Plus500 is an established CFD broker that operates in over 50 countries. The market maker is particularly popular with swing traders and other short-term strategists. This Plus500 review will explore the assets, platforms and live accounts on offer, before outlining the key pros and cons of signing up.

What Is Plus500?

Company Details

You might recognise Plus500 as the sponsor of the Spanish football team Atlético de Madrid (Atletico Madrid). The broker’s logo is displayed prominently on the team’s jersey. The firm is also the main sponsor of the Swiss team BSC Young Boys (YB). Moreover, the company offers a range of CFD products and provides news, market insights and share forecasts. Over 500,000 users are currently active on multiple continents.

History

Plus500 was founded in 2008 and is the biggest CFD broker in the UK, Germany and Spain. As of December 2021, the company had a market capitalisation of $1.69 billion and a net worth of over $500 million. The broker has its headquarters in Israel, plus several global offices in Britain, Europe and Australia.

The brokerage is a publicly-traded company (PLC) and, since 2018, has been listed on the London Stock Exchange (LSE). Going under the ticker PLUS, Plus500 Ltd.’s share price can be found online or through the live share chat on sites such as ADVFN for up-to-date prices and quotes.

If you decide Plus500 stock is a good buy and wish to invest in the company, you may be entitled to dividend payments. Important information regarding investing in the group such as investor relations, presentations, annual and quarterly earnings reports, dividend yield amounts, ex-dividend and dividend payment dates can all be found easily on the firm’s main website.

Trading Platforms

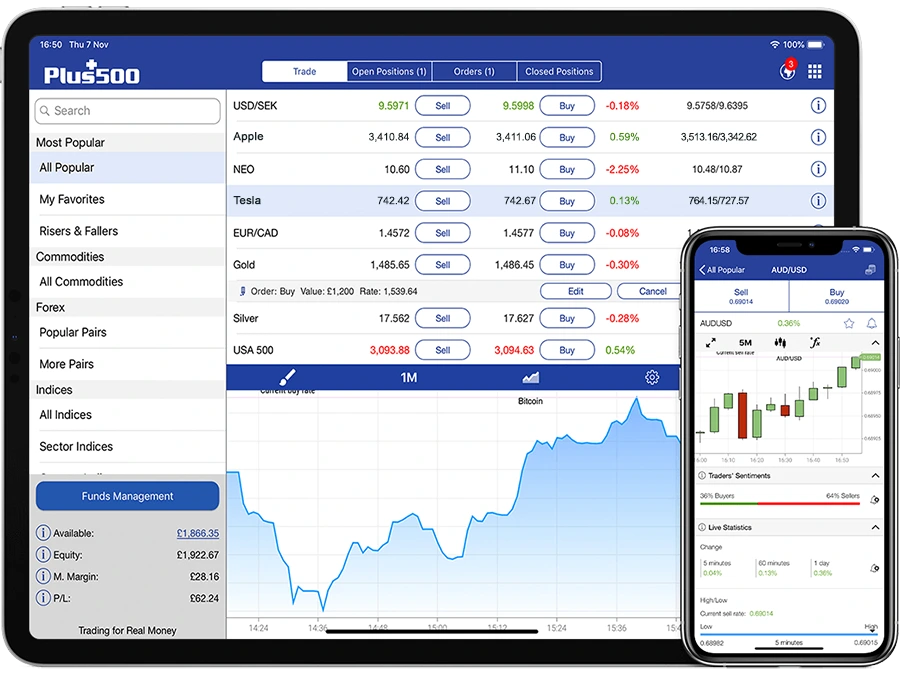

Plus500 offers its own trading platform, which is available as a web trader. The platform is available in 32 languages, including English, German, Greek, Italian, Spanish, French, Finnish, Danish, Swedish, Estonian, Russian, Romanian, Hebrew, Arabic and both Traditional and Simplified Chinese.

Unlike other popular brokers, there is no option to use MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader or other similar platforms. Nor is there a downloadable desktop platform for Mac (OS X or otherwise) or Windows 7/8/9 or 10.

WebTrader

Still, the platform is user-friendly and easy to get to grips with, though the interface is non-customisable and there is no API available for algorithmic trading using programming languages such as Python. Traders used to platforms such as MT4 will likely see this as a downside. However, many users find the platform fully functional. The platform does not support copy trading.

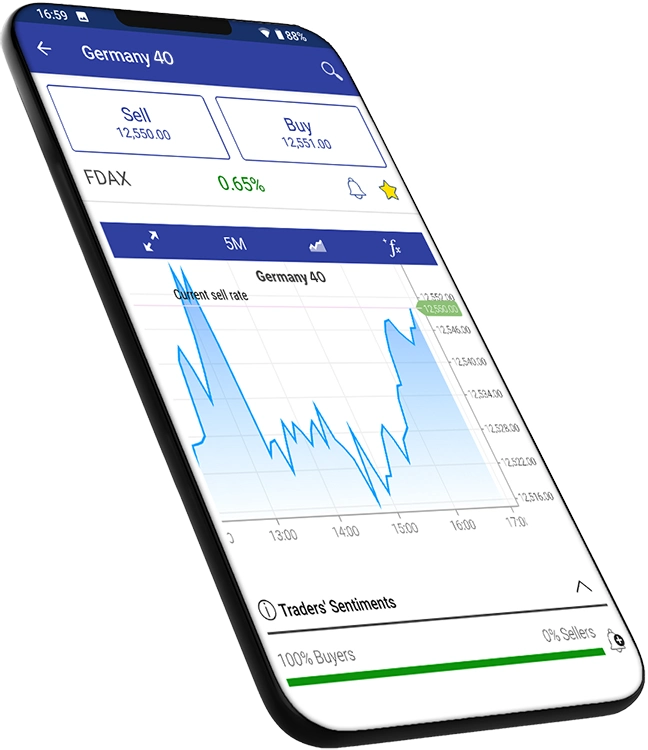

Mobile App

The Plus500 mobile app is available to download for Android and iOS devices from the Google Play Store or the App Store. The application is much like the WebTrader platform, containing the same features arranged in a straightforward and intuitive layout. Mobile trading is great for swing trading on the move, with no need to be tied to a desk or computer.

Mobile Application

Markets

Plus500 is an online broker with over 2,000 instruments, although it does not offer binary options trading or spread betting.

- Commodity CFDs – A wide range of commodities priced in USD, including oil (CL), gold (XAU) and natural gas (NG).

- Crypto CFDs – More than 10 crypto pairs, including Bitcoin (BTC), Ethereum (ETH) and Stellar (XLM). Unfortunately, some popular coins such as Ripple (XRP) and Monero (XMR) are not available. You can also trade the Crypto 10 Index (Crypto10), which measures the performance of the top 10 coins. Note, crypto CFDs are unavailable in the UK.

- Equity CFDs – 1,700+ shares from companies on The New York Stock Exchange (NYSE), The London Stock Exchange (LSE) and the Johannesburg Stock Exchange (JSE). For example, Air France-KLM (AF.PA), Xiaomi (1810.HK), Zendesk Inc. (ZEN), Hargreaves Lansdown (HL-L) and many penny stocks. Several, such as XPeng (XPEV), are on a weekly contract. This means your position will expire after seven days whether you have made a profit or a loss. Gamestop (GME) is not available.

- Index CFDs – 28 of the most popular global indices, arranged by country and sector. These include the UK 100, the USA 500 (based on the S&P 500 index), the US-TECH 100 (based on the NASDAQ 100 index), the German 40 (DAX 40, formerly DAX 30), the Indian Nifty 50 (IN), the Hong Kong 50 (HSI) and the Spain 35 (based on the IBEX 35 index). You can also trade thematic indices like the Cannabis Stock Index.

- Forex CFDs – Major, minor and exotic pairs, including EUR/USD, EUR/GBP, NZD/USD, GBP/USD and DKK/NOK. The Chinese Yuan (CNY) is not available.

- ETF CFDs – Plus500 offers almost 100 ETFs, including the USO-Oil Fund, TQQQ and GLD Gold.

- Options – You can trade a variety of call or put options on indices, forex pairs, commodities and more.

Account Types

Plus500 offers only one account type for retail users. These cap maximum leverage rates as per local regulations. For example, the FCA caps rates in the UK at 1:30.

In some jurisdictions, such as the UK, Cyprus and Australia, Plus500 offers users the chance to qualify for a professional trading account. Clients must meet eligibility criteria, such as sufficient trading activity, experience and a portfolio over $500,000. Real professional accounts have access to leverage levels of up to 1:300.

Plus500 also offers an Islamic, swap-free account for traders of the Muslim faith. The firm does not offer ISA accounts.

Demo Account

Plus500 offers free paper trading. This demo account allows you to practise trading on live markets with zero risk. There is no time limit on the demo solution. Once your account goes below $200, your balance will be reset.

Fees

Plus500 offers commission-free trading and generates its profit through spreads. The spread is the difference between the buy and sell (bid/ask) prices. You can view the spread on each instrument by clicking on the “Details” icon and scrolling to the “Info” section. Spreads on forex and ETFs are generally quite competitive, whereas stocks and cryptos are higher than average.

Plus500 charges overnight funding fees for positions held when the market is closed. Only cryptocurrencies are available for weekend trading. Details on swap rates can be found by clicking the hyperlink next to your instrument’s name. This is typically calculated using this formula:

- Trade Size X Opening Rate X Daily Overnight Funding %

An inactivity fee of up to $10 is charged if you do not log into your trading account for more than three months. Plus500 does not charge any withdrawal fees. However, your bank may make ancillary charges. If you are having withdrawal problems, please contact customer support.

If your profits exceed the tax bracket in your local jurisdiction (£12,500 in the UK, for example), you will need to report them and they will be taxed. The firm may withhold tax on dividend payments. You can find more information on withholding tax on the Plus500 website.

How To Open A Plus500 Account

We have prepared a beginner’s guide to show you how to use Plus500:

Open An Account

You will need to open an account by providing an email address, password and confirming your phone number. You cannot open an account if you are under 18 and US clients are not accepted. If you are from the US, you should find a platform like Robinhood that accepts US customers. Ensure you have read the user agreement thoroughly before signing up. According to ESMA regulations, you will then need to fill out a short questionnaire and include personal details, financial circumstances and reasons for trading. You will also have to answer a set of questions on your trading experience and general knowledge. If you get enough of these answers correct, you will be able to move on to the next stage.

Make A Deposit

You can deposit by clicking on the “Funds Management” option in the lower-left corner. The minimum deposit is 100 units of your base currency (Pound Sterling, Euro, US Dollar). You can make a deposit using credit/debit cards, bank transfers, PayPal or e-wallets such as Skrill and Neteller. The minimum deposit for bank transfers is 500 of your base currency.

Make A Trade

To make a trade, simply click on the “Trade” option and choose your instrument. Selecting an asset will bring up a chart on which you can track the instrument’s behaviour in the last minute, 5 minutes, 15 minutes, 30 minutes, 1, 2, or 4 hours, as well as the last day or week. Once you have decided on a position, click the “Buy” or “Sell” option and this will open the order tool, where you can choose the trade size, leverage and other options like a guaranteed stop loss.

Each asset on Plus500 has a defined “Unit Amount”, which is the minimum trade size to open a position. This, and other information such as trading hours and maintenance margin requirements, can be found under the “Details” link for each instrument.

Once you have exited your position, you will be able to calculate your net profit/loss (P&L). Net P&L refers to the amount of money you are left with after all operating fees and taxes have been deducted. If your net amount is negative, this is called a net loss.

Common Plus500 Strategies

Here are some of the main strategies used by traders on Plus500 explained:

- Scalping – This is a trading style that concentrates on small, short-term changes in price. The scalper aims to make a profit by carrying out a high volume of small profit trades. Scalpers exit positions as soon as they become profitable, limiting the chances of downturns and reversals.

- Swing Trading – Swing traders aim to profit from short-to-medium-term price shifts. Using technical and fundamental analysis, swing traders capture trends lasting anywhere from a few hours to a few weeks.

- Hedging – This is a technique traders use to protect themselves from adverse price movements. You can hedge by opening a position against an underlying portfolio position. For example, you may have a long position in oil and believe that this will grow long term. To protect yourself against short-term volatility, you can purchase a put option on oil, which will rise in value if the oil price falls. Thus, protecting your portfolio.

Plus500 Regulation

Plus500 is regulated by a variety of top-tier institutions around the world. These include the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), the Financial Markets Authority (FMA) in New Zealand, the Financial Sector Conduct Authority (FSCA) in South Africa, the Financial Services Authority (FSA) in Seychelles, the Monetary Authority of Singapore (MAS) and the Israel Securities Authority (ISA). These regulatory bodies offer various financial compensation schemes and ensure that the firm provides negative balance protection.

You can find more information about Plus500’s licensing status from the regulation news service (RNS) on The London Stock Exchange website. The firm follows the FCA’s Pillar 3 disclosure directive.

Security

The firm has a thorough KYC verification process and implements two-factor authentication (2FA) on login. The broker has a trustworthy reputation and, unlike many online CFD brokers, prides itself on transparency. Information such as a full list of the board of directors, level 2 share data and investor relations documents are all easily found online. Customers investing in US stocks will have to fill out the US W-8BEN form.

Robust regulation and security measures mean that Plus500 can be used in almost every country in the world, from the UK to the UAE and beyond. Some exceptions include the US, Canada, Cuba, Iran and Syria. Strict regulation also means that the broker is not able to offer any promotions such as a no deposit bonus or a joining bonus.

Clients under Plus500SG Pte Ltd and Plus500SEY Ltd are eligible for trader points, or TPoints, which are collected on every trade made over $1,000.

Customer Support

If you need help, you can contact Plus500 via live chat, WhatsApp link or email request. There is no phone number available. We found the live chat feature to be responsive and the customer service has high reviews on TrustPilot. The firm is also active across social media sites such as Facebook and Twitter and there are several helpful tutorials available on its YouTube channel.

If you wish to close or delete your account, you will have to contact customer support. You can do this by sending an email or creating a ticket on the broker’s website. The representative will probably try their best to keep you, so be sure to stay firm in stating you wish to terminate your account.

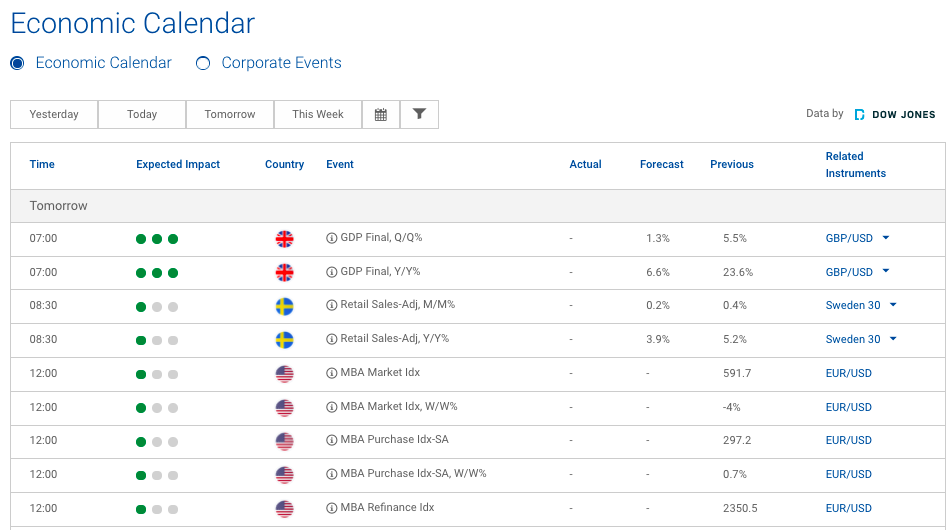

Education & Analysis

Plus500 has several additional features and tools available on its website to assist with its clients’ trading. These include a financial calendar, news and market insights blogs and a trader’s guide. Additionally, the broker publishes ebooks and insight articles for further market understanding.

Economic Calendar

Advantages

Benefits to registering for a Plus500 account include:

- Range of payment methods

- 2,000 CFDs & options

- Positive user reviews

- No scam complaints

- Scalping supported

- Safe regulations

- No hidden fees

- Crypto trading

Disadvantages

Downsides to a Plus500 account include:

- No phone support

- No automated trading

- Proprietary platform only

- Market maker execution model

Plus500 Verdict

Plus500 is a reputable online broker that is overseen and regulated by highly rated institutions around the world. The company’s selection of CFD instruments is extensive, spreads are competitive and few non-trading fees are charged. Plus500 offers a range of options for swing trading, scalping and other popular strategies, including cryptocurrency speculation. Check out the broker’s demo account to trial its services and decide whether to open an account.

FAQ

Is Plus500 A Good Broker?

Yes, Plus500 is a CFD broker offering more than 2,000 instruments including indices, forex pairs, shares and cryptocurrencies. Whether Plus500 is the right broker for you or not will depend on a variety of considerations. Be sure to compare key factors like fees, platforms and regulation when choosing the broker best suited to your needs.

Is Plus500 A Market Maker?

Yes, Plus500 is a market maker. This means that the broker will act as the counterpart to all your trades. Plus500 uses a dealing desk which may mean wider spreads than with an ECN broker.

Is Plus500 A Good Platform?

The Plus500 platform is well-designed and has an extensive range of features. However, it is not customisable and does not allow for third-party algorithmic trading. Traders who are comfortable with MetaTrader 4 or cTrader may wish to find a broker that offers these platforms.

Is Plus500 A Margin Account?

Leverage or margin limits with Plus500 depend on your jurisdiction, account type and chosen asset. Typical leverage limits are 1:2 for crypto, 1:10 for commodities and 1:30 for forex pairs.

Is Plus500 A Good App?

The Plus500 app is highly functional and contains all the same features as the WebTrader platform. The application also has high reviews and ratings on the Google Play Store and the Apple App Store.