Forex Brokers & Platforms – Top FX Brokers

The best forex brokers and platforms offer access to a range of major, minor and exotic currency pairs with competitive trading conditions. Yet with so many online brokerages to choose from, finding the best provider for your swing trading needs can be daunting. Fortunately, this 2025 forex brokers guide is here to help. We’ve outlined the key factors to consider when choosing a currency broker, from spreads and commission to mobile apps, customer support and more. We’ve also ranked and listed our top FX brokers and platforms directly below.

Forex Brokers for United States

Types of Forex Brokers

Online forex brokers can be classified into two categories, full-service or discount. We often see full-service firms take many spots in the top 8 or 10 ranked brokers in the US, UK, Germany, South Africa, Ghana, Japan and across the world. Generally, these firms offer a variety of services that suit both professionals and beginners. This can include innovative software, investment advice, forex market research and analysis, plus a full range of trading products. However full-service brokers typically charge higher commissions, so they are not always the most competitive for swing trading.

On the other hand, discount brokers typically offer FX services with much lower fees. The drawback is that you may not receive all the additional tools, advice or analysis offered by full-service firms. Essentially, you are using the broker simply for platform hosting and trade execution. Discount forex brokers are usually more suitable for entry-level swing traders due to the lower costs involved.

How to Find the Best Forex Broker

This guide will delve into the most important factors and considerations when choosing an online forex brokerage.

Trading Platforms

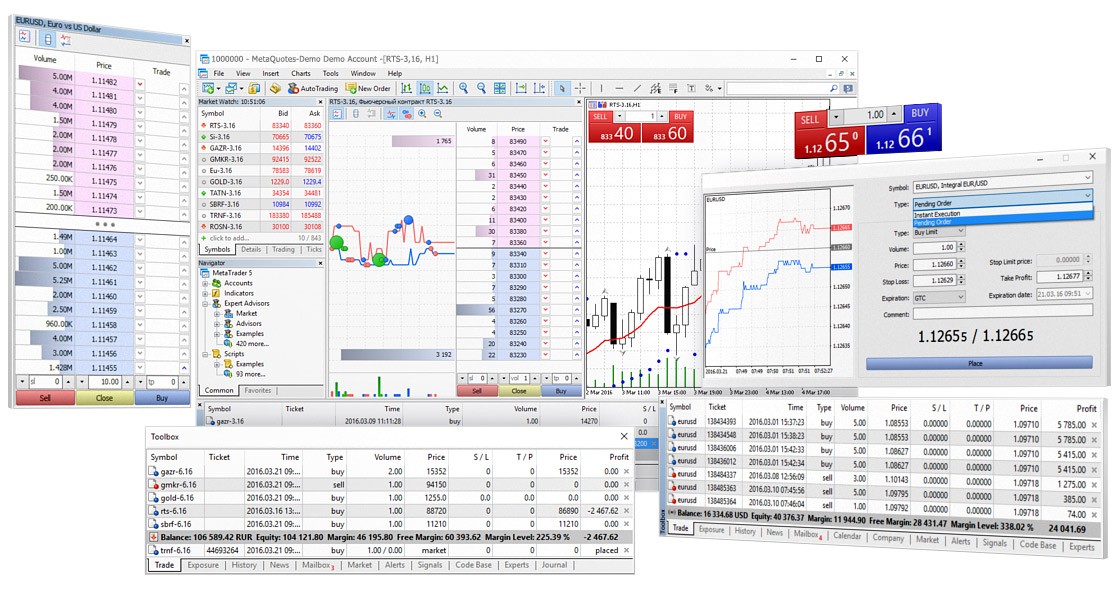

One of the most important considerations is the forex trading platform on offer. These can generally be split into established third-party tools like MetaTrader 4 (MT4), MetaTrader 5 (MT5) and cTrader, or bespoke, proprietary platforms.

There is some security with using a popular platform that millions of traders use. However, some innovative brokers have designed platforms tailored to their clients’ needs and FX investment objectives. Importantly, look for forex providers with a platform that compliments your strategies, such as those that allow hedging and scalping.

Note, some forex platforms may not be available in all countries. For example, a great online software tool may be listed as available in Australia, South Africa, Canada, Lebanon and the Philippines, while residents of India, Nigeria and Switzerland may not have access.

MetaTrader

MT4 is considered one of the best forex investing platforms for beginners. This is mainly due to its customisable and user-friendly interface, one-click trading, plus navigational charts and graphics. Essentially, MetaTrader 4 is a flexible terminal that offers in-depth technical analysis, forex signals, automated bots, and more.

MT5 builds on this with more advanced trading tools, greater order efficiency and a similarly intuitive interface. The platform provides all the necessary instruments for FX financial speculation, such as technical and fundamental analysis, algorithmic trading, customisable indicators and robot software.

MetaTrader 5

A large proportion of forex brokers offer both platforms for free download to Windows, Mac and Linux computers. Alternatively, you can use the browser-based application, which maintains most of the sophistication of their desktop counterparts.

MT4 and MT5 are generally safe bets for forex trading unless you’re an investing veteran with specialist requirements.

Proprietary Terminals

Some of the best forex brokers offer tailored, custom-designed software packages, either individually or alongside third-party alternatives. Proprietary platforms often integrate innovative, broker-specific software to provide an optimal forex trading experience.

Specialist features and requirements like social trading, custom algorithm frameworks plus built-in buy and sell signals can all lead FX brokers to design their own solutions.

Mobile App

For swing trading on the go, a user-friendly mobile application is vital. Many FX brokers and major platforms offer dedicated mobile alternatives. Ideally, these provide all the tools and functions found on the desktop terminals, including signals, alerts, market analysis, software integration and customisation. Of course, condensing sophisticated software tools into a mobile-friendly, handheld application is not always easy, so some solutions lack advanced features.

MetaTrader Mobile

The best mobile forex platforms are available as a free download to iOS, Android and Windows devices. Installation can be initiated via the Apple App Store, Google Play Store or Windows Store.

Demo Account

So, how do you know if a platform is for you? Standout platforms hosted on best forex brokers lists will often offer free demo accounts. These virtual simulators are great for practicing swing trading strategies risk-free while getting familiar with a broker’s desktop and mobile platforms.

The top paper trading accounts offer unlimited simulated funds, no time limits, live news streams and leverage opportunities. Free demo accounts are particularly useful for beginners new to the forex market.

Fees

Forex brokers generally make money by either widening the bid-ask spread or charging commissions. Each firm will follow slightly different approaches and pricing structures, depending on its business model. For example, ECN brokers display raw spreads and low latencies at the cost of commissions, whereas market makers tend to widen the spread to provide commission-free swing trading. Most companies also vary their trading and non-trading fees between account types.

Carefully consider the style of forex trading you will follow to compare the fees of each broker. This will help produce a personalised cost structure that will better represent the charges you will face when you start FX trading.

Commissions

Commission structures are generally split into three categories: floating, fixed and tiered. Floating models vary the cost of opening and closing a position alongside the prevailing market conditions. This can entail lowering costs during periods of high liquidity. Fixed rates are fairly self-explanatory, following a single flat rate that is outlined prior to account opening.

Tiered commission structures operate by reducing costs for high-volume clients, encouraging portfolio growth and the maintenance of trading activity. On the downside, this can sometimes lead to higher commissions for lower volume FX traders.

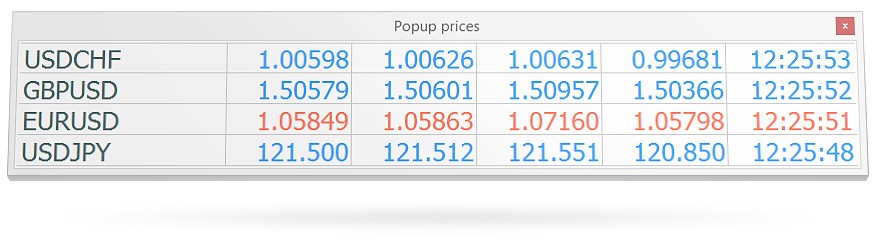

Spreads

Forex brokers also use spreads to make money. Spreads are generally either fixed or floating. Fixed spreads do not change and can therefore provide tighter spreads when there is low market liquidity. On the other hand, floating spreads vary with trading volumes and volatility, tightening during active periods and widening during passive sessions.

It is important to consider your strategy when comparing spreads at top forex brokers. For example, those regularly opening and closing positions on major currency pairs during active periods may be better off with floating spreads. However, if you are speculating on exotic forex pairs, fixed spreads may result in lower overall costs.

Non-Trading Fees

Online forex brokers may also charge non-trading fees. This is commonplace even among the top 10 forex platforms in the world. Typical additional charges include a dormancy fee, which will eat away at accounts that remain inactive for long periods, plus currency conversion fees for deposits and withdrawals made in currencies that the broker does not typically operate in. You should also keep an eye out for general transfer fees, margin rates, additional software costs and account subscription charges.

But perhaps most importantly, swing traders should compare swap fees. These charges are applied to positions held open overnight. Different strategies will involve different timeframes, so cross-reference swap rates with the length of time you plan to hold positions open for, as well as the number and volume of trades you intend to make.

Leverage

Leverage allows you to borrow funds from forex brokers to open larger positions than your capital allows. This can increase the sizes of profits, along with potential losses.

Leverage rates vary between the best forex brokers, often depending on jurisdiction and regulation. UK and EU-regulated brokers cannot offer retail traders leverage beyond 1:30. However, unregulated firms and many international platforms, offer much higher rates. For example, the top 5 forex brokers in South Africa offer some of the most competitive rates in the world. FXTM traders can access leverage up to 1:2000, which is four times higher than many of its competitors.

Leveraged swing trading can also incur extra charges. Some forex brokers incorporate a higher margin rate on leveraged positions that are held over longer periods. Competitive rates tend to be within a couple of percent.

Products

The best forex brokers offer all the major currency pairs, which consist of the USD against each of the other seven major currencies, including EUR, GBP and JPY. It is also good to have opportunities on a range of minor and exotic pairs.

In addition, it is worth considering the trading vehicles on offer. Contracts for difference (CFDs) are one of the most popular types of derivative products at forex brokers, allowing for a wide range of trading strategies. Some clients may also look for forex platforms offering futures, binary options and spot instruments.

Flexible Trades

A standard forex lot amounts to 100,000 units of the base currency. For beginners, this could mean larger trades than their capital allows. Therefore, look for forex brokers that offer micro lot (0.01 lots) trading. Note, some firms might limit this option to special ‘micro’ accounts.

Regulation

Regulatory oversight is an important factor when comparing forex brokers in 2025. An authorisation license and regulatory body impacts the protection that clients benefit from when using a firm’s forex trading services. These will vary for entities throughout the world, with brokers adhering to local laws and regulations.

You can search for a brand within a regulatory agency’s website directory to check for their licensing and compliance status. We have outlined some of the key details for major regions below.

Europe

The European Securities and Markets Authority (ESMA) has jurisdiction over all regulators in the European Economic Area (EEA), including the Cyprus Securities and Exchange Commission (CySEC). Authorisation from one regulator in the EEA means that clients from all other countries are placed under the protection of the local agency there. For example, a German client with a CySEC-regulated firm will be protected by the BaFin.

The ESMA and all of its subsidiary authorities are reputable regulators. Levels of client protection are high, with forex brokers required to be transparent in the failure rates of their customers, their financial statuses and the organisation of their businesses. Additionally, all traders are automatically part of financial compensation schemes that reimburse capital in the event of malpractice or insolvency. Furthermore, regulations limit the levels of risk that forex brokers can let their clients absorb, generally meaning the limitation of leverage rates to 1:30 for retail traders.

Worldwide

Outside of European territories, there are many recognised regulatory bodies. Most of the more stringent authorities require that forex brokers agree to licensing conditions before they can legally provide services. This is the case for the Australian Securities and Investments Commission (ASIC) and the Canadian Securities Administration (CSA). Other well-regarded regulators include:

- The Financial Conduct Authority (FCA) in the UK

- The Securities and Exchange Commission (SEC) in the US

- The Financial Industry Regulatory Authority (FINRA) in the US

- The Financial Sector Conduct Authority (FSCA) in South Africa

- The International Financial Services Commission (IFSC)

- The Securities and Exchange Board of India (SEBI)

Always check the level of protection that clients receive under the authority in question before risking your capital, whether you are trading forex in the Philippines, Kenya, Pakistan, Hong Kong, Mexico or elsewhere.

Safety

The best forex broker regulators ensure platforms adhere to basic security standards. Important safety measures include segregating client funds and implementing negative balance protection so traders can’t lose more than their account balance.

The top forex brokers also offer additional account security features. This may include two-factor authentication (2FA) or touch and face recognition for mobile apps. US and UK forex brokers with MT4 and MT5 implement this as standard practice. Swing traders should also ensure that personal and financial data transmissions are encrypted.

Note, you can find safety details in the privacy policy available on FX broker websites.

Peer Reviews & Scams

A check on customer review sites can provide a good indication of a forex broker’s legitimacy. Peer forum channels often highlight important details on issues or scams that past or present clients have faced. With that said, these should only be used as a guide. Not all traders will be pleased with the services offered by FX brokers and some incorrectly claim services to be a scam if they lose money.

Payments

You shouldn’t overlook payment options when selecting forex brokers. Not only can it be inconvenient to set up a new account with a payment provider but conversion fees can eat into trading capital.

Deposits & Withdrawals

Most FX brokers accept some form of bank wire or ACH transfer, both domestic and international. However, these can incur third-party charges and will often take several days to process. Clients may find using debit and credit cards is an option, often through an online portal, though check that your card providers are accepted, as some firms do not accept Amex, JCB, Diners Club and others. Visa and Mastercard tend to be the standard.

Forex brokers are also increasingly accepting digital payment solutions that offer instant transfers. Popular options include Skrill, Neteller, FasaPay, PayPal, POLi and Perfect Money. Crypto payments are also becoming popular, with Bitcoin, Ethereum and Tether supported by many leading forex brokers.

Minimum Deposit

For beginners and more casual speculators, low minimum deposit requirements like $10 can make forex brokers more accessible. However, platforms with low or no minimum deposits may not be the best option in terms of market access, tools and fees. That being said, several trustworthy forex brokers offer competitive services with low deposit thresholds. For example, CMC Markets, OANDA and XTB are well-regarded forex brokers with zero minimum deposit requirements.

Additional Features

Many top forex brokers distinguish themselves through extra features and tools. For example, investors interested in automated strategies may want to look for API support, free VPSs and robot-building tools. Moreover, there are some firms offering dedicated account managers, PAMM & MAM accounts, free mobile alerts, debit cards and copy trading services.

Educational Content

New forex traders should look for brokers with user-friendly educational resources. Training materials can help you explore new strategies and interpret charts and financial news. Also look for firms with a dedicated webpage or forex trading training software that hosts tutorials, embedded videos, articles, guides and e-books. A definition of key terms, FAQ page and platform guidance are standard practice.

Software

The suite of software that forex brokers offer can make a significant difference to the trading experience. Additional software can include automated bots or signals that you can integrate with your desktop or mobile platform. This can be particularly important for swing trading and can help identify trends and momentum.

NinjaTrader is a good example of a signals tool that allows traders to build their own custom indicators and alert notifications.

Technical Indicators

The technical indicators that you use to identify trends and market movements can impact your trading success. Not all forex brokers and platforms will support the indicators and graphical objects your strategy requires. Popular indicators and tools include the RSI, support and resistance lines, stochastic oscillators and Fibonacci retracements.

Promotions

Many of the top 100 forex brokers are offering financial incentives such as a no deposit bonus or welcome deal to attract new customers. However, several regulatory bodies have begun to restrict these, hoping to protect clients from being drawn into overly risky trades with the promise of free money. For example, the FCA and ESMA do not allow the FX brokers they regulate to offer no deposit bonuses.

That being said, some offshore and international companies maintain these offers, with bonuses rising to several thousand dollars. If you do sign up for these deals, make sure you are diligent. Read customer ratings and reviews to see if the firm has a history of withholding bonus profits. Also check terms and conditions as many promos include clauses that require significant trading volumes before withdrawals can be made.

Customer Service

Poor customer service could prevent you from closing positions that are losing money or opening ones that could lead to profits. As a result, it is important to check that forex brokers offer a good level of assistance. Keep in mind response times and support channels, such as telephone lines, live chat windows and email.

Final Thoughts on Selecting a Forex Broker

Forex brokers can vary significantly, from rigorously regulated platforms to unregulated offshore firms that are running scams. Ultimately, we recommend opening an account with a trusted provider, that offers the currency pairs you wish to trade, the tools you need to manage positions, plus a competitive and transparent pricing structure. Use our ranking list of the best forex brokers in 2025 to get started.

FAQ

Are There Any Forex Brokers That Accept PayPal?

Forex brokers are increasingly accepting funding via electronic payment methods, with PayPal, Neteller and Skrill now commonplace. E-wallets offer secure transfers with low fees and are available to FX traders worldwide.

What Are The Best Forex Platforms In The World?

Every brokerage is unique with its own services, tools, platforms and fee structures. As a result, the best forex brokers in South Africa may not be the top companies in New Zealand, Australia, Canada, China, Russia or Qatar. Local regulations can also play a key part in the FX trading services that brands can offer. In the end, there is no one size fits all approach. Instead, consider your investment objectives and trading requirements.

Which Forex Brokers Offer High Leverage?

Highly leveraged trading opportunities vary among forex brokers due to regulatory restrictions. Firms with services in Europe are under authorisation from the ESMA with a maximum cap of 1:30 for major currency pairs. Companies based and regulated in other jurisdictions can offer rates of up to 1:2000.

What Are The Best US Forex Brokers With The Lowest Spreads?

The top forex brokers accepting US clients and with the lowest spreads typically follow an ECN zero spread model. Pepperstone, IC Markets and XM are global brokers with an average floating fixed spread of 0.1 pips for the EUR/USD currency pair.

What Are The Regulations For Forex Brokers In The UAE?

The Securities Commodities Authority (SCA) of the UAE is the regulatory authority for all non-banking financial activities, including forex brokers. Their listing conditions cover all online brokerage firms, including in Dubai and Abu-Dhabi. Head to the respective regulator’s website for a breakdown of locally regulated providers.