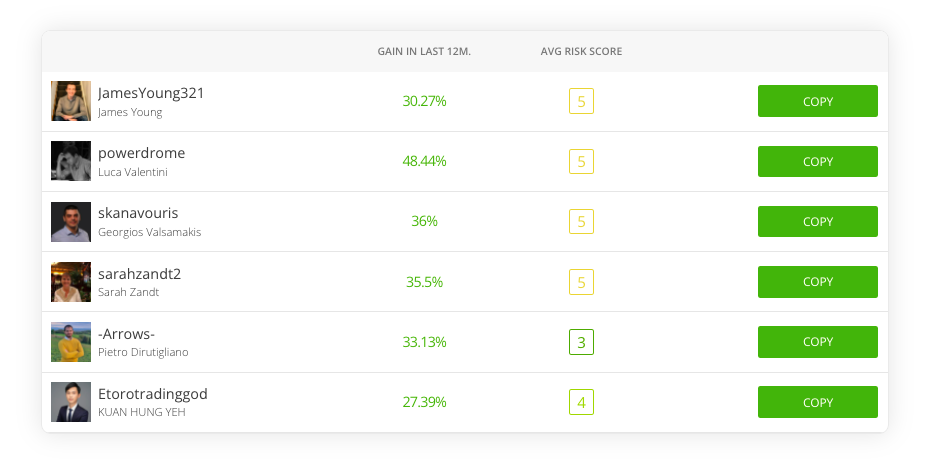

How to Choose a Copy Trader

Picking your go-to copy trader is arguably the most crucial aspect when it comes to copy trading. This is because this trader will determine all your trading decisions. Remember, if you choose an untrustworthy copy trader, the chances of making losses are high. Here are key things to guide you through the process of choosing your preferred copy trader:

Asset Type

Experienced traders often specialize in specific financial markets. For instance, a successful forex trader barely touches futures, cryptocurrencies, or ETFs. Instead, they maintain their lanes. Therefore, you need to filter potential copy traders based on the assets you’re interested in.

For instance, if your preferred asset is in forex, look for copy traders who focus on the currency arena.

Historical performance

Don’t select a copy trader randomly. You may end up losing your hard-earned investments. That said, always check their historical trading performance to determine how well they perform and your expected return on investment.

Average Trade Duration

Different traders use different trading styles. While others may prefer holding their trade positions for a couple days, others don’t leave it open overnight. Check your copy trader’s average holding period. This way, you can select a trader that matches your financial goals.

How to Choose a Broker

There are many options when it comes to online brokers, so knowing how to choose the right one for you is important. The key factors to look out for are:

- Fees: If you are swing trading, fees are important. Check the different swap rates charged by each broker. These are incurred when you hold positions overnight. In addition, check deposit and withdrawal fees, as well as any commission charged.

- Typical spreads: Compare the average spreads offered at each broker. These will impact how much profit you make, particularly when copy trading forex assets.

- Minimum deposit: The minimum deposit is a key factor when selecting any broker, and it is no different when copy trading. Platforms with low minimum deposit requirements are a good option for beginners.

- Mobile app: If you are looking to conduct mirror trading on crypto or any other asset on the move, the broker must offer a mobile app. This will allow you to copy trade no matter where you are. OctaFX, for example, offers an iOS app.

- Customer support: Make sure the broker you choose offers suitable levels of support. If you encounter any issues, this will ensure they are solved as quickly as possible.

- Trading platforms: Check the platforms each broker offers. Make sure your chosen broker uses a platform that is suitable for copy trading (such as MT4) and one that is always online for swing trading.

- Payment methods: Compare the different payment methods available at each broker. Pick a provider that accepts the solutions you would usually use, with minimal or no fees.

- History: Have a look at the history of different brokers. Do they have reputable pasts? Ensure your chosen broker has operated for a few years with suitable regulatory oversight.

Copy Trading vs. Social Trading

Copy trading replicates trades, and the main gain is profit from the results. Social trading is slightly different: users gain ideas and insights from other investors on websites and platforms. From this content, they develop their own trading strategies and plans and choose which trades to place.

If you are a beginner, social trading could be more beneficial, as it teaches you to understand market trends. It gives investors an effective tutorial about the world of trading and market analysis.

Copy Trading vs. Bot Trading

Copy trading and automated bots are equally popular among investors, and in many cases, they work together. Both systems allow users to generate money with minimal effort and without deep market knowledge. Trading bots can be set up to copy master trader’s transactions and mimic their investing style.

Regulations Explained

Copy trading is a completely legal process in almost all countries. However, this does not mean you should trade without caution. Always trade with a broker who holds a license with a top regulatory body like the Cyprus Securities and Exchange Commission (CySEC), the UK Financial Conduct Authority (FCA), or the Australian Securities and Investments Commission (ASIC).

Bottom Line

Copy trading is suitable for beginners who do not yet understand the financial markets and want to gain experience with minimal effort, as well as experienced traders who do not have time for research. There are numerous providers out there, each offering different strategies and levels of risk. Use our guide to get started today.

FAQ

Is Copy Trading Profitable?

Copy trading is among the most profitable investment strategies with limited effort. Traders only need to identify the best copy trader to copy signals from. In the past, there were concerns regarding its profitability and risks. Recently, copy trading has become a highly profitable and easy-to-integrate trading strategy. Note: Even though a copy strategy is easy to set up, it does entail a loss of control over your money. Profits are not guaranteed and you might end up losing your investments.

Can Copy Trading Make You Rich?

You are unlikely to get rich from copy trading alone. It is possible to make profits, but do not treat it like a get-rich-quick scheme. As with all investing, it will require monitoring and refinement.

Which Countries Accept Copy Trading?

Copy trading is accepted in many countries around the world, such as the UK and other European countries, the United States (USA), Canada, Malaysia, Philippines, Singapore, Australia, New Zealand, Indonesia, Kenya, Japan, Hong Kong, the UAE, and Pakistan.

Is Copy Trading Halal?

This depends on the account used when copy trading. If your chosen broker offers a swap-free account, it may be compliant with Sharia law and, therefore, suitable for Muslims. Consult your local religious leader for guidance.

Do You Pay Tax On Copy Trading?

Copy trading is taxable the same way as profits from any investments. It all depends on tax rules in the country you trade in. Speak to a local tax advisor for guidance.

Is Copy Trading Legal In India?

Copy trading is legal in India, although it is fairly uncommon. Social trading is more commonly available, but international brokers like OctaFX do offer the service in India.