Best CFD Brokers in 2026

The right CFD broker can make the difference between capturing short-term market momentum and missing out. That’s why we’ve spotlighted the top CFD brokers for swing trading – offering the best mix of low costs, fast execution, and reliable platforms.

CFD Brokers for United States

How SwingTrading.com Chose The Best CFD Brokers

Our list of the top CFD trading platforms are based on SwingTrading.com’s overall broker ratings, built from 200+ individual metrics. As part of that analysis, we assess 8+ CFD-specific factors to ensure strong support for contract for difference trading.

These CFD-focused criteria include trading costs (spreads on popular assets), leverage options, and any relevant promotions for CFD traders.

The brokers featured here score highly not just in general performance – like platform usability and customer support drawing on our hands-on tests – but also in areas that directly impact CFD trading.

How To Compare CFD Brokers

Regulation & Safety

Safety is one of the most critical factors to consider when choosing a CFD provider.

This means ensuring your personal data and trading funds are secure and that the broker offers a fair and transparent trading experience—essential for swing traders who may leave positions open for days or weeks, exposing themselves to extended market risk.

To reduce potential risks, it is wise to choose brokers regulated by respected financial authorities. Nearly every country has an agency responsible for licensing and supervising brokers operating within its borders.

However, not all regulators enforce the same standards. Authorities like the UK’s FCA and Europe’s CySEC are known for strict oversight and robust consumer protections.

When swing trading, working with a broker under such jurisdictions helps ensure that sudden market volatility or broker-related issues won’t compromise your funds or positions.

Also, look for CFD accounts that offer protective features tailored to the realities of swing trading.

These include segregated client accounts to keep your capital separate from the broker’s money, negative balance protection to prevent losing more than your deposit, and strong account security measures like two-factor authentication (2FA) and encrypted connections.

Markets & Assets

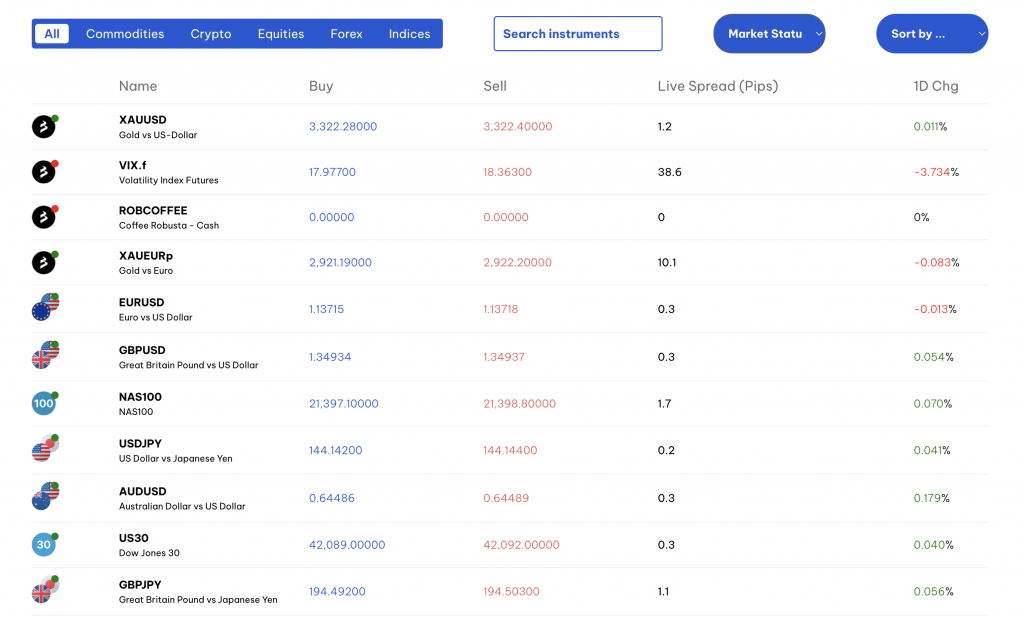

CFD brokers give traders access to a wide range of financial markets, allowing you to speculate on price movements without owning the underlying assets.

Swing traders can tap into dynamic markets such as stocks, forex, indices, commodities like gold and oil, and even cryptocurrencies like Bitcoin and Ethereum.

While leading brokers provide an extensive selection across these categories, some specialize in specific markets, offering deeper liquidity or tighter spreads.

For example, a swing trader looking to ride short-term momentum in tech stocks might choose a broker that excels in equities. In contrast, another targeting gold price swings might prefer a broker known for offering commodities.

Before committing to a live account, it’s important to confirm that the broker offers CFDs in the markets you plan to trade. This will ensure that you have access to opportunities that match your strategy.

BlackBull Markets offers over 26,000 tradable CFDs

Forex

CFDs are a go-to instrument for swing traders looking to capitalize on price swings in the forex market.

Many brokers we’ve tested cater specifically to forex enthusiasts, providing access to all seven major currency pairs—including EUR/USD, GBP/USD, and USD/JPY—usually with tight, competitive spreads.

However, the real differentiators among brokers often emerge in their offerings of minor and exotic currency pairs, where spreads and liquidity vary widely.

For instance, a swing trader targeting medium-term trends in pairs like AUD/JPY or USD/MXN may benefit from a broker offering deep liquidity and reasonable fees in these less-traded pairs.

Commodities

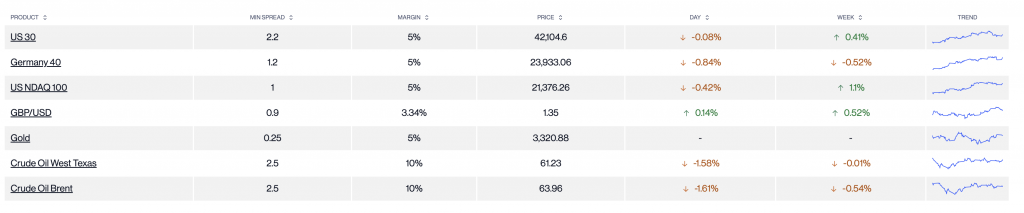

Top CFD brokers typically offer access to key commodity futures markets, including precious metals like gold and silver on the London and New York exchanges and energy assets such as crude oil and natural gas.

These markets can be ideal for swing trading, where price patterns unfold over days or weeks due to supply disruptions or geopolitical events.

Moreover, many CFD brokers are broadening their product offerings, exposing you to soft commodities like coffee, cocoa, and orange juice, semi-precious metals, and additional energy products such as heating oil or ethanol.

For example, suppose you anticipate a seasonal price increase in natural gas due to colder-than-expected winter forecasts. In that case, you can use CFDs to ride the upward trend, exiting the trade before any reversal.

Similarly, you might speculate on rising gold prices during economic uncertainty, taking advantage of multi-day or multi-week price swings.

Stocks

Equities are arguably the most recognized asset class, and no serious broker can afford to exclude stocks from its CFD offerings.

CFDs on individual stocks allow you to speculate on price movements across global markets—capturing a breakout in a US tech giant or riding momentum in a European energy company—without the hefty costs of direct stock ownership.

For instance, you might spot a bullish chart pattern on a UK banking stock and aim to capitalize on a multi-day rally, or you might short an Australian mining stock based on unfavorable earnings news.

Some platforms focus on a narrower range of stocks but often compensate with lower trading costs and tighter spreads, making them attractive for swing traders specializing in particular markets or sectors.

Indices

Leading CFD brokers also provide contracts on major global indices, including the S&P 500, FTSE 100, and Nikkei 225.

These indices allow you to speculate on the broader market, gaining exposure to entire economies or specific sectors rather than individual companies.

For example, you might anticipate a market rally driven by positive US economic data and take a long CFD position on the S&P 500 to profit from a multi-day upward move.

In addition to the leading indices, some brokers offer contracts on volatility-focused index like the VIX 75, which measures market uncertainty.

Whether targeting a bounce in the DAX after a political shift in Europe or shorting the HK50 on signs of slowing growth in Asia, CFDs on indices provide flexible opportunities to capitalize on market momentum.

Cryptocurrencies

Crypto has emerged as one of the fastest-growing areas in financial markets, with daily trading volumes in the billions.

Recognizing this demand, many CFD brokers have incorporated popular digital assets like Bitcoin, Ethereum, and Cardano into their offerings.

These major cryptocurrencies allow swing traders to capitalize on short- to medium-term price movements driven by news events, market sentiment, or technical patterns.

For example, you might identify a breakout in Ethereum after a network upgrade or capitalize on a pullback in Bitcoin following a regulatory announcement.

However, it’s important to note that the selection of digital currencies at most CFD brokers remains relatively limited based on our investigations. They are often focused on well-known coins rather than newer, emerging tokens that could offer hidden potential for sharp, speculative price swings.

Swing traders with a keen eye might spot these opportunities early but will need to seek out brokers with a wider selection of tokens or complement CFD trading with other platforms.

Additionally, you should be aware of regulatory restrictions in certain regions. For instance, in the UK, retail clients are prohibited from trading crypto CFDs, limiting access to this market. Always check the rules in your jurisdiction before diving in.

Trading Platforms

A subpar trading platform can seriously undermine your swing trading results even if a broker offers excellent spreads and a wide range of assets.

A slow, unintuitive, or glitch-prone platform can lead to missed entries and exits, potentially turning profitable trades into losses.

CFD trading platforms differ in charting tools, user interface, and automation options. Many top brokers offer a choice between proprietary platforms designed in-house and popular third-party platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView.

You may prefer the familiarity and extensive indicators of MT4 or MT5, or you might find that a broker’s proprietary platform offers a smoother user experience or innovative features like integrated news feeds or advanced risk management controls—perfect for swing trading setups.

Before committing to real capital, testing the platform through a free demo account is invaluable. Demo accounts allow you to trial specific strategies, from tracking a moving average crossover to catching momentum on gold or the Nasdaq, without risking any money.

TradingView offers advanced charting, analysis and trading tools

Margin & Leverage

One of the standout advantages of CFDs is the ability to trade with leverage, which essentially allows you to control larger positions than your actual account balance would otherwise permit.

This can amplify profits and losses, making it a powerful tool to capitalize on medium-term price moves.

For instance, you might use leverage to take a position on the Dow Jones Industrial Average index based on a technical breakout, holding the trade for several days to ride the trend. With even modest price movement, the returns could be multiplied—though so could any losses if the market turns unexpectedly.

Some CFD brokers we’ve evaluated offer high leverage, sometimes up to 1:500 or even 1:2000, especially in less strictly regulated regions.

However, major financial regulators like the UK’s FCA and the EU’s ESMA have introduced caps to protect retail traders. These rules typically limit leverage to 1:30 for forex and even lower for other asset classes to reduce the risk of significant losses, especially when holding trades overnight—a common practice in swing trading.

Fees, Spreads & Commissions

When selecting an online broker for swing trading, minimizing fees is often a key concern.

CFD brokers typically earn money through spreads—the difference between the bid and ask prices—or commissions, depending on how the trade is executed. These costs can add up if you hold positions for multiple days, directly impacting profitability.

Fortunately, competition among CFD brokers has driven many to eliminate standard non-trading fees, such as deposit or withdrawal charges, inactivity penalties, platform costs, and even currency conversion fees.

However, it’s wise to carefully check each broker’s fee structure, as some global firms still apply additional costs that could eat into returns.

The overnight swap or rollover fee is particularly relevant for swing traders. This financing charge applies when a position is held overnight and calculated based on the prevailing market interest rates plus a broker’s markup.

Savvy swing traders often compare swap rates across brokers, especially when holding trades open for a week or longer. Some even adjust their strategies to enter positions just before periods of lower or no financing costs, such as over weekends or holidays, to maximize returns.

CMC Markets provides competitive CFD spreads and tiered margin rates

Payments

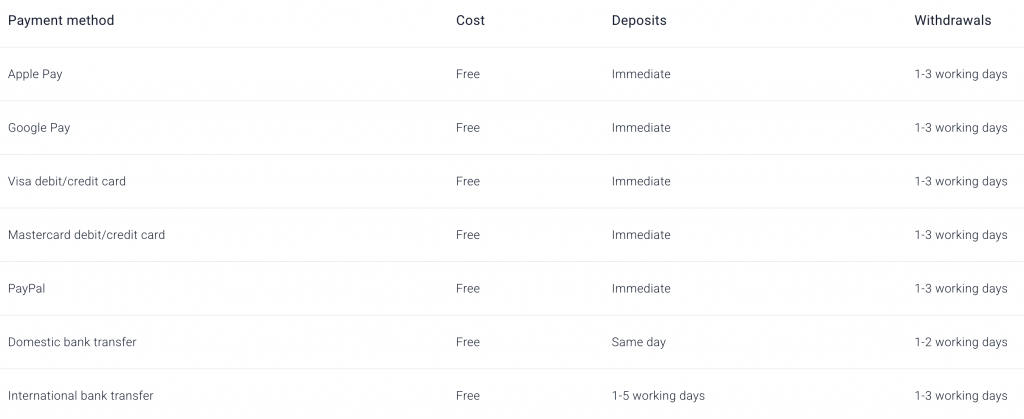

CFD brokers typically provide multiple ways to fund your account and withdraw profits, including traditional bank wire transfer and debit card or credit card payments.

Increasingly, e-wallets like Skrill, Neteller, PayPal, and POLi are also accepted. These wallets offer faster and more convenient transactions—ideal when you need quick access to funds to seize market opportunities.

Remember that available payment methods vary depending on your region, as some options aren’t supported everywhere. International bank transfers and currency conversions often incur extra fees, which can eat into your trading capital over time.

For swing traders, checking minimum deposit requirements and any limits on free monthly withdrawals is essential. Ensuring easy access to your money helps you stay agile and ready to enter or exit trades without delay.

Pepperstone offers multiple methods for fast, secure deposits and withdrawals

Additional Features

- Demo Accounts: Most CFD brokers offer free demo accounts, letting you practice swing trading strategies risk-free with virtual funds. Try holding a simulated trade on the S&P 500 or gold before going live.

- Research Tools: Top brokers provide advanced research tools, including market analysis, real-time news, and economic calendars. You can use these to plan trades around key events and spot new opportunities.

- Educational Resources: Look for brokers with strong academic content—videos, guides, webinars—that help sharpen your swing trading skills, from chart patterns to risk management.

- Islamic Accounts: Islamic (swap-free) accounts remove overnight interest charges but may include higher spreads or commissions. They are ideal for swing traders seeking Sharia-compliant solutions.

Bottom Line

Choosing the right CFD broker ultimately depends on your trading needs and preferences.

While every swing trader has unique goals, strategies, and risk tolerance, key factors to consider include the range of available assets, quality of trading tools, platform security, pricing structure, and leverage options.

However, it’s worth noting that these elements don’t always align—brokers offering the highest leverage, for example, might operate with looser regulatory oversight, potentially increasing risk.

FAQ

Should I Only Use A Regulated CFD Broker?

Before opening an account, check if the broker is licensed by a reputable financial authority such as the UK’s FCA, Australia’s ASIC, or Cyprus’ CySEC.

Look for features like segregated client funds, negative balance protection, and strong data encryption. These safeguards help secure your funds, especially when holding swing trades over several days.

What Features Should I Look For In A CFD Broker?

For swing trading, prioritize brokers offering a wide range of markets (e.g., forex, stocks, commodities), low spreads and commissions, and advanced charting tools.

Reliable trade execution, risk management features, and flexible leverage options can also be critical to capturing multi-day price movements.