Brokers With The Best Risk Management Tools

Brokers with the best risk management tools help traders limit losses and protect profits. The top platforms offer a suite of risk management alerts and techniques, from stop-loss and take profit orders to deal cancelation and hedging features. In this guide, we list the brokers with market-leading risk management tools in 2025. We also share tips for managing risk when trading the financial markets.

Recommended Brokers With The Best Risk Management Tools for United States

The Role of Risk Management

To make stable, long-term returns, traders must take a careful approach to managing risk. Without an effective strategy, a series of big losses can wipe out trading capital. Equally, one severe loss could put beginners in the red. American Business Leader, Gary Cohn, summed it up nicely: “If you don’t invest in risk management, it doesn’t matter what business you’re in, it’s a risky business.”

The best traders use risk management tools to generate consistent returns over the long term. Savvy investors know that not all trades will make money. However, they also know that if they can limit the severity of losses while maximizing profitable trades, then they will have a better shot at profits in the long run. Arguably, it is the approach taken to risk management that separates the novice trader from the seasoned investor.

Fortunately, brokers with the best risk management tools today offer a suite of comprehensive features, including push alerts to mobile devices, risk calculators, stops and limits, plus portfolio rebalancing features.

Risk Tolerance

The first step in developing a risk management strategy is determining your risk appetite or tolerance. This is essentially how much exposure or potential loss you are willing to absorb. Fidelity, for example, offers a free risk and reward calculator that helps you define your tolerance in numbers.

Of course, some markets are also notoriously risky, with cryptocurrencies in particular not suitable for risk-averse traders. More than $200 billion was erased from the value of cryptos in a single day in May of 2022. But as well as the markets you speculate on, some trading strategies are riskier than others, with intraday scalping in large lot sizes often bringing more risk than long-term buy and hold approaches.

Risk Management Tools

The best brokers support and provide a range of risk management tools and services:

Hedging

The top platforms support hedging strategies where you essentially take the opposite position in a related asset. Hedging is best thought of as a form of insurance. Let’s say you believe in the long-term prosperity of Tesla but you are concerned about the volatility in the price of batteries. Swings in the value of batteries could impact the electric car manufacturer’s profits. To protect against price uncertainty, Tesla could buy a futures contract that enables the firm to buy batteries at a set price at a specific date in the future. This will enable it to have confidence in its future operating costs.

Note, traders may take a hit to potential profits by paying for protection, known as a ‘premium’.

Diversification

The best brokers also offer portfolio rebalancing tools. A diverse investment portfolio will essentially spread capital across various markets and products, from forex and stocks to spot and derivative instruments. Let’s say you put all of your trading capital in two cryptocurrencies. If the value of these cryptos plummets, you could lose all of your funds. However, if your capital is spread between those two cryptos, plus eight stocks and gold, if the value of the digital currencies falls, you still have other positions that could make money and offset any losses.

Importantly, a portfolio balancing tool will make recommendations about how to spread your pot between risky and more stable assets. The best brokers also provide a service where portfolios are automatically rebalanced at regular intervals.

Deal Cancellation

Some brokerages offer a deal cancellation feature which lets you back out of a position should the market move against you. This usually comes at a cost but essentially provides a safety blanket. There is also normally a time limit within which you can activate the feature. Not many brokers offer this service but it is popular with beginners starting out.

Asset Selection

Risk-averse traders may want to avoid highly volatile markets, such as cryptocurrencies. Instead, traders could open an account with a broker that provides access to safer assets like bonds, defensive stocks, and safe haven currencies like the Swiss Franc.

Leverage

The top brokers also limit the amount of leverage that retail traders can use. So where some offshore firms offer leverage up to 1:1000, which means that for every $10 you can trade with $10,000, EU-regulated brokers cap leverage to 1:30, which means that the same $10 gives you $300 in trading power. The downside of trading with high leverage is that losses are amplified as well as profits, making it a riskier form of trading.

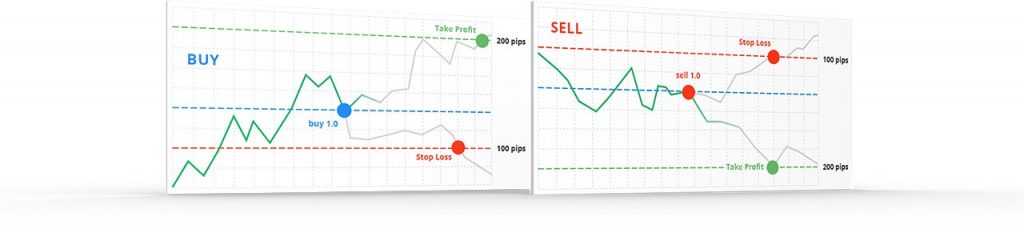

Stop Loss

Most brokers with risk management tools provide a trading platform that offers stop-loss orders. Put simply, a stop-loss is an order to buy or sell an asset when the price reaches a particular point. It is used by investors to limit the potential loss if the market moves against you.

Let’s say you buy 10 Apple shares at $145 each (total price: $1,450). If the stock price falls then you risk losing a significant sum. However, if you place a stop-loss at $140, then your broker would automatically sell your 10 Apple shares at $140, limiting your loss to $50 (10 * $5 = $50).

Investors simply need to decide how much they are prepared to lose and then enter a stop-loss order on their trading platform.

Stop-Loss Orders on MT4

Take Profit

The flip side of a stop-loss is a take-profit order. This is where your position is automatically closed once an asset returns sufficient profit.

Using the example above, let’s say you bought 10 Apple shares at $145 each (total price: $1,450). If you placed a take-profit order at $150, then your brokerage would automatically sell your shares when the price reached $150. This would give you a profit of $50 (10 * $5 = $50).

Both orders can be used together to limit your potential losses and protect potential profits.

Charts & Indicators

Brokers with the best risk management tools provide user-friendly charts and indicators. This allows investors to conduct sufficient market analysis and price research. Importantly, this can help you indicate upper and lower price boundaries to supplement any pending orders that you want to implement.

The top platforms, including MetaTrader 5, offer customizable charts, free signals and alerts, plus indicators like moving averages, pivot points and average true range.

Risk Management Tips

The 1% Rule

A popular risk mitigation technique used today is the one-percent rule. This says that you should only invest 1% of your capital in a single trade. And while this will severely restrict your profit potential if you are a beginner with less capital, you significantly reduce the chances of a couple of bad trades wiping out your pot.

Adopt this approach at the beginning and you will also establish good risk management practises as you grow your capital and become a more experienced investor.

Demo Trading

Investing online is an emotional activity, especially for retail traders who put their own money on the line. Now while this can make it fast-paced and exciting, it can also bring additional stress when the market moves against you. It is all too easy to get caught up in a particular trade and make rash decisions.

With this in mind, it is important that you try to leave your emotions at the door. That’s why we recommend starting out with a demo account where you can develop discipline, learn to follow a strategy, and make any refinements before you put real money on the line. Fortunately, most brokers with the best risk management tools offer free paper trading accounts in 2025.

Bottom Line on Brokers With Risk Management Tools

Trading requires patience, discipline and a sensible approach to risk management. The top traders develop not just a robust mindset but also turn to brokers with the best risk management tools to help them protect profits and limit losses. From pending orders to deal cancellation features and risk calculators, make the most of the services available.

FAQ

Which Is The Best Risk Management Tool?

Among the most popular risk management tools are stop-loss and take-profit orders. These instruct a broker to buy or sell an asset when a specific price is reached, limiting the potential downside and safeguarding profits. Other popular features include portfolio balancing services and hedging support.

Where Can I Learn About The Top Brokers For Secure Trading?

You can read reviews and ratings of the best brands here. Alternatively, you can read customer reviews on social media websites such as Telegram, Discord, Facebook, and Reddit. These websites host large trading communities where you can discuss different brokers and share tips.

How Will Risk Management Affect My Returns?

Introducing risk management to your trading strategies may reduce the potential profit you can make from each trade. However, in the long run, risk management tips and tricks can help you generate more stable, consistent returns. They are key if you want to have a long and fruitful trading career.

Where Can I Conduct Trading Technical Analysis?

Brokers with the best risk management tools provide a trading platform where you can conduct detailed market analysis. Some brokers use a proprietary platform while others turn to third-party software like MetaTrader 4 and MetaTrader 5. These platforms offer various charting options, trading signals, level 2 market data, plus a range of indicators to overlay on charts.

How Does A Stop-Loss Order Work?

A stop-loss order will automatically buy or sell an asset when the price hits a certain point. So if you buy 10 troy ounces of gold for $1,750, you could set a stop-loss order for $1,700 to sell your holdings when the price begins to fall. This would allow you to cut your losses and prevent further damage to your portfolio.