Venmo

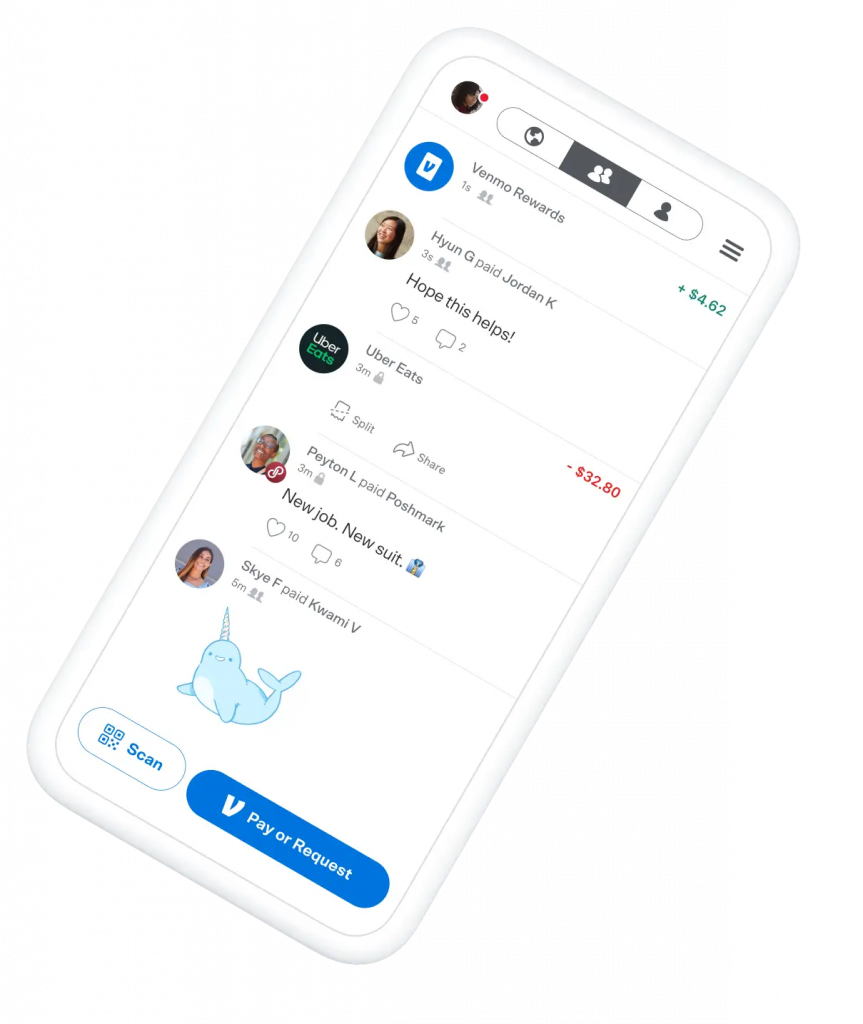

Venmo is a digital wallet used by traders to make deposits and withdrawals at online brokers. In this guide, we cover how it works and sending money, the registration and login process, app downloads, user reviews and more. We also run through common error messages and supported vendors.

Brokers in United States with Venmo

What is Venmo?

Venmo is a mobile payment service with a history dating back to 2009 when Andrew Kortina and Iqram Magdon-Ismail founded the platform. Braintree purchased Venmo in 2012. Then it became a PayPal company with the giant acquiring Braintree the following year. The firm has 70+ million users, annual revenues of $900+ million, and a net worth valuation of around $40 billion.

If you are a US citizen, you can download the app on your iPhone (iOS) or Android (APK) device, using the App Store or Google Play. With it, you can make deposits and withdrawals to and from trading brokers. Unfortunately, the wallet isn’t available internationally.

In 2021, the company began offering the ability to buy, hold and sell cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. A Venmo debit card is also available. The card can be used to withdraw money from ATMs with the Mastercard, PULSE, and Cirrus brands accepting transactions. Importantly, users have to pay a charge if they withdraw from a machine that is not part of the MoneyPass network.

Venmo also offers a credit card. The card has a QR code so others can scan it and see your profile. They can also send you money or request a payment. A virtual card number distinct from the standard 16 digit number is visible and can be used to make online purchases.

Transaction Times

If you want to make an instant transfer from your bank to Venmo or vice versa, it usually takes around 30 minutes. Transferred money appears immediately in your account. On the other hand, a standard deposit or withdrawal through a credit card, debit card, or bank account, can take 1-3 business days.

Venmo is a fast method with often instant transfers at brokers. Some deposit and withdrawal times vary, but most platforms process payments within seconds. The key thing that can delay payments is KYC checks that your broker may need to complete at the withdrawal stage.

Pricing Review

Deposits to your Venmo account are free and so is sending money to other users. The standard withdrawal to your bank account is likewise free and it usually takes up to 3 business days to clear. For swing traders, money transfers at brokers are generally fee-free, but this can vary.

Importantly, you incur fees if you send money to your bank account using instant transfers. Venmo charges 1.5%, with a maximum fee capped at $15 per transaction. If you have the debit card, you may also pay ATM fees. ATMs in the MoneyPass network are free to use, but the rest cost $2,5 – $3. The ATM withdrawal ceiling for the Venmo debit card is $400 per day.

Cheques are priced at 1-5% with a minimum of $5. If you want to transfer money through a credit card, Venmo will charge you 3%. Fortunately, holding cryptocurrencies is free though purchases and sales are charged between $0.50 (minimum) and 2.3% (maximum).

Your initial deposit and receiving limit is $299.99 per person. Upon verification, your weekly rolling max transfer increases to $4,999.99, while the daily limit is set at 30 transactions.

Security

Venmo is a reputable and safe payment method for swing traders. The service protects consumers’ financial data using encryption measures and passwords. You can also activate multi-factor authentication (MFA) when signing in, including two-factor authentication (2FA). This adds a layer of security to your account. All you need is a phone number to receive your code. Another way to protect yourself is to validate your financial details if your account is connected to a bank or card.

The company, by default, exposes all peer-to-peer transactions (except the amount) – publicly broadcasting personal information. Users have to modify the application’s “Privacy” settings to make transactions private.

To prevent being hacked and falling for email scams, you should always keep your details and codes private. If you have any concerns regarding your account security, the company has customer service operators available online and on the phone – (855) 812-4430.

Pros of Venmo for Traders

Advantages of trading with Venmo include:

- 3D Secure

- Promo gift cards

- 4 digit security code

- Accepts prepaid ecards

- Easy transfers to brokers

- Options for business users

- There are no monthly or yearly fees

- Users can log in and organize into groups

- You can have two accounts or a joint solution

- Ability to purchase various goods and services

- Venmo is owned by PayPal, a reputable brand

- Good for crypto traders as it accepts Bitcoin, Ethereum, Litecoin and Bitcoin Cash

- Easy to get in touch with support – they offer help online via the official website or by phone

- You can link debit and credit cards to your account. The credit card also offers usage rewards

- You can view your monthly and yearly statements in a few clicks, meaning tax reporting is more straightforward

Cons of Venmo for Traders

Disadvantages of trading with Venmo include:

- Transfer limits per day

- Not available if you are under 18 years of age

- The brand has a history of undervaluing customer privacy

- The fee structure is complex, with some fees exceeding 5%

- Focused on peer-to-peer transfers rather than specifically designed for investors

- Limited crypto options – coins such as XRP, USDT, SHIB, and ADA are not accepted

- Buyer protection is lacking and only inactive accounts can cancel a Venmo payment. If you make a transaction to the wrong person or amount, you may not be eligible for a refund

- Venmo is only available in the US and compatible with bank accounts and phone numbers in the same region. This means swing traders from other countries, such as Europe and the UK, will need to find equivalents

How to Make Venmo Deposits & Withdrawals

To sign-up with Venmo, follow these simple steps:

- Download the mobile application

- Choose a sign-in method and password (between 8 and 32 characters long)

- Add a phone number and email address

- Pass the identity and bank account verification process

Once registered, making direct deposits and withdrawals at trading brokers is straightforward:

- Log in to your trading account

- Find “Deposit/Withdraw Funds” under settings

- Select Venmo as the payment method

- Enter the amount and confirm the transaction

Note, steps may vary between brokers – check your broker’s FAQ portal for details.

Verdict

Venmo is a fast and versatile payment method for investors. You can get a branded debit or credit card to access funds similar to a bank account. The digital wallet is also an excellent alternative to competitors like PayPal, Revolut, Monzo and Zelle cashapp. On the downside, if you are based outside the US, you will need to sign up with another provider.

FAQ

Can You Venmo To PayPal?

Yes, you can link your bank account to both Venmo and PayPal. In your app, select “Transfer to bank” and enter the amount, then choose a transfer option. Now go to your PayPal account, click on “Transfer money” and then “Add money to your balance”. Finally, choose the bank account that’s liked to both wallets. The funds should arrive in your PayPal account in 3-5 business days.

Is Venmo Safe?

Yes – the wallet uses encryption technology and multi-factor authentication (MFA). This means personal contact information is kept secure from fraudsters and hackers.

Is Venmo International?

No – you can only use Venmo if you are based in the US. This is a major drawback for traders in other regions. So if you get an error message saying “Venmo is not available in my area”, consider competitors like PayPal instead.

Is Venmo Free?

It is free to open an account and most transfers don’t come with a charge. However, if you want to speed up payments to your bank account, you will be charged a fee of 1.5%. See our pricing review above for a breakdown of individual charges.

Is Venmo Anonymous?

No – you can’t pay someone anonymously. By default, all transactions are displayed on the public social feed. Fortunately, privacy settings can be amended in your account area.