AvaTrade is a global broker with over 300,000 customers throughout the world, including from the UK and South Africa. The firm specialises in forex and CFD trading and is regulated by several top-tier financial institutions. The broker’s brand ambassador is the Olympic gold medalist, Usain Bolt, and trading conditions and services are competitive. Check out this 2025 AvaTrade review to find out more about the firm’s fees, assets, platforms and more.

What Is AvaTrade?

Company Details

AVA Trade EU Limited (AvaTrade Ltd.) has its headquarters in Dublin, Ireland. As well as its head office, the company has regional locations in Australia, Japan, UAE and South Africa (Johannesburg, Sandton).

AvaTrade is available to traders from the UK, South Africa, Australia, Dubai, Kuwait, Qatar, Japan, Hong Kong, Jamaica, Jordan, Kenya, Zimbabwe, Nigeria, China, France and Germany, as well as a whole host of other countries. AvaTrade does not accept US clients. Traders from the USA will need to look for other brokers that are regulated by the Securities and Exchange Commission (SEC).

AvaTrade is not an ECN broker.

History

AvaTrade is a market maker and dealing desk broker. This means the firm will act as the counterpart to any trade you make. AvaTrade is currently planning an IPO to be listed on the London Stock Exchange, though the dates are not yet confirmed.

Markets

In total, AvaTrade offers over 1,200 tradable instruments, focusing on forex, equity CFDs and cryptocurrencies. Different securities are available depending on which platform you choose to use. Leverage is available on all assets, although limits will depend on your jurisdiction and chosen instrument.

Assets include:

- Cryptocurrencies: 20 major cryptos and altcoins, including Bitcoin, Ethereum and Ripple, as CFDs against the US dollar

- Commodities: CFDs on 10 precious metals, energies and soft commodities (including crops and lean hogs livestock)

- Indices: 38 thematic and global index CFDs like the S&P 500, NASDAQ 100, US 30 and Volatility (VIX 75)

- Stocks: CFDs on 600+ company shares from major global exchanges. AvaTrade pays out dividends

- Forex: 50+ major, minor and exotic currency pairs. These are available as CFDs or vanilla options

- Bonds: Speculate on Euro bund and Japanese government bonds

- ETFs: 60 CFDs on popular global exchange-traded funds

Platforms

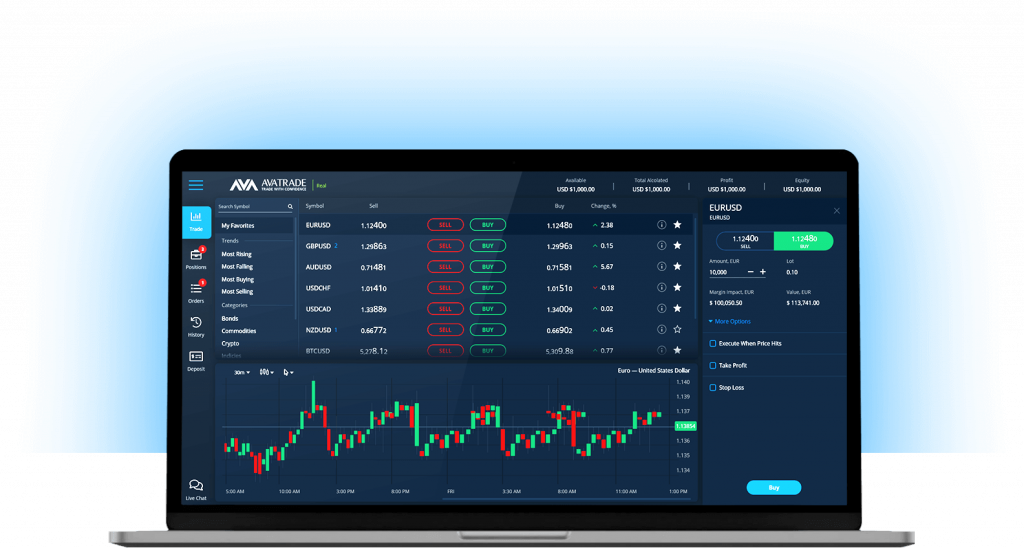

WebTrader

The AvaTrade web platform is designed specifically for novice traders. There is no need to download or install anything as it can be used on all major web browsers. Charts come with 90 indicators and the platform automatically integrates with trading tools from Trading Central.

The software offers close to 200 tradable instruments, including several major and minor forex pairs. The search function makes it easy to find an asset but the interface lacks any customisability.

The WebTrader allows users to execute three basic order types: market, limit and stop. You can also set a “good ‘til time” (GTT) limit, which sets the exact date and time for the expiry of an order.

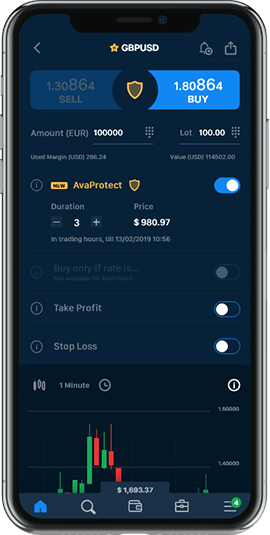

AvaProtect, a unique feature offered by AvaTrade, is available on the web platform. This allows traders to purchase insurance at a pre-determined fee and guarantees that any losses will be reimbursed. This feature is only available on market orders.

AvaTrade WebTrader

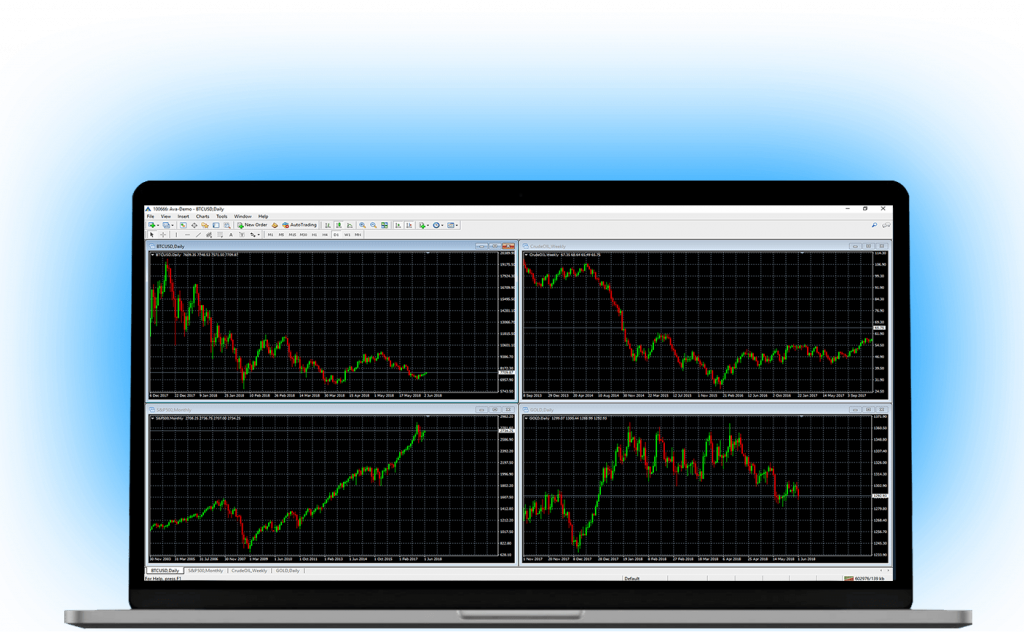

MetaTrader 4 & 5

The MetaTrader platforms are among the most popular and widespread in the market and are available in a vast array of languages. AvaTrade gives users access to both the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. Both of these give users access to a higher number of assets than the WebTrader, over 800, with the increase coming mainly from stock and ETF CFDs. The full range of AvaTrade individual stock and ETF CFDs can only be found on MT5.

MetaTrader offers an improvement in customisability and a wide range of chart types, signals and indicators. However, it is not possible to search for an asset by its name. MetaTrader is typically used by traders that employ short to medium-term strategies, such as swing trading and spread betting.

MT4 and MT5 can be downloaded for desktop (Mac, Windows and Linux) or mobile (Android or iOS) devices. AvaTrade also offers MetaTrader demo accounts.

MetaTrader

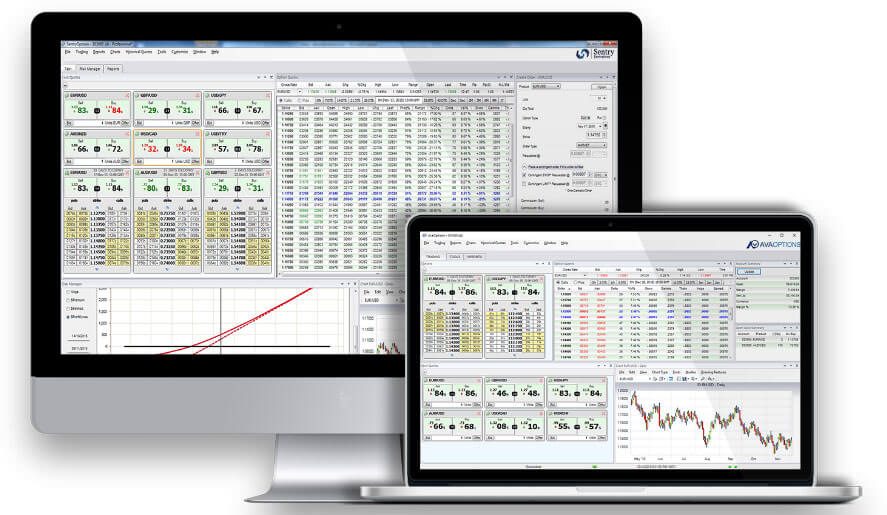

AvaOptions

AvaOptions is AvaTrade’s proprietary options-focused platform. It is only available in English and can be downloaded for desktop or mobile. You can choose from options contracts on more than 40 currency pairs with a range of strategies, including straddles, strangles, risk reversals and spreads.

AvaOptions

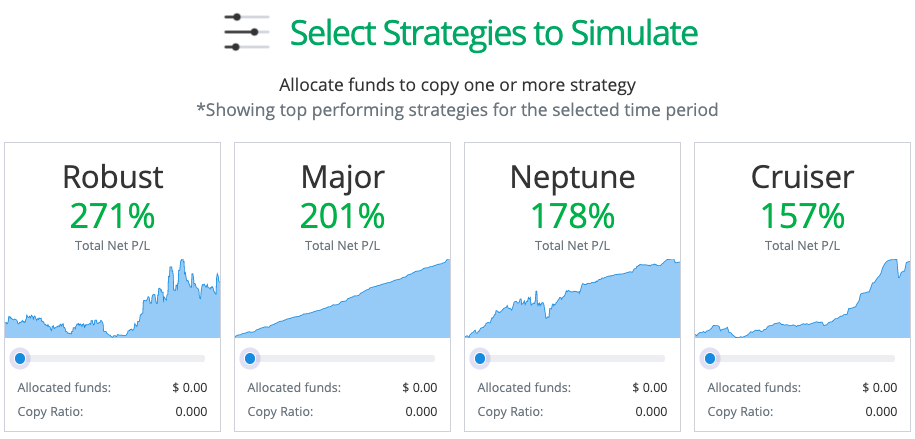

DupliTrade

This platform allows users to automatically duplicate the trades made by vetted professional traders. A minimum deposit of $2,000 will give you access to a portfolio of strategy providers, each representing different methods and trading styles. DupliTrade will send signals directly to your AvaTrade account and you can set up auto-execution for automated copy trading.

DupliTrade

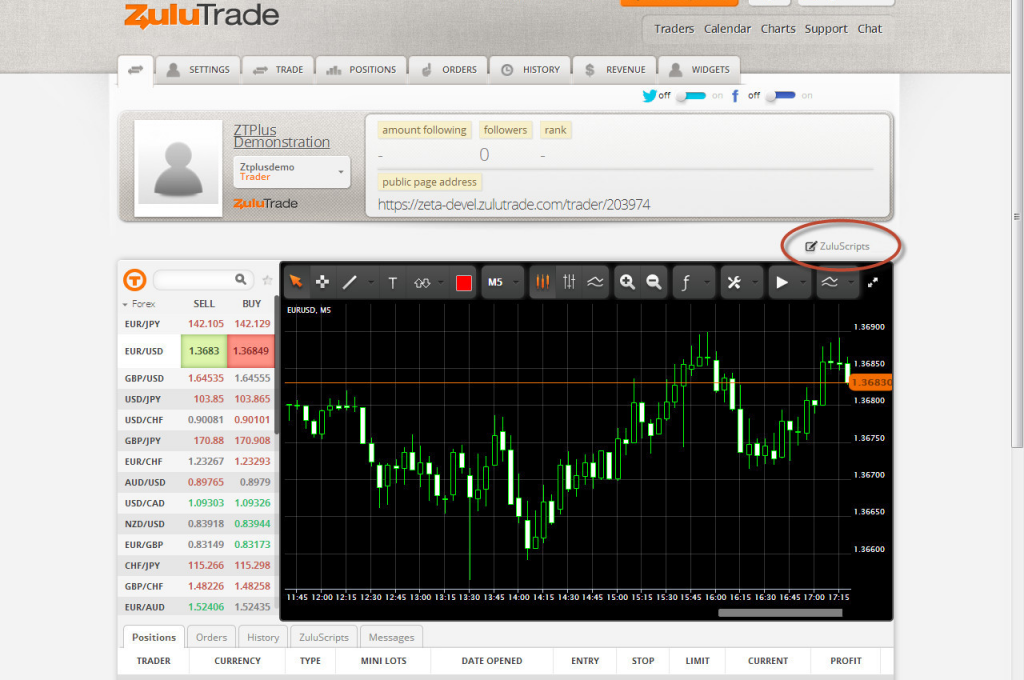

ZuluTrade

This is an auto copy trading platform that links with your MT4 account. With a minimum deposit of $500, you will gain access to over 10,000 traders that you can follow and imitate. If you wish to practise your copy trading strategies before investing any real capital, you can also open a ZuluTrade demo account that is loaded with $100,000 in virtual funds.

ZuluTrade

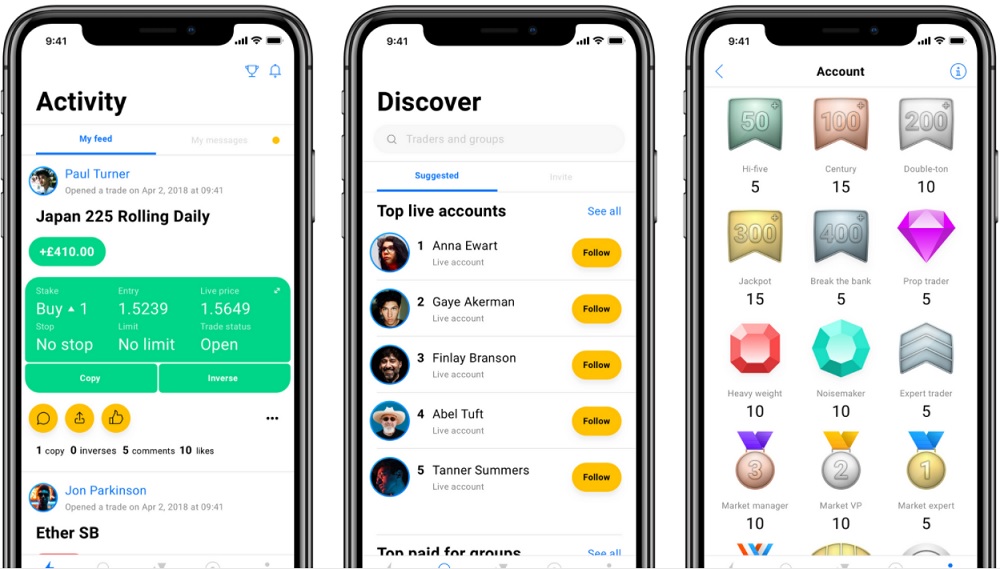

AvaSocial

AvaSocial is a social trading app that lets users follow and copy the trades of a variety of experienced traders. The application, offered in partnership with FCA regulated Pelican Trading, is a simple, user-friendly platform designed for traders of all levels.

AvaSocial

Mobile Apps

AvaTradeGO is the broker’s dedicated mobile platform. It gives users access to over 250 tradable instruments, including forex, commodities, stock and indices. The application also includes the AvaProtect feature and can set price alerts and push notifications.

AvaTradeGO

AvaOptions also has a mobile solution that has entirely the same functionalities as the desktop platform. Like AvaTradeGO, it is available to download for Android (APK) and iOS devices from the Google Play Store and the Apple App Store.

The broker also offers a range of platform options and tools that focus on automated and copy trading strategies. These third-party features connect with your existing account through programme interfaces known as APIs

Trading Accounts

AvaTrade has one standard account type for forex and CFD trading known as a retail account in Europe. In certain countries, this can be opened as a joint account and shared with other traders. If you wish to trade options, you will need to open a dedicated options account. Traders with more experience are eligible for professional account types. However, these require relevant experience in the finance sector, proven trading experience or a sizeable financial portfolio.

Accounts can be opened in six base currencies: USD, EUR, GBP, CHF, AUD and ZAR. Only Australian and UK clients can open AUD and GBP accounts, respectively. AvaTrade’s ZAR account makes it a popular choice for South African traders. Clients whose main currency is not available can still open an account but may need to pay conversion fees.

If you wish to test out the broker’s features before investing any of your own money, demo accounts are available across all platforms. This is a great way to trial strategies in real market conditions and see if AvaTrade is best suited to your needs.

The firm also offers Islamic, halal, swap-free accounts. Our review found that, with these, no rollover fees or swaps are charged on overnight positions. Cryptocurrency trading is not possible on Islamic accounts.

AvaTrade Leverage

In Australia, South Africa, the UAE, the EU and the UK, the leverage rate for major forex pairs is 1:30, which equals a margin requirement of 3.33%. Less commonly traded currencies, like the Russian Ruble (RUB), have lower leverages of around 1:20 in Europe, Australia and other countries. Countries with less tight regulation such as Indonesia and Malaysia have leverage caps as high as 1:400 for major pairs.

Leverage for commodities CFDs is generally around 1:10, though more liquid assets like gold and crude oil often have higher limits. UK, EU, UAE and Australian clients can access leverage rates of up to 1:5 with stock CFDs and 1:20 for indices. ETF leverage rates are capped at 1:5, while cryptos can be leveraged at only 1:2. However, international clients can access much higher rates, even 1:25 for cryptos.

Fees

The minimum spread for forex majors is pretty standard for dealing desk brokers. The broker advertises the EUR/USD to be 0.9 pips, though this drops to 0.6 pips if you qualify for a professional account. AvaTrade does not offer zero-spread ECN accounts, though Muslim traders can find Sharia-compliant swap-free accounts. However, these will display wider spreads.

The firm incorporates its forex and CFD trading fees into the spread, so it does not charge commission. Clients can calculate charges like overnight funding fees using the calculator on AvaTrade’s website.

AvaTrade charges a quarterly fee of $50 after three months of inactivity. Clients will incur a further $100 administration fee after one year of inactivity.

Payments

Deposits

AvaTrade requires a minimum deposit of $100, or 100 units of the base currency. There are no deposit fees. The minimum deposit is higher on the copy trading platforms. Clients can fund accounts using bank transfer, credit/debit cards or e-wallets such as Neteller, Skrill, Klarna, WebMoney and POLi in Australia.

Withdrawals

Withdrawals can be made via any of the methods listed above. AvaTrade charges zero fees and there is no withdrawal limit. Processing times vary but will typically take between three to five business days.

AvaTrade Regulation

AvaTrade has top-tier regulation across six jurisdictions worldwide:

- AVA Trade EU Ltd – The Central Bank of Ireland, which caters to European clients and offers protection of up to €20,000

- Ava Capital Markets Australia Pty Ltd – The Australian Securities and Investments Commission (ASIC) in Australia

- AvaTrade Middle East Ltd – The Abu Dhabi Global Market Authorities Financial Services Regulatory Authority (ADGM – FSRA), which caters to clients in the Middle East

- Ava Capital Markets Pty – The Financial Sector Conduct Authority (FSCA) in South Africa

- Ava Trade Japan K.K. – The Japanese Financial Services Agency (FSA) in Japan

- AVA Trade Ltd – The British Virgin Islands (BVI) Financial Services Commission, which caters to other international clients

Security

AvaTrade follows strict know-your-customer (KYC) procedures but most platforms do not offer two-factor authentication (2FA), which would give users an added level of security. The company has a long track record and provides negative balance protection in all countries, regardless of whether the local regulator requires it. With that said, in November 2021, the Polish watchdog, the KNF, placed the Irish broker on a caution list.

Customer Support

AvaTrade customer service is available 24 hours a day Monday to Friday but not at weekends. You can contact the firm via live chat, phone or website-embedded email in over ten languages including English, Arabic, Chinese, French, Italian, German and Russian. The live chat function is also directly available from the AvaTradeGO mobile app. The live chat is quick and responsive during working hours and there is a long list of phone numbers available for each country and time zone.

However, having 24/7 customer support is always useful, should you encounter an urgent withdrawal problem and need help over the weekend.

You can read or watch reviews and testimonials to find out more information about AvaTrade on websites such as Trustpilot, Quora and YouTube.

Education & Research

AvaTrade’s research and education tools are widely available across all its platforms. Through a third-party research provider called Trading Central, the firm provides trading ideas based on technical analysis. This information covers commodities, stock indices and most forex pairs. It also applies to a range of trading styles, including swing trading, scalping and hedging.

Clients also have access to fundamental data on AvaTrade’s economic calendar, which contains a wide range of annual reports and earnings releases. You can click the “Impact” button to view historical data related to an upcoming economic event. The “Market Buzz” feed on the WebTrader is slightly more informative than the news feed on MetaTrader. However, this information should always be viewed critically and in conjunction with other research methods.

Technical analysis training

The broker also provides a comprehensive education portal that provides a beginner’s trading guide, economic indicators, how to trade video tutorials and a forex e-book. The videos are high-quality and informative. The firm also hosts regular webinars.

Advantages

Benefits of registering with AvaTrade include:

- Islamic accounts

- Options trading platform

- Top-tier global regulation

- Negative balance protection

- More than 1,200 instruments

- Free deposits and withdrawals

- Range of online trading platforms

- Multilingual, responsive customer service

Disadvantages

Drawbacks to opening an account with AvaTrade include:

- Full range of assets only available across multiple platforms

- No single platform with full asset range

- Market maker execution model

- Limited promotions

- High inactivity fees

Trading Hours

Forex markets are open 24/5, with trading breaks on the weekends. Most other assets follow the opening times laid out by their exchanges and markets. However, cryptocurrencies are available 24/7.

AvaTrade Verdict

AvaTrade has a proven track record and boasts top-tier regulation across the globe. Even when the regulator does not enforce negative balance protection, the firm still offers it to every customer, proving their client-orientated focus. The firm has a wide array of tradable assets to choose from across an impressive range of platforms. Clients across the world can access copy trading, automated trading and cryptocurrencies from the software they prefer, with competitive trading conditions and transparent pricing. Check out AvaTrade using its free demo account today.

FAQ

What Is The Minimum Deposit On AvaTrade?

AvaTrade’s minimum deposit for a standard retail account is $100, or 100 units of your base currency. This can be USD, EUR, GBP, CHF, AUD or ZAR. The broker does not offer KWD accounts. Copy trading on ZuluTrade requires $500, whereas the use of DupliTrade requires a $2,000 deposit.

Is AvaTrade A South African Broker?

AvaTrade is a broker based in Dublin, Ireland. It offers accounts in a range of currencies, including the South African Rand, making it a popular choice for South African traders.

Is AvaTrade A Good Broker?

AvaTrade is a reliable broker with many years of experience in global markets. The firm offers competitive spreads and a wide range of tradable instruments across several platforms. Always read the terms and conditions and be sure to open a demo account and compare the broker against competitors before investing any real money.

Is AvaTrade A Market Maker?

AvaTrade is a market maker, also known as a dealing desk broker. This means the firm acts as the counterpart to all your trades. The firm is not an ECN broker, so marks up spreads.

Is AvaTrade A Scam Or A Legit Regulated Company?

AvaTrade is regulated across six global jurisdictions and is a legitimate trading company, not a scam. The Central Bank of Ireland, the Australian Securities and Investments Commission (ASIC) and the Financial Sector Conduct Authority (FSCA) in South Africa are some of the institutions that regulate the firm. The broker provides negative balance protection for clients in all jurisdictions.

Can I Trade Options With AvaTrade?

Yes, it is possible to trade options contracts with AvaTrade. However, you must do so through the firm’s dedicated options trading platform, AvaOptions.

Does AvaTrade Allow Copy Trading?

AvaTrade offers the automated social and copy trading platforms DupliTrade, ZuluTrade and AvaSocial. Each caters to copy traders of different levels of experience and require a different minimum deposit to the standard brokerage account.

Does AvaTrade Offer An Islamic Account?

Yes, AvaTrade offers a swap-free solution for traders of the Muslim faith. Note, Islamic accounts will incur wider spreads.

How Do I Withdraw From AvaTrade?

It is free to withdraw from AvaTrade and you can do so via credit/debit card, bank transfer and e-wallets such as Neteller, Skrill, Klarna, WebMoney and POLi. To do so, simply login to your account, go to “Withdraw Funds” and select your method and amount. The broker usually processes withdrawals within three to five working days.