Discover our complete guide to one of the largest online FX and CFD brokers, Forex.com. This multi-award winning broker connects swing traders to markets worldwide, through the Advanced Trading and MetaTrader 4 platforms. In this 2025 broker review, we dive into the features on offer, including mobile apps, fees, demo accounts, leverage and more. So, whether you want to learn how to trade, or hone existing skills, read on to find out if Forex.com is the right broker for you.

What Is Forex.com?

Forex.com first entered the market in 2001 as part of GAIN Capital holdings. Today, it’s an established brokerage operating under StoneX Group Inc, a NASDAQ-listed financial giant.

Forex.com itself boasts a trading community of over 200k, connecting clients with over 1000 global markets. Clients can trade an extensive range of instruments, across classes, from CFDs to spread betting, futures, commodities, cryptocurrencies and more.

The platform caters to all, offering insightful educational resources for newbies and advanced tools for those looking to push their swing trading careers to new heights.

Overall, Forex.com is an organised, transparent and well-regulated platform. And when it comes to customer funds, Forex.com is the number 1 broker in the U.S, and it is not hard to see why.

Markets

Clients can trade forex, indices and shares on the world’s largest markets including the Dow Jones (US30) and NASDAQ (NAS100). Trading products include:

- ETFs

- Bonds

- Indices

- 4,500+ stocks

- 80+ forex pairs

- Cryptocurrencies

- Futures and options

- Commodities, including precious metals such as gold and silver

Trading Platforms

Forex.com offers two trading platforms: the Advanced Trading platform and the popular MetaTrader 4 terminal. The two solutions cater to everyone from novice traders to seasoned investors.

Advanced Trading Platform

The Advanced Trading Platform is a powerful terminal that offers Direct Market Access (DMA). The interface is intuitive and packed full of features:

- Live charts

- Drawing tools

- 15 time-frames

- Options for customisation

- Integrated trading strategies

- 80+ technical indicators

- Smart trading signals

- Multiple watch lists

- Historical data

Traders can download the software onto their devices using the link on Forex.com. It is compatible with both Mac and Windows PCs.

Advanced Trading Platform

Web Trading

Clients can also trade using the web-based version of the Advanced Trading Platform. Web trading with Forex.com can be accessed through most browsers and doesn’t require the download of any software.

Clients can enjoy the full range of platform features including advanced tools, technical analysis and direct market updates. The charting package provided by TradingView is expansive and is one of the best we’ve seen in the market. Unfortunately, guaranteed stop-loss orders are not available on the web-based version.

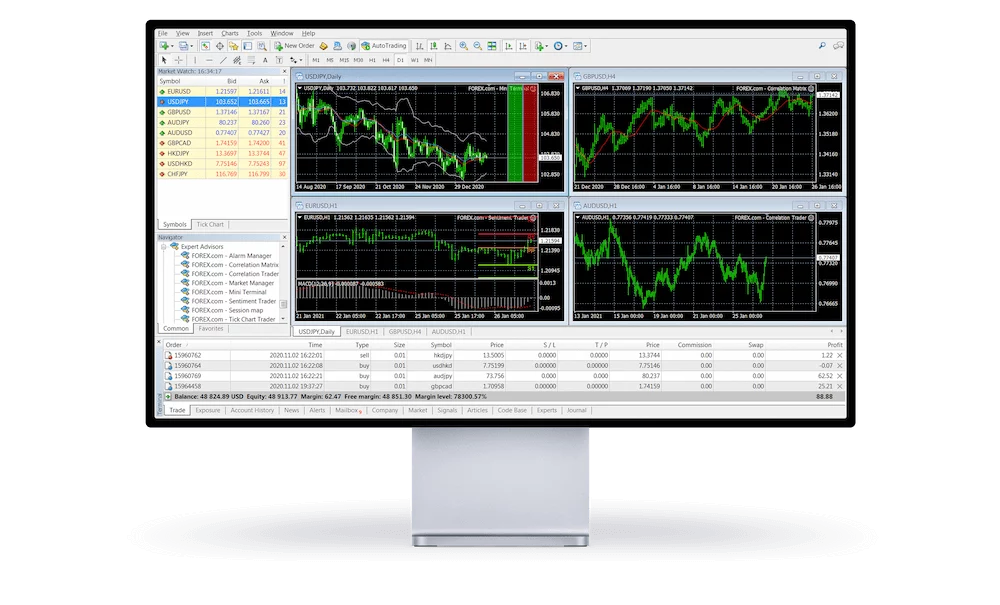

MetaTrader 4

Additionally, Forex.com offers the much loved MetaTrader (MT4) platform. MT4 and its successor MetaTrader 5 (MT5), dominate the world of automated trading thanks to their in-depth trading tools, customisation options and intuitive interface.

At Forex.com, clients can automate their swing trading with the added bonus of exclusive tools such as integrated news, research and technical analysis. Features include:

- VPS – keep strategies running around the clock

- Expert advisors – automate your trades and test them in safe, secure environments

- One-click trading – enter and exit positions with ease

- Mobile app – trade on the go with the MT4 mobile app

- Advanced charts – 24 analytical objects

MetaTrader 4

Forex.com accounts can also be integrated with the NinjaTrader platform.

Forex.com Mobile Apps

Clients also have the option to trade on mobile devices through free Forex.com apps, which are easy to navigate and offer seamless integration with desktop terminals. Clients can withdraw funds, create watch lists, view trade history and charts. The primary drawback of the mobile apps is the limited charting tools, which come with a select number of common indicators.

To download the apps, Android (APK) users should head to the Google Play Store and iOS users should visit the Apple App Store.

Trading Accounts

Forex.com offers four account types, each catering to different investment and strategic requirements. The key difference between the account types is the trading platform available, though there are also other nuances.

- Standard Account – offers a traditional trading experience. Low spreads, commission-free trading and advanced charting tools are all accessible through Forex.com’s proprietary trading platform.

- MT4 Account – a dedicated forex platform that offers fully integrated news updates and advanced technical analysis. Account holders can trade using one of the world’s most popular trading platforms, MetaTrader 4.

- DMA Account – designed for experienced traders only, looking to access deep liquidity. Users can trade on prices from top liquidity providers with no markup. The commission structure is tiered meaning the more you trade, the less you pay.

- Corporate Account – available for institutional and retail business trading. The account permits multiple authorised users and corporate cash payments.

Demo Account

Both the Standard and the MT4 accounts can be trialled risk-free with a demo account. To open the practice account, head to Forex.com and register. The registration and login process is quick and simple.

Demo accounts are credited with $50,000 in virtual funds and once armed, you can trade a wide range of markets and instruments. The one drawback is that demo accounts expire after a period of 30 days and there is no opportunity to extend or transfer activity.

Forex.com also offers an Islamic account that prevents the accumulation and payment of interest.

Should you change your mind further down the line and wish to close a live account, get in touch with the customer support team who can assist you.

Leverage

The highest leverage available on Forex.com is 1:50, which applies to most major forex pairs. However, rates do vary according to the instrument, market and industry regulation. For example, gold leverage will not be the same as cryptocurrency leverage. For the latest information on broker leverage and ratios, head to the margin calculator at Forex.com.

Traders should note that leverage is a risky tool that should only be used alongside effective risk management strategies.

Fees

Forex.com has adopted an ECN model. The broker generates profit through commission as well as the bid/ask spread. Overall, the pricing structure is transparent and on par with market rates.

Spreads vary between account types. To give you an idea, the minimum EUR/USD spread for standard account holders is 1 pip whilst the STP Pro account offers a spread of 0.1 pips. The STP Pro account does, however, charge an additional commission.

Forex.com’s minimum deposit requirement is 100 units of the base currency of your account, for example, £100 or $100.

As is fairly standard, an inactivity fee of $15 per month is payable if you do not open any new positions for over 12 months. Clients will also be charged swap fees on positions left open overnight. There are no additional trading fees.

Payments

Forex.com supports multiple deposit and withdrawal options including:

- Debit and Credit card

- Bank Wire transfer

US clients also have the option of check and e-check payments. Unfortunately, PayPal is not supported on Forex.com.

Forex.com Regulation

Forex.com services are regulated by some of the world’s leading financial bodies including the UK’s Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC) and the US Securities and Exchange Commission (SEC).

Regulatory bodies ensure brokers comply with certain standards, which offers clients a level of protection unavailable with unregulated brokers. In accordance with the FCA, clients can receive up to £50,000 in compensation should the company enter liquidation.

Security

The safety of client funds is a priority at Forex.com. The broker implements a number of measures to ensure that funds are safe and secure. All cash is held in segregated accounts with reputable global banks. Forex.com is also a member of the Investor Compensation Fund (ICF). Clients are covered up to 20,000 EUR or 90% of the investor’s claim.

The broker also states that they continuously review their risk management, recovery and information security policies to offer clients the best online security available.

Additional Features

One of the things that sets Forex.com apart from its competitors is its extensive range of educational resources which clients can access through the website, free of charge. The resources are located in the ‘Learning Centre’.

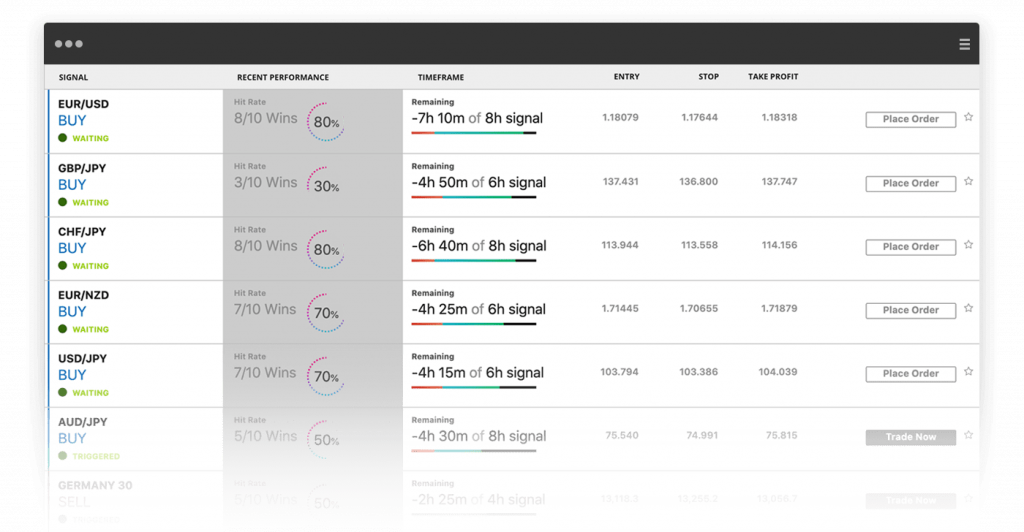

The services available include self-study courses, training videos, webinars and workbooks. They span a broad range of topics such as technical analysis, economic calendars, historical data, strategic guidance and platform features. Resources are divided into three categories: beginner, intermediate and advanced. Useful market signals are also offered.

Trading Signals

Whilst the resources are undoubtedly a good place to start, we would recommend that clients do their own research as well. In particular it is important to stay up to date with market news, updates and trends.

Pros And Cons

So who is Forex.com for? The platform caters to the mass market providing a good range of products for swing traders. Some of our favourite features can be found below.

Pros

- VPS

- 1-click trading

- Regulated

- MT4 platform

- Demo account

- Competitive spreads

- 24/5 customer support

- Flexible account options

- Free paper trading account

- Competitive exchange rates

- Negative balance protection

- Zero commission forex trading

- Access to automated trading tools

- Good range of swing trading instruments

Cons

It can be all too easy to get caught up in the reputation of a platform, but of course there are also some limitations to consider:

- No deposit bonus

- No guaranteed stop losses

- Limited promotional offers available

- Spread betting and binary options not offered

- Web version is not compatible with all internet browsers

Customer Support

If you have any questions, help is available via the customer service team. Visit the Forex.com website where you can connect quickly and easily via the live chat service.

Alternatively, clients can submit a ticket via the Contact Us tab on the website. The site also hosts an expansive FAQ section.

Support is available in a number of languages:

- English

- Spanish

- German

- Polish

- Lithuanian

- Russian

- Arabic

The friendly and knowledgeable support team are on hand to help with a range of queries from security concerns, platform features and payment options, to forgotten usernames and more.

There is no phone number or email provided, but traders can also check out Forex.com on Twitter, Facebook and YouTube.

Forex.com Vs Market Competitors

So, how does Forex.com compare vs Pepperstone, Oanda, IG, FXCM, XM Trading 212 or Questrade? The market is competitive but as a complete trading experience, we’d easily put Forex.com in the top 5. In terms of its complete offering, mobile apps, platforms and tools, it is tough to beat. We feel confident in recommending Forex.com to swing traders.

Forex.com Verdict

There’s a reason thousands of people choose to trade with Forex.com. The account options are accessible and the pricing structure is transparent. Overall this broker caters to everyone from beginners to more experienced traders, with a range of advanced tools and features.

FAQ

Is Forex.com A Good FX Broker?

Yes, Forex.com offers an excellent range of forex pairs, including major, minor and exotic pairs. However, it is not exclusively a forex broker and offers trading on indices, shares and commodities, too.

What Does A Forex Broker Do?

A forex broker connects traders to FX markets, usually offering a range of different currency pairs. However, not every currency will be offered by every broker, so traders should check first if they are looking for a particular pair.

Is Forex.com Legitimate And Safe?

Yes, Forex.com is a safe and reliable broker regulated by leading regulatory bodies. Client funds are held in segregated accounts with reputable banking institutions.

Should I Use Forex.com?

Forex.com is an established, reputable forex broker. Clients should feel assured the broker is regulated by global authorities. As well as offering a range of assets with a competitive pricing structure, it also provides a suite of educational resources.

How Do I Change The Leverage on Forex.com?

To change the account leverage or margin, fill out a Margin Change Request form and submit it to global.support@forex.com.