NordFX is an established forex and CFD broker, offering a range of accounts and trading tools. The platform also provides competitive spreads on its suite of leveraged financial products. This 2025 review will run through all you need to know about NordFX, including its history, regulation, margin requirements, withdrawal methods, plus the key pros and cons of opening an account.

What Is NordFX?

Founded in 2008, NordFX is a global online trading company offering a range of assets including forex, cryptocurrency and CFDs. Despite its relatively young age, the broker has gained over 1.5 million clients in almost 190 countries.

NordFX is authorised and regulated offshore by the Vanuatu Financial Services Commission (VFSC). The broker has subsidiaries that are regulated by different bodies, including NordFX EU which is regulated by the CySEC, and NordFX India PVT Ltd which is regulated by the SEBI.

The NordFX headquarters are in Port Louis, Mauritius. The broker also has an office in India and a location in Cyprus. The company caters for customers in a wide range of countries including the UK, Indonesia, Sri Lanka, Philippines, Malaysia, Ecuador, Iran and many EU countries. With that said, there are some countries where trading is not permitted, including the USA (many brokers do not accept clients based in the US), Canada and North Korea.

Markets

At NordFX, investors can trade a range of assets including forex, cryptos and contracts for difference. There is also binary options trading in permitted regions. The wide range is ideal for any customer looking to start swing trading.

Assets available include:

- Forex – Clients can trade 33 different forex pairs, including a range of major, minor and exotic currencies.

- Shares – NordFX partners can invest in stock CFDs relating to some of the most popular companies around, including Apple, Amazon and Tesla.

- Indices – There are six index CFDs available to trade, including the Dow Jones 30, Nikkei 225 and Hong Kong 50.

- Commodities – Customers can also trade commodity CFDs on precious metals and energies such as gold, silver and crude oil.

- Cryptos – NordFX offers a range of cryptocurrency pairs including Bitcoin (BTC), Ethereum (ETH), Ripple (XRP) and Litecoin (LTC).

The spread of assets available on NordFX is comparable vs competitors like XM. The broker also allows investors to hedge against investments using different forex strategies.

Trading Platform

MetaTrader 4

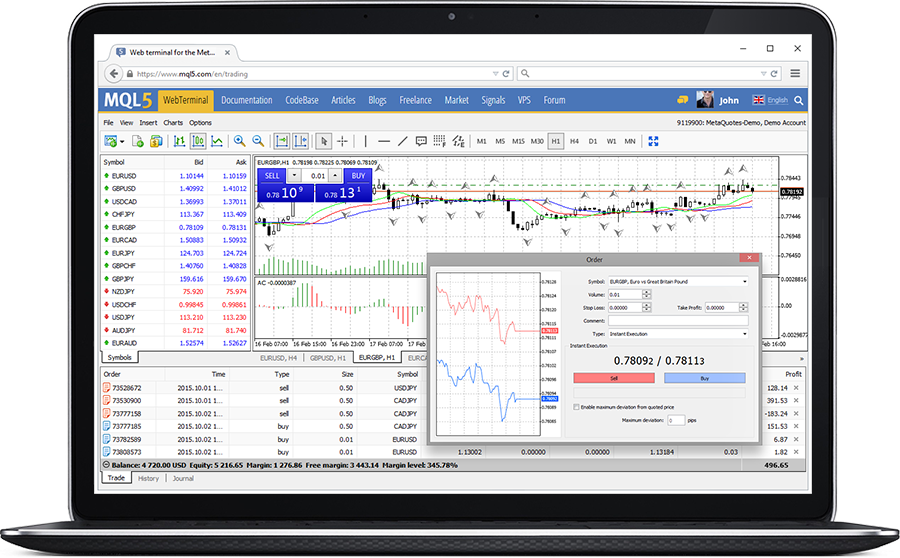

NordFX uses the popular MetaTrader 4 (MT4) platform, which is available to download for free on Windows and Mac, with no hidden prices. Alternatively, MT4 can be accessed via a web portal.

The registration and account login processes are simple for new and existing accounts. There are heaps of options when it comes to analysis, with plenty of charts and a news page should you wish to complete news trading.

Key features include:

- Trade in multiple time intervals from 1 minute to 1 month

- Auto-trading capabilities with Expert Advisors

- Real-time technical analysis tools

- Economic analysis and forecasts

- Instant market execution

MetaTrader 4

Traders should note that NordFX only uses MetaTrader 4 (MT4); it does not offer MetaTrader 5 (MT5).

Mobile App

NordFX provides the MetaTrader 4 mobile app, which is available via free download for iPhone (iOS) and Android (APK). While some functions are reduced compared to the desktop version, users can still track all investments through the application, as well as conduct market analysis. Opening and closing trades is simple and easy and the app is designed to run on a low signal and use minimal data.

MT4 app

NordFX also provides a bespoke mobile app. You can search for the broker’s logo in Google Play or the App Store to find the free download link. Via the server, users can access complete account management through the Traders Cabinet, execute orders and analyse the market. The application also allows users to set up price alerts. The mobile solution is considered trustworthy and receives positive reviews on both stores.

NordFX Trading Accounts

There are three account types available at NordFX: the Fix Account, Pro Account and Zero Account. The spread details and minimum deposit are the main variations between each of these.

The Fix Account requires a minimum deposit of $10 and features fixed spreads starting from 2 pips. This account has access to all assets apart from 5 forex pairs. The Pro Account requires a minimum deposit of $250 and features floating spreads starting from 0.9 pips, with access to all assets. Each of these accounts charges no commission.

The NordFX Zero Account requires a minimum deposit of $500 and features the lowest spreads starting from 0 pips. This account charges a commission of 0.0035% per trade on each side. It also gains access to interbank liquidity (ECN). The minimum lot size for each account is 0.01.

The broker does not provide a cent account or a swap-free account for Islamic traders.

Demo Account

NordFX allows users to login and create a demo account easily. The owner of a demo account can trade with $10,000 of virtual funds, allowing new users to practise risk-free trading. In particular, beginners can spend time getting to know the trading platform and account features. NordFX also regularly runs a demo contest in which account holders can compete to earn real rewards.

Leverage

If trading in the UK or any non-EU country, NordFX offers maximum leverage of 1:1000. EU customers can trade with a maximum leverage of 1:30, in agreement with EU policy. Traders should always be aware that whilst leveraged trading can increase winnings; it can also magnify losses. Always use a margin calculator before trading with leverage and use all available risk management tools.

Commission, Fees & Spreads

NordFX charges a $10 inactivity fee per month after 365 days of account dormancy. Additionally, there are overnight fees for positions kept open which will come into play for anyone swing trading.

Overall, NordFX fees are transparent. The only account which charges a commission is the Zero Account (0.0035% per trade on each side).

Spreads on the Fix Account are:

- Crude Oil – from 2 pips

- BTC/USD – from 1 pip

- EUR/USD – 2 pips

- GBP/USD – 3 pips

- EUR/GBP – 2 pips

Typical spreads on the Pro Account are:

- Crude Oil – from 1 pip

- BTC/USD – from 1 pip

- EUR/USD – 1.2 pips

- GBP/USD – 1.9 pips

- EUR/GBP – 1.7 pips

Typical spreads on the Zero Account are:

- Crude Oil – from 0 pips

- BTC/USD – from 1 pip

- EUR/USD – 0.3 pips

- GBP/USD – 0.4 pips

- EUR/GBP – 0.5 pips

Payments

NordFX does not charge any fees for deposits, though charges may be incurred via the method used. Many deposit methods are processed instantly but bank transfers can take three to five business days. Deposits can be made via the following methods:

- Debit/credit card

- Bank transfer

- Dragonpay

- PayToday

- Neteller

- Skrill

The typical withdrawal time on NordFX is one business day for online payment methods. Bank transfers and debit/credit card withdrawals can take three to six business days. The broker does not charge for withdrawals but the payment system used may invoke charges. Withdrawals can be made to the same methods as deposits.

NordFX Regulation

NordFX holds a license with the Vanuatu Financial Services Commission (VFSC). This is an offshore body and therefore the license does not hold as much weight as one from more reputable agencies such as the Financial Conduct Authority (FCA).

With that said, NordFX EU is regulated by the Cyprus Securities and Exchange Commission (CySEC), a top tier regulatory body. The Indian branch is also regulated by the Securities and Exchange Board of India (SEBI).

Security

NordFX is a reliable and safe broker. The broker also uses Secure Socket Layer (SSL) encryption technology, meaning client data cannot be intercepted upon submission. Other safeguards are also in place, including firewalls, authentication systems such as passwords, as well as access control systems.

User Reviews

For a broker that has been in business for over a decade, commentary and feedback of NordFX’s performance online is fairly limited compared to other providers. Nonetheless, NordFX has received some good feedback from forex websites, with particular praise around competitive trading costs and ECN liquidity.

Additional Features

NordFX offers some additional features to improve the trading experience:

- Education: NordFX provides a range of educational resources designed to develop customers’ trading skills and knowledge. Resources include videos, articles and a glossary.

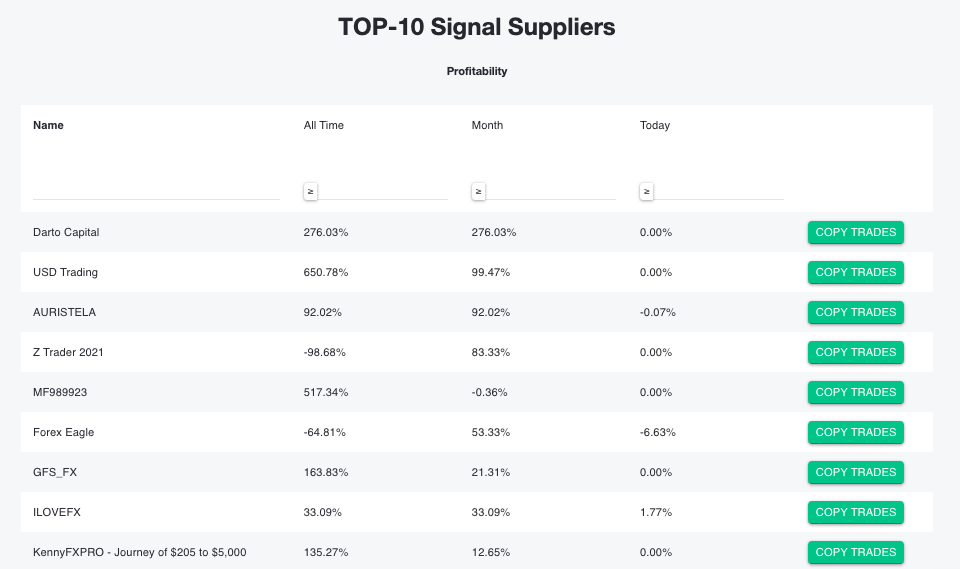

- Copy Trade: Users can subscribe to signals provided by successful traders and the Copy Trade system will automatically open and close the same positions.

- Affiliate Program: The broker provides a competitive affiliate program through which partner businesses can promote NordFX online and earn commission.

Copy Trade

Advantages

Our review uncovered several benefits of trading with NordFX:

- Commission-free trading

- Low minimum deposit

- Low non-trading fees

- Regulated by CySEC

- Demo account

- Tight spreads

Disadvantages

Investors should note the following potential drawbacks of trading with NordFX:

- Comparably high deposit & withdrawal fees

- Not as many assets as other competitors

- Lack of specialised research tools

- Not FCA-regulated

Customer Support

NordFX provides good levels of customer support, ideal if you were to encounter a withdrawal issue or another problem while swing trading. The broker does not provide a contact number or live chat system. Instead, users are required to fill out a form on the website, where responses are then sent via email.

Promotions

As per increased regulation from various global licensing bodies, NordFX does not offer a ‘no deposit’ or welcome bonus.

Trading Hours

Forex assets are available to trade during the standard forex session at NordFX. This runs from Sunday at 22:00 GMT to Friday at 22:00 GMT. Crypto assets can be traded 24/7, while other assets can be traded during the hours of their respective markets.

NordFX Verdict

NordFX is a strong choice for both new and experienced traders. Throughout its history it has developed a solid reputation, offering a great range of products and assets, high leverage, tight spreads and low minimum deposits. The broker also sets itself apart by providing extra services such as the ability to copy trade.

FAQ

Is NordFX Regulated?

Yes, NordFX is regulated. It holds a license with the VFSC, as well as the CySEC and SEBI. The CySEC is one of the most robust and trustworthy regulatory global bodies, allowing EU swing traders to open accounts with peace of mind.

Is NordFX A Market Maker?

No, NordFX is not a market maker. The broker has access to interbank liquidity (ECN) and therefore offers variable tight spreads starting from 0 pips.

Is NordFX A Scammer?

NordFX is authorised and regulated offshore, but also holds reputable licenses around the world. Always make sure that brokers are regulated in your local jurisdiction before signing up. This will ensure you receive financial protection, should the broker ever fail to meet its obligations.

Is NordFX A Legit And Genuine Broker?

Yes, NordFX is a legitimate broker and you do not need to worry about whether it is fake or real. Many Trustpilot and Reddit reviews vouch for the legitimacy of the brokerage.

Is NordFX A Good Broker?

NordFX provides a decent range of assets at low spreads. Traders can also access a good selection of educational tools, plus superior trading platforms. This makes it an attractive choice for investors of all experience levels.