Global Prime is an acclaimed broker, offering various trading mechanisms on a range of financial markets. The firm appeals to both retail and institutional traders who are offered MT4, TraderEvolution and FIX API investing tools. The ECN solution also offers direct access to 26 liquidity providers. This 2025 review will cover Global Prime’s trading services in detail, from spreads and leverage to regulation and customer support. Find out whether to open a live account today.

What is Global Prime?

Global Prime was founded in 2010. Elan Bension is the Institutional Director and Jeremy Kinstlinger is the Retail Director. The company’s leadership team have 80+ years combined experience in the financial markets. The head office can be found in Sydney, Australia and the Group is regulated by the ASIC, VFSC and FSA.

The Global Prime Group is comprised of three entities:

- Global Prime PTY Ltd in Australia

- Global Prime FX Ltd in the Seychelles

- Gleneagle Securities PTY Limited in Vanuatu

Global Prime has an institutional-grade liquidity setup, allowing prices to be aggregated from three prime brokers and 26 liquidity providers. The result is sharp pricing and excellent fills on trades.

The company’s investment services are used by thousands of traders in 196 countries, including the UK and Australia. Traders from the United States, however, are prohibited from opening an account.

Markets

Clients can trade forex, CFD, indices, commodities and shares:

- Commodities – 20 commodities including gold, silver and platinum

- Indices – 10 indices including the Nasdaq 100, Nikkei 225 and FTSE 100

- Forex – 45 major, minor and exotic currency pairs including EURUSD and GBPUSD

- Cryptos – Five cryptocurrencies including Bitcoin (BTC), Ethereum (ETH) and Litecoin (LTC)

- Shares – Access popular global brands including Amazon, Apple and Facebook, with dividend payments available

Futures and debt trading are not supported. The minimum order size is 0.01 lots while the maximum position is 1000 lots. Online trading services are available 24/5, Monday to Friday.

Trading Platforms

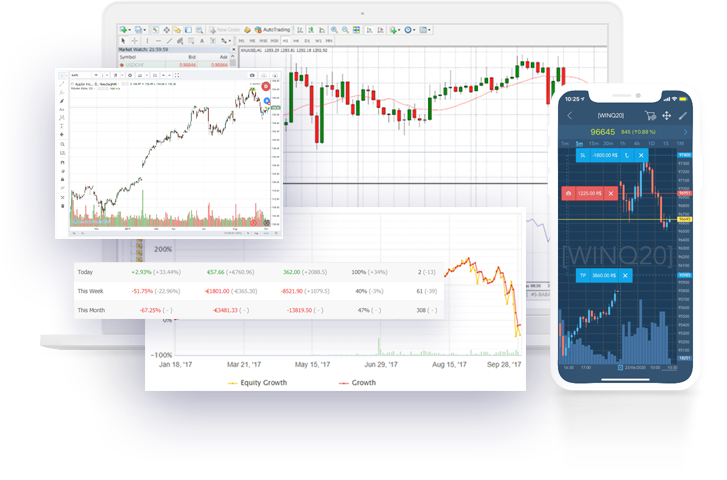

Global Prime offers three trading platforms: MT4, TraderEvolution and FIX API.

MetaTrader 4

MT4 has been the world’s leading forex trading platform for nearly two decades. Created by MetaQuotes in 2002, most online brokers offer the retail investing solution.

MT4 is simple for beginners and full of advanced functions for professionals. The terminal offers a wide range of built-in and customisable features alongside a wealth of online resources created by its users, including custom indicators, signals systems, charting tools and automated trading bots (EAs).

Notable features include:

- Nine chart timeframes

- 30 technical indicators

- 39 available languages

- Real-time news stream

- Integrated trading signals

- Four types of pending orders

- Fully customisable charts & tools

- Automated trading via MQL4 programming language

MetaTrader 4

TraderEvolution

Global Prime’s TraderEvolution provides investors with advanced functionality for order entry, technical analysis and algorithmic trading. The terminal also offers liquidity transparency through Level 2 pricing, volume analysis and DoM trading. In addition, VPS opportunities are offered to clients to improve the quality and speed of trade executions and VPS services are free for clients who trade more than 20 lots a month.

Notable features include:

- Available on Windows, iOS & Android devices

- Quick access to order entry

- Drag & drop for SL/TP

- 23 technical indicators

- Three chart styles

- Nine timeframes

TraderEvolution

FIX API

FIX API is tailored to professional investors looking for algorithmic trading solutions with low latency. The software is best suited to experienced traders and provides the flexibility to use any programming language. Users can connect to trading servers in real-time, as opposed to via third-party programs, such as MT4. Investors are also drop copied to either an MT4 or TraderEvolution account depending on what the client chooses, providing straightforward account management capabilities.

To use the platform, customers need to make a USD 2,500 minimum deposit alongside a monthly commission of USD 2,000.

FIX API

Mobile Trading

Global Prime offer its own mobile app; however, it is currently in beta form. Fortunately, it is possible to download the free MT4 application via the Apple App Store and Google Play for iPhone (iOS) and Android (APK) devices. The mobile trading terminal is available in English, Chinese, Czech, Dutch, Finnish, Russian, Serbian, Swedish and Turkish.

The MetaTrader 4 mobile app has the majority of the functionalities that the web solution offers, with some limitations in terms of visual and charting features.

Global Prime Accounts

Global Prime offers two account types: The Commission Free account and the Spreads + Commission ECN account. The ECN account comes as an Individual, Joint, Corporate or Trust solution. The Commission Free account is currently in the beta development stage.

The Commission Free account comes with spreads from 0.4 pips and $0 commissions. The Spreads + Commission account offers spreads from zero pips plus a $7 commission per lot. Both accounts have a starting deposit of $200 and offer the MT4, TraderEvolution and TradingView platforms.

Servers for both accounts are located in New York, with execution speeds from 1ms and micro lot trading (0.01) also available. Both solutions use 26+ liquidity providers and come with automated trade receipts. No order distance restrictions are in place and one-click trading is enabled on each option. Most swing trading and longer-term investing styles are supported.

Demo Account

A free demo account is available on the MT4 and TraderEvolution platforms. Global Prime’s paper trading accounts are risk-free and offer beginners the chance to develop their investing skills on their preferred terminal. And when traders are ready to invest capital, the switch to a real-money account is straightforward.

Setting Up An Account

Signing up for and opening an account with Global Prime is simple. The broker requires ID verification, contact details and financial background information. Members can then sign in and manage their accounts through the client portal on the company website.

Spreads & Fees

Global Prime combines tier-1 bank, non-bank and ECN liquidity to give clients tight spreads across a range of global markets. Typical spreads on leading forex pairs such as EUR/USD, GBP/USD and GBP/EUR, are 0.1 pips, 0.64 pips and 0.85 pips, respectively. Typical spreads on indices like the FTSE 100 are 0.84 points, while on the NASDAQ 100, it’s 1.0 point. Spreads on popular commodities are competitive, coming in at 3.0 points on Crude Oil.

It’s also worth pointing out that zero pip spreads are available with the ECN account, though Global Prime charges a commission on forex and metals. Commission charges per standard lot are as follows: 7 AUD, 7 USD, 5.4 GBP, 6.2 EUR, 9 CAD and 9.5 SGD.

Global Prime also offers competitive overnight swap rates, taken directly from the interbank market.

Leverage

Leverage at Global Prime ranges from 1:100 to 1:200. The 1:100 standard leverage rate has a 1% margin requirement whilst the 1:200 rate has a 0.5% requirement. The broker does not, however, offer negative balance protection. Fortunately, other protection measures are in place, including the 100% Margin Stop Out and the 120% Margin Call Level.

Payments

Global Prime accepts payments in the following base currencies: CAD, EUR, GBP, SGD, AUD and USD.

Deposits

Deposits can be made in Global Prime’s client portal and are fee-free. The brokerage offers a variety of deposit methods, which vary in processing times:

- POLi – Instant

- Skrill – Instant

- Neteller – Instant

- ZotaPay – Instant

- FasaPay – Instant

- Accentpay – Instant

- DragonPay – Instant

- BPAY – 24 to 48 hours

- PagSmile – Within 24 hours

- Thai QR Payments – Instant

- PayRetailers – Within 24 to 48 hours

- Credit/debit cards (Mastercard & Visa) – Instant

- Bank wire – 1-2 business days (Australia), 3-5 business days (International)

Minimum deposit requirements range from AUD $1 to AUD $200.

Withdrawals

Withdrawals are available via Mastercard, Visa, Bank Wire and Neteller. Card payment processing times range from 1-10 days depending on the schedule of the card provider. Bank wire transfers take 1-2 business days domestically and 3-5 business days internationally. Neteller withdrawals are instant.

Global Prime does not charge withdrawal fees, but respective bank charges are forwarded to clients.

Global Prime Regulation

Global Prime is regulated and licensed as a group of contracting entities across Australia, the Seychelles and Vanuatu. Global Prime PTY Ltd is regulated by the Australian Securities and Investments Commission (ASIC), under license number 385620. Gleneagle Securities Pty Limited trading as Global Prime FX is regulated by the Vanuatu Financial Services Commission (VFSC), under license number 40256. Global Prime FX Ltd is regulated by the Seychelles Financial Services Authority (FSA), under license number 8426189-1 and holds a Securities Dealers Licence SD057 issued by the FSA.

It is worth highlighting that the VFSC and FSA are not as reputable as other regulatory bodies, such as the ASIC. The VFSC offers limited client protection with minimal screening of companies.

Safety

Global Prime is a transparent and legitimate broker. The firm conducts regular independent audits of its financial and compliance procedures and does not have a history of complaints or regulatory issues.

Global Prime is also transparent about how it generates income, i.e. from commissions, spreads and swaps. In addition, the MT4 platform offers high-tech encryptions, secure logins and industry-standard data privacy.

Educational Content

Global Prime offers various trading guides, including Forex for Beginners, Trading Strategies, Trading Plan, Trading Candlesticks and Trading A-Z. The brand also has an established YouTube channel with 300+ videos and a user-friendly search function on its website. Content includes short-form explanatory videos and direct podcast discussions with veteran traders, plus the company’s founders and leadership team.

Traders of all skill levels can benefit from Global Prime’s comprehensive and structured trading academy program. The broker also has an active trading community with mentors that have positive reviews on sites like Trustpilot and Reddit.

Finally, Global Prime offers an FX pip calculator and a margin calculator that works out the required position size based on your currency pair, stop loss and risk level.

Advantages

Reasons to open a Global Prime account vs Pepperstone or Oanda, for example, include:

- Deep liquidity

- 100+ markets

- Low latency

- Copy trading

- No deposit bonus

- Webtrader available

- Hedging supported

- Forex & stocks trading

- New York server location

- Low minimum deposit requirement

- Platforms for beginners & advanced traders

Disadvantages

Downsides to registering with Global Prime include:

- US and Ontario clients are not accepted

- MT5 platform not offered

- No compensation scheme

- No Islamic account

Global Prime Trading Hours

Markets are generally open 24/5 from Monday to Friday. Trading hours for individual markets are detailed on the Global Prime website as well as the MT4 and TraderEvolution platforms.

Customer Service

Global Prime’s customer support team is available 24/5, Monday to Friday. You can reach them via phone at +61 (2) 8379 3622, via email at support@globalprime.com, or directly through the live chat bot. The website offers specific email addresses based on particular queries. Global Prime also has a contactable LinkedIn account.

Verdict

Global Prime scores high in brokerage rankings. Its ECN account offers low spreads and investors have access to a selection of powerful trading tools. And with a proprietary mobile application also in the works, there is a lot to like about this broker. Our only major criticism is that traders outside of Australia will receive limited regulatory oversight with Global Prime FX Ltd and Gleneagle Securities PTY Limited.

FAQ

Is Global Prime A Good Or Bad Broker?

Global Prime is a solid broker overall, offering a seamless and reliable trading experience across a range of platforms. More than 100 popular financial markets are available and the firm is accessible for those new to online trading.

Is Global Prime Safe & Legit?

Global Prime is a legitimate and relatively secure broker. The firm is regulated by the ASIC, VFSC and FSA, depending on where you open an account from. On the downside, the broker does not provide a compensation scheme, so traders should be careful when depositing large amounts of capital. Global Prime also holds client funds in segregated bank accounts.

Where Can I Open A Global Prime Account From?

Aspiring investors can open accounts from most major trading hubs, including Australia, the United Kingdom, Indonesia, Malaysia, Singapore, Hong Kong, India, South Africa, Canada, France, Germany, and Thailand. Unfortunately traders from the US are not accepted.

Does Global Prime Offer A Demo Account?

Yes, Global Prime offers a risk-free demo account compatible with its MT4 and TraderEvolution platforms. You can register for a paper trading account on the broker’s website.

What Is The Minimum Deposit To Trade With Global Prime?

The minimum amount of capital needed to trade with Global Prime is AUD$200. Investors can finance accounts using a range of popular payment options.