Best Fractional Shares Brokers 2026

High-priced stocks can be hard to buy in full, especially for small accounts. Fractional shares let you buy part of a stock, which helps with position sizing and risk management. But we know from testing that fractional stock brokers vary wildly in market access, fees and tools.

Open an account with one of our best fractional shares broker for swing trading.

How SwingTrading.com Chose The Best Brokers For Trading Fractional Shares

We identified the best brokers for fractional shares by comparing minimum trade sizes, availability across stocks and ETFs, and any fees or restrictions, then testing how easy and seamless the process was in practice.

By combining these data points with our team’s hands-on experience, we highlighted brokers that make fractional investing genuinely accessible rather than limiting it with fine print.

Key Features To Check In A Broker With Fractional Shares

When choosing a fractional shares broker, these features matter most:

Fractional Share Options

Some brokers let you buy by dollar amount, like $100 of Apple. Others allow you to buy fractions of shares, like 0.25 shares. Dollar-based buying is simple for beginners. Having both options gives more flexibility.

Dollar-based buying is ideal because it can match your account size perfectly. But you might also appreciate brokers that allow fractional quantities, as it makes adjusting position sizes easier when you want to allocate different amounts based on confidence levels in each trade.

Minimum Investment

Some platforms let you start with $1. Others require $5 or $10. Small minimums make it easier to build multiple positions. Check what the broker allows before committing.

Starting small can be motivating. Seeing small positions grow over time will give you confidence as a beginner. It will also allow you to experiment without feeling stressed about losing large sums.

Order Types

Market orders are standard, but limit orders are important for swing trading. Not all brokers allow fractional limit orders. Without them, you might end up paying an unfavorable price.

I once tried a swing trade using a fractional share broker that only allowed market orders. The stock moved quickly, and I got filled at a price much higher than I intended.That experience taught me the value of limit order support. Being able to set your entry or exit price can save money and reduce frustration.

Execution & Fill Quality

Fractional trades are usually filled as whole shares and then split. Some brokers batch orders at certain times instead of filling them instantly. Speed matters because delayed fills can affect trade entry and exit.

In practice, brokers with higher trading volume tend to fill fractional orders faster. For swing trading, this speed can be the difference between entering a setup at the right price or missing the optimal range.

Stock & ETF Coverage

Some brokers only allow fractional shares for big US stocks. Others cover more assets. If your strategy includes mid-cap or international stocks, verify the availability of these in fractions.

It’s frustrating when a stock you want to trade isn’t available in fractional form. Planning around the broker’s coverage can help prevent missed opportunities. If your favorite swing setups are often in mid-cap or international stocks, choose a broker that supports them.

Fees & Costs

Even if a broker advertises zero commission, fractional trades can have hidden costs like wider spreads. Over time, this can reduce profits. Compare fills to see how execution affects costs.

Tracking fills will help you understand if brokers add a small cost per trade due to the fractional nature. It might be a minor amount per trade, but noticeable over multiple positions. Keeping an eye on this helps manage overall trading costs.

Why Fractional Shares Matter

Some stocks move well but cost hundreds of dollars per share. Buying one share can tie up too much money. Fractional shares let you trade smaller amounts, diversify, and manage risk better.

For example, if you have $500 to invest and want exposure to five high-priced stocks, buying whole shares would be impossible for most of them.

Fractional shares allow you to put, say, $100 in each stock, keeping your portfolio balanced. Being able to invest in smaller portions makes swing trading more flexible. You can adjust position sizes to your strategy without needing a big account.

Fractional shares are beneficial when testing a new trading strategy. Instead of committing a full position to a stock you’re unsure about, you can start small. It feels safer and gives real-world feedback on your strategy without risking too much.

How Fractional Share Brokers Work In Practice

Fractional brokers differ in how they handle orders. Dollar-based buying is flexible and straightforward. Fractional quantities give more control over positions.

Order type support varies. Some brokers only allow market orders for fractional shares. Others support limit orders, which let you set the price. Execution speed also differs. Some fill instantly, while others batch orders. This can change entry points for swing trades.

Combining fractional buying with limit orders is a reliable approach for swing trading. It gives control over entry price and position size, while still allowing for smaller investments across multiple stocks.

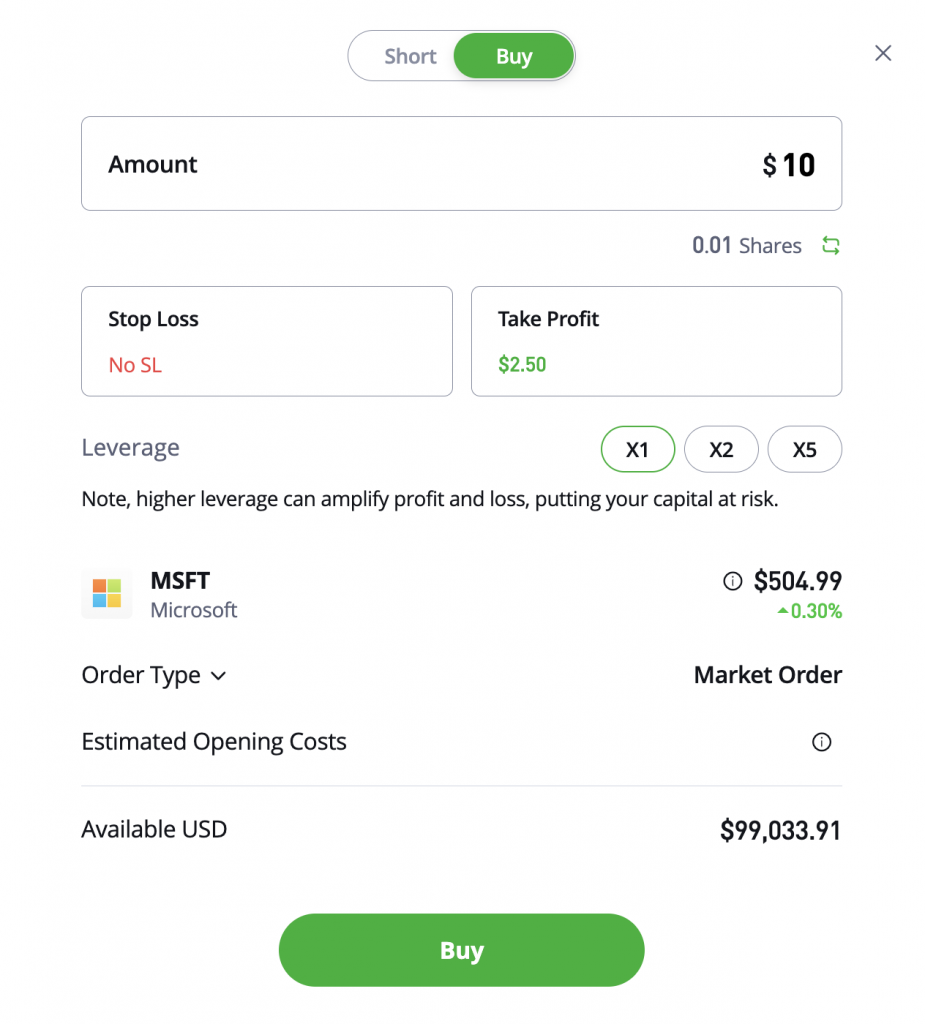

Fractional shares on eToro let you invest any amount, not just full shares

Common Beginner Mistakes

- Over-diversifying with tiny positions: Fractional shares make it easy to buy a bit of everything. Focus on a few clear setups.

- Ignoring order type restrictions: Some brokers only allow market orders for fractions. This can affect timing.

- Overlooking costs: Even small spreads add up. Compare fills to see the real cost.

In my early trades, I made all three mistakes. I spread small amounts over too many stocks, used market orders blindly, and didn’t check costs. The result was mediocre returns and frustration. Learning to focus and track execution improved results significantly.

Matching Brokers To Strategy

Fractional shares are a tool. They help with position sizing, but the trading strategy still matters. Choose a broker that allows you to size positions accurately, place limit orders, access the stocks you need, and execute trades reliably.

It helps to test the broker with small amounts first. You’ll get a feel for execution speed, order handling, and coverage. For example, start with $10 trades to evaluate brokers. It will give you a real sense of how each platform behaves without risking too much.

Final Thoughts

Fractional shares make swing trading accessible. They allow small accounts to trade high-priced stocks while managing risk. But brokers handle fractions differently. Look at order types, execution speed, stock coverage, and costs.

Pick a fractional shares broker for swing trading that fits your trading style and gives flexibility. Test it with small trades, watch fills, and focus on your setups.

Fractional shares are a tool to make trading easier, but the strategy and discipline behind them remain the most critical factors.