Trade Nation is a forex and CFD broker with offices in the UK, Australia, South Africa and the Bahamas. Low-cost swing trading is available through its mobile app, CoreTrader 2 and the MT4 platform. In this 2025 review, we break down Trade Nation’s offering, from the login process and minimum deposit to spreads and financial assets. Find out whether to sign up for a Trade Nation account.

What is Trade Nation?

Trade Nation is an award-winning broker that offers a market-leading trading experience with transparent pricing and powerful investing tools. The online broker provides access to a range of popular financial markets, including stocks, forex and bonds.

Trade Nation’s parent company, Finsa Europe Ltd, was established in 2014 and has its main office address at 30 Crown Place, London. Until 2019, the broker operated under the name Core Spreads, but it has since undergone a firm-wide rebranding.

Finsa Europe has several overseas affiliates: Finsa Pty Ltd (Australia), Trade Nation Financial Ltd (South Africa), and Trade Nation Ltd (Bahamas). All of its divisions are regulated by the relevant authorities – the FCA in the UK, the ASIC in Australia, the FSCA in SA, and the FSB in the Bahamas.

Trading Platforms

CoreTrader 2, Trade Nation’s in-house platform, is available via web browser and mobile app. Investors looking to use a desktop client can download MetaTrader 4 (MT4) – a leading retail forex trading platform.

CoreTrader2 Web

CoreTrader2 is a user-friendly web platform optimised for FX and CFD trading. The site is well-designed and sleek, with an intuitive search function for easy navigation. Clients can use the platform to place a standard set of orders: market, limit, stop-loss, stop-limit, trailing stop and guaranteed stop loss. Core Trader 2 also comes equipped with 12 interactive chart types and multiple timescales for technical analysis. Portfolio and fee reports are clear and accessible, reflecting Trade Nation’s commitment to transparency.

Overall, CoreTrader2 is a good option for beginner traders: it is straightforward to use and has relatively advanced charting capabilities. The only major downside is the lack of market research features or live news feed.

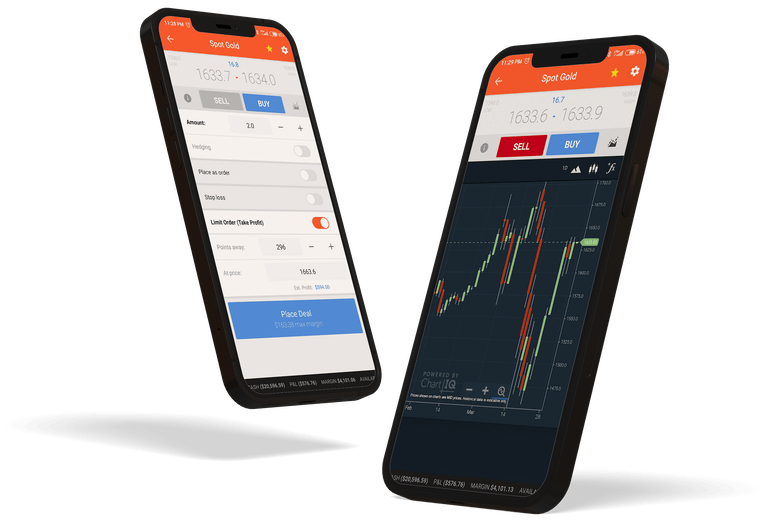

CoreTrader2 App

Like the web-based solution, CoreTrader2 Mobile has a minimalist design and is easy to navigate. Trade Nation clients can use the application to monitor and execute trades from both real and practice accounts. The search function is again, very reliable, and the app supports the same range of orders as the web client. Traders can also use the application to create custom watchlists, although price alerts are not supported. In addition, the Smart News module provides a helpful overview of relevant news headlines and Twitter content.

The CoreTrader2 app can be downloaded to both iOS and Android devices.

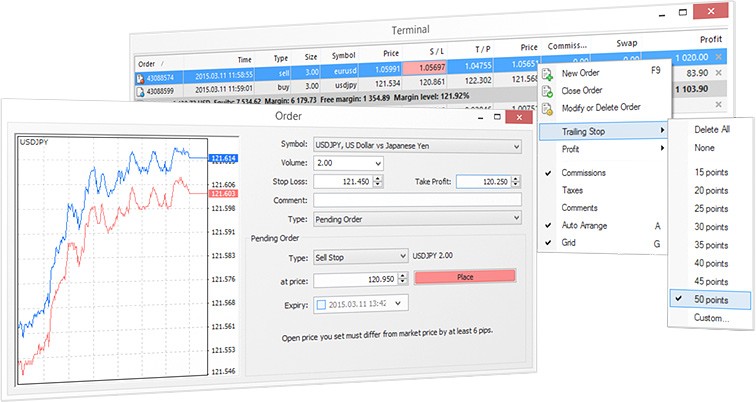

MetaTrader 4

Users can also download the MT4 desktop software. MetaTrader 4 is the most popular forex and CFD swing trading platform worldwide. The system is praised for its reliability, speed and variety of features, offering interactive charting, rich historical data and one-click trading.

Clients can program trading bots and indicators using the MQL4 language or purchase solutions on the MetaTrader marketplace. MT4 is suitable for all levels of trading experience, from beginner to advanced.

Trade Nation Markets

Trade Nation is primarily a forex (foreign exchange) and CFD (contract-for-difference) broker. CFDs are simple financial derivatives that state that the buyer must pay the seller the difference between the current price of an underlying asset and its future price when the contract expires. CFDs can be used to assume both long and short positions. Clients can choose from over 1,100 CFDs at Trade Nation, spanning 1,000+ stocks, 16 indices, 17 ETFs, 9 commodities and 3 bonds.

In addition to the CFD offering, users can trade around 30 currency pairs, including majors, crosses and exotics. This is a limited range versus the competition, though this is offset by Trade Nation’s transparent pricing.

Trading Fees

Trade Nation charges fees exclusively through the spread – the difference between the bid and ask price of an asset. Unusually, the broker uses a fixed spread system, meaning that clients know the cost of trades upfront. With that said, spreads widen during the rollover period and positions held overnight will incur additional fees.

Spreads at Trade Nation are competitive. Popular forex pairs, such as the EUR/USD, GBP/USD, and USD/JPY, have spreads of 0.6, 0.8, and 0.7 pips respectively. During the rollover period (22:00 – 23:00 GMT), these increase to around 1.4, 2.8, and 1.6 pips.

Trade Nation’s CFD products are also less expensive than many brokers, with spreads on the US 500, UK 100, and US Tech 100 indices, coming in at 0.14, 0.4, and 0.8 points respectively.

Trade Nation Leverage

Leverage allows traders to borrow money against the future price of an asset, dramatically reducing the amount of capital needed to open a position. This can amplify profits, but may also lead to larger losses. Different regulatory bodies place different limits on the leverage that brokers can offer. For instance, in the UK, the FCA caps leverage at 1:30 for CFDs and currencies. Elsewhere, Trade Nation offers leverage of up to 1:200.

Always approach leveraged trading with caution and make sure that you have a risk management strategy in place.

Trading Accounts

Trade Nation clients can choose from two accounts: low leverage (up to 1:30) and high leverage (up to 1:200). The high leverage account is offered through the broker’s offshore affiliates, meaning that customers won’t receive the same degree of legal protection.

The account opening process is straightforward, with most applications completed within one working day. New customers are required to provide proof of identity and address via email, as well as some additional information, such as trading knowledge. Once the account has been verified, clients can log in to the Trade Nation platform from the broker’s website.

Note, there is no minimum deposit to open a live account.

Demo Account

New traders can also practice swing trading using a demo account, provided free of charge. This account is pre-loaded with 10,000 USD in virtual capital. This is a great option for those looking to test the broker’s tools and services before putting money on the line.

Education & Research

Trade Nation uses a leading third-party signals provider, Signal Centre, the only major FCA-regulated merchant of its kind. Signal Centre provides fundamental signals (based on the financial news) and technical signals (based on chart patterns/ price movements). A wide variety of indices, commodities and currencies are used as part of Signal Centre’s technical analysis.

Customers can also use Trade Nation’s Smart News feature, which cross-references key financial events with data from independent sources to provide alternative market insights. In addition, the broker has compiled a series of tutorial videos and documents which can be found alongside market news and research articles. The official website also features a glossary of trading terminology.

Overall, users can access a decent range of educational resources, aimed mainly at beginners.

Deposits & Withdrawals

Trade Nation accepts debit and credit cards, bank transfers, plus e-wallets such as Skrill. The broker has a minimum withdrawal of 50 USD but does not charge any transfer fees. Card withdrawals can take 2-3 business days, while bank transfers may take longer (up to 5 working days). Deposits made via card are processed instantly and there is no minimum payment requirement.

Regulation

European clients of Trade Nation (i.e. those registered with its UK arm) are entitled to investor insurance, which protects your funds if the broker goes under. Depending on the territory, customers also receive negative balance protection, making it impossible to lose more money than is held in your account. In addition, Trade Nation keeps clients’ funds segregated from its own.

Note, the Bahamas and South Africa entities do not have top-tier regulatory oversight, so clients using these branches will not receive the same level of legal protection.

Advantages

Benefits of opening an account with Trade Nation include:

- Australian and UK-based branches regulated by top-tier organisations

- Straightforward, well-designed, and streamlined web platform

- Transparent pricing structure

- Good user reviews

- Free demo account

- MT4 download

- Tight spreads

Disadvantages

Downsides of investing with Trade Nation include:

- Market research is not integrated with the CoreTrader2 web platform

- Limited range of assets versus other brokers

Trade Nation Promotions

Customers registered with the Bahamas and South Africa Trade Nation offices can access a loyalty rebate scheme. New clients are given 1,000 reward points upon signing up with the broker and earn a point for every USD traded. These points can be used to claim discounts on spreads – a 20% maximum rebate is available for traders with over 10,000 points.

Note, it’s always worth checking bonus clauses before signing up for promos.

Customer Support

The customer support team are easy to reach and available 24/5. They can be contacted via:

- Phone: +44 203 180 5952

- Email: support@tradenation.com

- Live chat: Available on the Trade Nation website

- Social media: Twitter and Facebook accounts

Trade Nation Verdict

In this review, we have seen that Trade Nation is a budget forex and CFD broker with an admirable commitment to transparency. The broker has lower spreads than many competitors but features a narrower selection of trading assets. Clients can use CoreTrader2 for web and mobile app-based swing trading, while also retaining access to MetaTrader 4. New traders can also benefit from the free demo account and educational resources.

FAQ

Does Trade Nation Have A Practice Account?

Yes, Trade Nation offers a free demo account to prospective users. The practice platform is pre-loaded with 10,000 USD in virtual cash.

Can Trade Nation Customers Download MT4?

Trade Nation customers can access the MT4 platform for desktop trading. They can also use the broker’s mobile and browser-based platform, CoreTrader2.

What Forex Markets Does Trade Nation Offer?

Clients can choose from 30 forex pairs, including majors, crosses and exotics. Popular instruments include EUR/USD, GBP/USD and EUR/GBP pairs.

Is Trade Nation Available In India?

Indian traders can use Trade Nation, although the broker does not list an office address in that country. It’s also worth highlighting that traders from some other regions are not accepted, including the US.

What Is The Minimum Deposit At Trade Nation?

Traders do not need an initial deposit to register for a Trade Nation account. With that said, each instrument has a particular margin requirement to open a position.