Capital.com is a popular global broker, offering trading opportunities in over 4,000 financial markets. The brokerage targets beginner and veteran traders with user-friendly educational content, AI-driven personalisation and a suite of technical features and advanced tools. This 2025 Capital.com review will explore the key systems and features available to retail and professional clients. Find out whether a Capital.com account could meet your swing trading needs.

What Is Capital.com?

Capital.com is a global fintech company that was founded in 2016 by Viktor Prokopenya. The broker is owned by VP Capital, of which Prokopenya has 100% ownership. Revenues, net worth and profit and loss (P&L) data are not publicly available.

The company employs 800 staff across its offices in London (UK), Limassol (Cyprus), Minsk (Belarus), Gibraltar (UK) and Melbourne (Australia). It has an office in each of its major bases, with no dedicated headquarters. Jonathan Squires is the current CEO and David Jones is the Chief Market Strategist.

Capital.com has trading volumes of over USD 88 billion and provides services to 2 million clients that have registered for a live account. It is one of Europe’s fastest-growing investment and trading platforms. The company is ISO certified and has several licences and practice certificates.

Markets

Capital.com provides its clients with several different avenues for financial speculation and trading. More than 4,000 CFDs are available, consisting of 23 indices, 138 forex pairs, 24 commodities, 20 cryptocurrencies and over 3,600 company shares. Popular assets include Gamestop (GME), AMC Entertainment (AMC), Bitcoin (BTC), Ripple (XRP), gold (XAU) and natural gas (NG).

The broker also supports longer-term investments and position trading through securities investing. More than 1,000 different company shares and ETFs can be bought and sold through the proprietary platform, with fractional shares and price alerts supported. On top of this, clients can take part in financial spread betting on more than 3,000 instruments with no commissions and tight spreads for tax-free short and long-term profits.

Trading Platforms

Capital.com offers its own web-based proprietary platform, as well as MetaTrader 4 (MT4) and TradingView. MT4 and TradingView are available for download to Windows, Mac and Linux devices, while all three options have browser-based clients on offer.

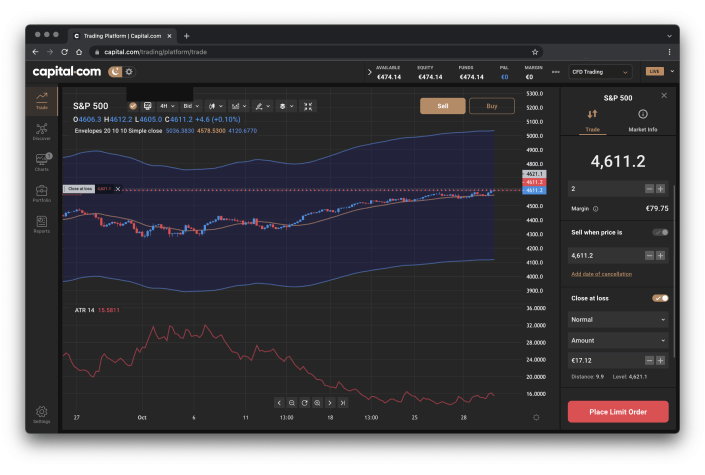

Web Platform

The broker’s proprietary browser-based platform has been designed with user experience and intuitive functionality in mind. The sleek interface boasts a competitive level of technical analysis features and charting capabilities in a modern, uncluttered style. Traditional charting can easily be combined with integrated financial articles, business analytics updates and trading education.

Key features include:

- Hedging tools

- 30+ languages

- Built-in glossary

- Automated trading

- 75 technical indicators

- Personalised watchlists

- Two pending order types

- Risk management features

- Integrated articles & education

- Up to six chart tabs in one window

Web Trader

MetaTrader 4

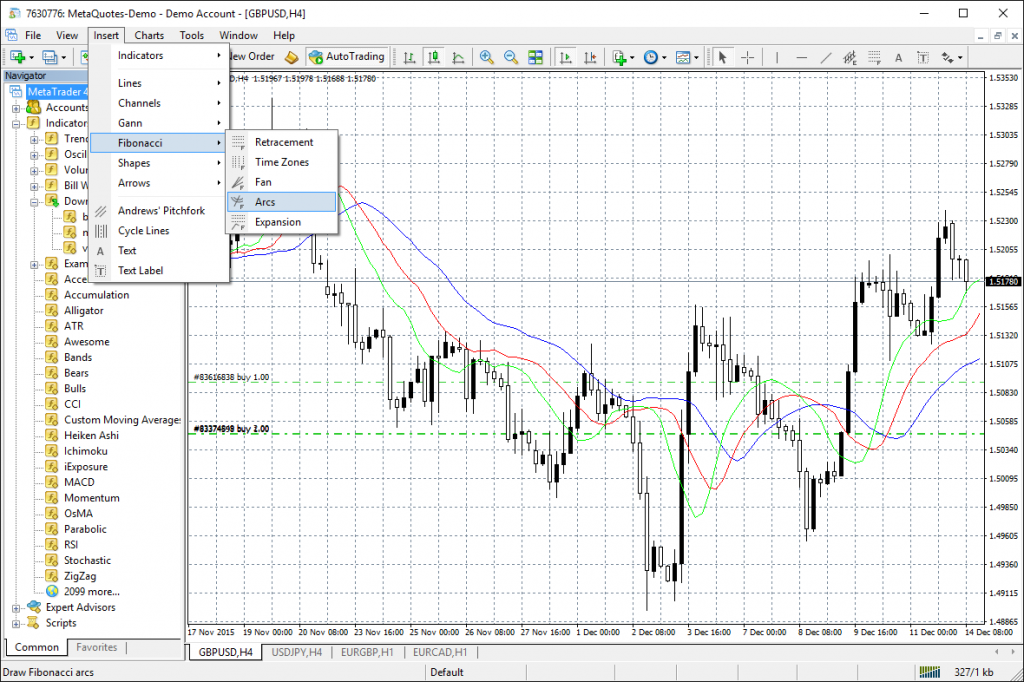

MetaTrader 4 (MT4) has been one of the world’s leading forex trading platforms for nearly two decades. Created by MetaQuotes in 2002, most online brokers, including Capital.com, now provide it as an option. MT4 has a wide range of built-in features alongside a wealth of online resources created by its users, including custom indicators, charting tools, automated trading bots (or EAs) and signals systems.

Notable features include:

- 39 available languages

- Nine chart timeframes

- 30 technical indicators

- Integrated trading signals

- Four types of pending orders

- Fully customisable charts & tools

- Automated trading through its MQL4 programming language

MetaTrader 4

Note MT4 is not available to UK customers.

TradingView

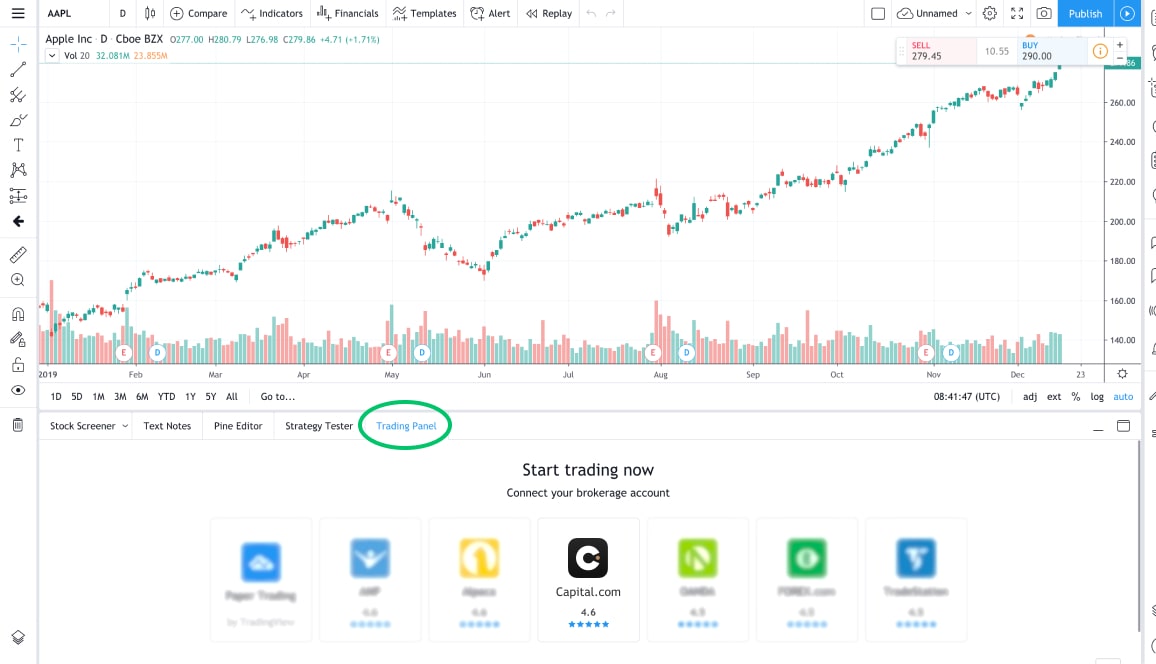

TradingView is a popular charting system and trading platform that is used by finance websites and global brokers. On top of the advanced analytical features, customisation options and data depth, the platform has hundreds of thousands of community-built indicators and tools.

Key features include:

- Level 2 data

- Market news

- 12 chart types

- 40 timeframes

- Stock screeners

- 100+ indicators

- 50 drawing tools

- Signals and alerts

- Automated trading

- Economic calendar

- Public trading chats

- Personalised watchlists

- Fundamental analysis data

- Python and JavaScript APIs

TradingView

Mobile App

Capital.com clients are spoilt for choice when it comes to mobile trading opportunities. All three desktop platforms offer dedicated, integrable mobile applications. These apps can be downloaded for free to Apple (iOS) and Android (APK) devices via the Apple App Store and the Google Play Store. Most of the top-level functionality is available on the mobile platforms, with account management, order execution and alerts functionality all provided.

However, it’s worth keeping in mind that mobile trading platforms are more difficult to use for sophisticated chart analysis and strategy applications because of their smaller screens. Moreover, some technical indicators, automation and customisation options will be unavailable due to the technical limitations of mobile devices. Overall though, mobile platforms are still good for position monitoring and the execution of existing analyses and algorithms.

Capital.com Trading Accounts

Capital.com offers accounts for both retail and professional traders, supporting up to ten live accounts per person. Accounts can be created in GBP, USD, EUR, AUD and PLN and funds can be transferred instantly between same-currency accounts.

Four live account types with negative balance protection are provided for retail customers, which support scalping and hedging, pending orders and mobile trading. The Standard account supports CFD trading across all markets, with a minimum deposit of $20 and a minimum trade of 0.01 lots. Plus accounts have a $3,000 minimum deposit, 0.01 lots minimum trade and CFD assets. Premier account holders have access to the full range of CFDs, plus exclusive private webinars and events. The minimum deposit for these accounts is $10,000 and trailing stops and OCO orders are supported.

Capital.com Invest accounts support equity investments with no commissions, transaction fees or markups. These cannot access CFD instruments but fractional shares are available.

Traders can also apply for a professional account to access higher leverage rates, though this requires sufficient trading capital and experience. If you initially choose to set up a retail account but are eligible for a professional account according to MIFID II directives, you can switch up. However, some protective measures like negative balance protection will be removed.

Opening An Account

Setting up an account with Capital.com is straightforward. Firstly, input standard know-your-customer (KYC) information, which involves a variety of personal and financial information. Next, you need to answer questions relating to your financial situation, investment experience and future goals. You can then select your account currency, upload your ID (passport, driver’s license or national ID card) and proof of residence (bank statement, utility bill, etc).

The broker requires a deposit of at least $20 and you can get started once your account is verified. Clients can also speed up the process by signing up with Apple, Google and Facebook accounts.

Demo Account

Capital.com offers a comprehensive demo account for clients and prospects to test out the broker’s services. These accounts are simulations of live trading environments, combining real-time data with digital funds, perfect for platform trials, asset exploration and strategy tests. You can create up to ten demo accounts at one time.

Leverage

Retail clients from areas within ESMA and FCA jurisdictions can trade CFDs with leverage up to 1:30. However, maximum rates vary with the asset:

- Currency Pairs – 1:30

- Equity Indices – 1:20

- Commodities – 1:10

- Equities – 1:5

- Cryptos – 1:2

Professional clients can access much higher leverage rates, capped at 1:500 for forex, 1:200 for indices and commodities and 1:20 for shares and cryptocurrencies.

Commission, Fees & Spreads

Capital.com has a transparent fee structure, charging no inactivity fees or commissions, even for Investment accounts. Deposits, withdrawals and account closures are all free, while spreads are tight and leveraged positions incur overnight fees. Typical spreads are 0.6 pips for EUR/USD, 1.3 for GBP/USD, 0.9 for the FTSE 100 and 0.02 for crude oil. This makes Capital.com a popular choice for traders looking for a low-cost provider.

Payments

Capital.com accounts can be opened in GBP, USD, EUR, AUD and PLN, removing conversion fees for clients that hold bank accounts in these currencies.

Deposits can be made via Visa and Mastercard credit and debit cards (Apple Pay & Google Pay supported), plus bank wire transfers. Clients can also use a wide range of e-wallets, including PayPal, Trustly, WebMoney, Doku Wallet, Giropay, iDeal and Sofort. Funding accounts is quick and free, with a low minimum deposit limit of $20, though bank transfers must exceed $250.

Withdrawals are supported in all of the same methods as deposits, except for credit cards. Funds must be withdrawn to the same account as deposits were made in, to reduce money laundering opportunities, and transactions are all free. The minimum limit is $50. Withdrawals may be denied if the amount is lower than this or if unusual activity is detected.

Capital.com Regulation

Capital.com is authorised and regulated by the Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the National Bank of the Republic of Belarus (NBRB) and the Australian Securities and Investments Commission (ASIC).

The FCA authorises and regulates Capital Com (UK) Limited under registration number 793714. Capital Com SV Investments Limited is regulated by the CySEC under license number 319/17. ASIC regulates Capital Com Australia Limited under AFSL 513393. Closed joint-stock company “Capital Com Bel” is regulated by the National Bank of the Republic of Belarus, registered by the Minsk city executive committee, with a certificate of inclusion in the register of forex companies No. 16 dated 16.04.2019.

Security

Capital.com has group entities that are located in London, Limassol and Melbourne, where they are authorised and regulated locally by the FCA, CySEC and ASIC. This means that users can have peace of mind knowing that the broker is regulated by several reliable statutory authorities. All deposits fall under Financial Services Compensation Scheme (FSCS) protection, meaning that, if the firm were to fail, clients would be entitled to compensation of up to £85,000. The broker is also part of the Investor Compensation Fund (ICF) in the EU, protecting local clients for up to €20,000.

Capital.com is CASS compliant, holding retail client money in segregated bank accounts with Eurobank and RBS. The broker also has robust risk management controls and transparent pricing. Data is adequately encrypted and protected according to GDPR and PCI standards. The mobile apps all have SSL encryption and two-factor sign-in authentication (2FA).

Further safety measures include the ability to control your risk with stop-loss orders and take-profit orders and negative balance protection for all retail customers.

User Reviews

Capital.com services two million traders worldwide and has generally positive customer reviews. The broker has an ‘Excellent’ rating of 4.3 from 4,500 reviews on Trustpilot, while its proprietary app has a rating of 4.7 on the Apple App Store from 1,400 ratings and 4.3 on Google Play from 25,600 ratings. The online broker has generally positive reviews on Reddit and Quora, with few complaints seen online regarding the app coming down or not working.

Additional Features

Capital.com goes beyond the standard provision of a trading platform and a few financial instruments, bringing some advanced and useful features to the table. The hedging mode allows clients to concurrently open several positions in opposing directions on the same instrument. There is also a section of the website dedicated to frequent market analysis, insights and trader support through articles, webinars and YouTube videos.

Capital.com Trading Tutorials

Clients and readers can also take advantage of Capital.com’s Investmate app, designed to teach users about finance and speculation on the go. The platform is comprehensive, letting investors select their educational goals, such as to “learn the ABCs of finance” or “grow my trading knowledge”, and producing a personalised path. There are more than 30 courses on the application, efficiently packing rich content into intuitive and sleek learning pages. The Investmate courses incorporate videos, study cards and real-world examples into one handy place.

Advantages

Benefits of registering for a Capital.com account include:

- Tight spreads

- Demo account

- 0% commission

- Personalised insights

- MT4 & TradingView access

- CFDs & securities investing

- Fast order execution (22 ms)

- Up to 10 concurrent accounts

- Reputable, four-fold regulation

- Strong privacy and security protocols

- Latest market news, insights and economic updates

- Innovative and engaging Investmate educational app

Disadvantages

Downsides to signing up with Capital.com include:

- Swap fees

- No binary options

- No Islamic accounts

- US clients not accepted

- MT4 unavailable in the UK

Customer Support

Capital.com customer support is available 24/7. The fast and reliable service is available in 31 languages and the team can quickly respond to any queries or answer questions you may have. You can also establish contact via telephone, live chat, messenger and email. The broker also has a social media presence on Facebook, Instagram, Twitter, YouTube and LinkedIn.

- Email: support@capital.com

- UK Telephone: +44 208 089 7893

- Cyprus Telephone: +357 2526 2045

- Belarus Telephone: +375 173 922 822

Promotions

As per regulatory requirements in the UK, Europe and other jurisdictions, Capital.com does not offer any promotions, deals or no deposit bonuses. Instead, the firm must rely on competitive services to attract clientele, not just financial incentives.

Trading Hours

Capital.com’s platforms can be used 24/7, though market opening times vary according to the assets being traded. Cryptocurrencies are available at any time, while forex markets are open from Sunday 22:05 GMT to Friday 22:00 GMT. Commodity CFDs are available from Sunday 23:05 GMT to 22:00 GMT on Friday. European equity CFDs can be traded from Monday 08:00 GMT to Friday 16:30 GMT. US equities are available from 14:30 GMT on Fridays to 21:00 GMT on Sundays.

Capital.com Verdict

Capital.com boasts a competitive range of trading platforms, markets and tools to clients across the world. Access to three trading platforms and over 6,000 financial instruments has helped attract its 2 million-strong client base. Moreover, the tight spreads, low minimum deposit and impressive Investmate app make the broker a great choice for beginners. Rapid execution times, extensive customisation options and advanced analysis tools also provide a competitive service for more experienced swing traders.

FAQ

Is Capital.com A Good Or Bad Broker?

Capital.com is a popular online broker, with a wide range of assets and competitive trading conditions. The firm’s intuitive web application is a slick option for beginners, while MT4 and TradingView provide more advanced capabilities.

Is Capital.com Safe And Legit?

Capital.com boasts licenses from four reputable financial agencies. The UK Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC) and the National Bank of Belarus all regulate the broker in different geographical regions. The FSCS and ICF compensation schemes protect clients and provide compensation in the case of insolvency.

Where Can Capital.com Be Used?

Clients from many countries across the world can open accounts with Capital.com, though US citizens are not permitted. Other restricted countries include Canada, Iraq, Iran, North Korea and the Bahamas.

Does Capital.com Offer A Demo Account?

Capital.com allows existing and prospective clients to create up to ten concurrent demo accounts. These provide a great opportunity to practise trading and trial the broker’s services for free.

What Is The Minimum Amount Of Capital I Need To Trade With Capital.com?

The minimum deposit required to open a Standard Capital.com account is $20. Higher-tier account types can require up to $10,000.