Vantage FX has built a strong international presence over the last decade, continually evolving and improving its online services. The broker currently offers competitive trading conditions on a wide range of CFD markets and spread betting. This 2025 Vantage FX review will explore its leverage rates, payment options, deposit limits and promotions.

What Is Vantage FX?

Company Details

The Vantage FX platform is available to both UK and international clients through separate entities. The broker has a strong global customer base, expanding from a Sydney headquarters to more than 30 offices around the world.

Clients from the United States and Canada cannot open accounts due to restrictions on CFDs. However, customers from Malaysia, Bangkok, Thailand, Europe, Australia, New Zealand, Vietnam, Dubai, France, Indonesia, Peru or Auckland, Australia can review and take advantage of the broker’s services.

History

Vantage FX has been trading for over ten years, having been established in 2009. The company began as MXT Global before acquiring its current branding in 2015. Clients have a range of trading options, from futures to CFDs on forex, commodities, indices and a curated range of global shares. UK clients can also take part in spread betting to enjoy tax benefits and 24-hour dealing.

Vantage FX Markets

Forex

The primary asset class of Vantage FX. Forex CFDs are offered on over 40 currency pairs, including majors like GBP/USD, EUR/USD and USD/JPY, plus exotics like AUD/CNH and EUR/PLN.

Spreads start at zero pips with ECN accounts. International clients can access leverage rates of up to 1:500, though UK and EU customers are capped at 1:30 for majors and 1:20 on the rest.

Indices

More than 15 global equity index CFDs are available with Vantage FX. These include the Nasdaq, Dow Jones, FTSE 100, VIX 75, DAX 40 and SPI 200. International clients can also access the South African SA 40, Indian INDIA 50 and US 2000. UK and EU clients must settle for a maximum leverage rate of 1:20, whereas international traders can access up to 1:333.

Commodities

The range of commodities CFDs on Vantage FX is diverse. Six energies, including gasoline, natural gas and low-sulphur diesel, three precious metals and five agricultural products are offered.

UK clients can access leverage rates of up to 1:10 for energies, soft commodities, copper and silver and 1:20 for gold. International clients are capped at 1:100 for silver, energies and agricultural products, whereas they can access rates of 1:500 for gold and 1;50 for copper.

Equities

CFDs on selected individual shares from the UK, US, Australian, Hong Kong and European equity markets are available with Vantage FX. Margin is capped at 1:5 for UK clients and 1:20 for international customers.

Spread Betting

UK clients can also speculate through spread betting with zero commission and 24-hour dealing. As the UK tax authorities classify spread betting as gambling, profits from this approach are tax-free. However, spread bets have set expiry dates while CFDs do not, so this should be considered in product comparisons.

Trading Platforms

Vantage FX offers access to MT4, MT5 and the TradingView Pro Trader. The former two can be downloaded to Windows, Mac and Linux computers. All options are also available as web-based trading platforms, supported for login on all the major browsers.

MetaTrader 4

- Nine timeframes

- Interactive charts

- Customisable interface

- Four advanced order types

- 30 built-in technical indicators

- Automated trading with MQL4

- Windows, Mac & Linux downloads

MetaTrader 4

MetaTrader 5

- 21 timeframes

- Interactive charts

- Trade all CFD types

- Customisable interface

- Six advanced order types

- Automated trading with MQL5

- 38 built-in technical indicators

- Windows, Mac & Linux downloads

MetaTrader 5

Pro Trader

- 20 chart layouts

- 50 drawing tools

- Eight timeframes

- Customisable interface

- Automated trading robot

- Hundreds of technical indicators

TradingView Pro Trader

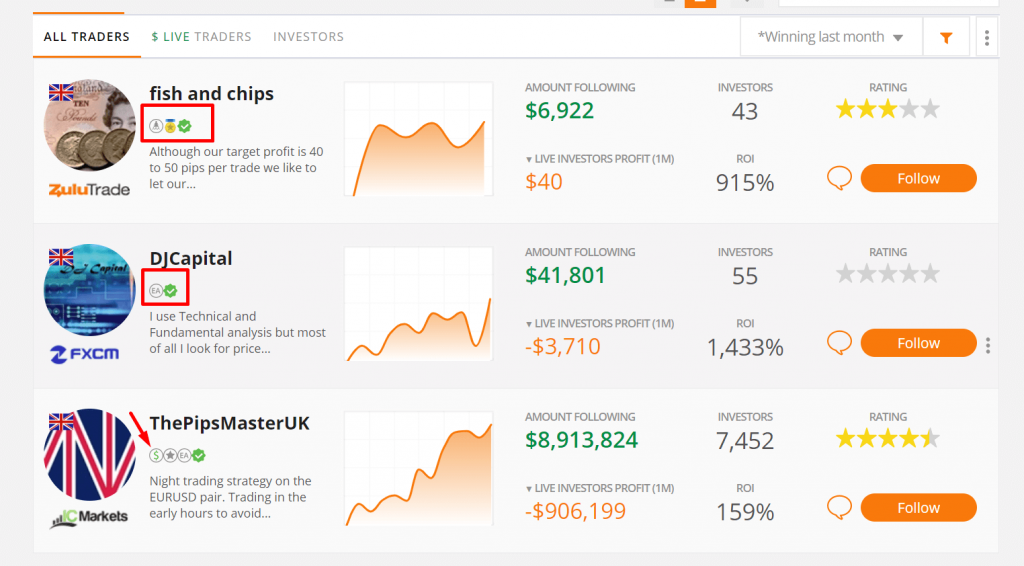

Vantage FX also supports social and copy trading through the ZuluTrade, AutoTrade and DupliTrade platforms for international clients.

Mobile Apps

All of the above trading platforms are available as dedicated mobile applications. Each is accessible for download for Apple iPhone (iOS) devices through the App Store and Android (APK) devices through the Google Play Store. Mobile trading brings the sophistication of online speculation to convenient mobile devices, with interactive charts and a wide range of functionality, including one-click trading. On the downside, this sometimes comes at the cost of some more advanced features that can be found on desktop clients.

Vantage FX Trading Accounts

Vantage FX clients can open one of three accounts, Standard, Raw ECN and Pro ECN. Minimum trade sizes are 0.01 lots and base currencies can be any of AUD, GBP, SGD, NZD, HKD, USD, EUR, CAD or JPY. International clients can trade with leverage rates of up to 1:500 on all accounts, whereas UK and EU residents are capped at 1:30 for Standard and Raw ECN account types, though Pro ECN leverage rates remain at 1:500.

All accounts can be opened as Islamic halal solutions that do not charge swaps for overnight positions. Additionally, new and existing clients can open each option as a demo account, which provides unlimited simulated trading capital. Therefore, you can login and trial the broker, accounts, platforms and assets without risking real money.

Standard Account

- Leverage 1:30 UK, 1:500 international

- $200 minimum deposit

- Spreads from 1.0 pip

- $0 commissions

Raw ECN Account

- Leverage 1:30 UK, 1:500 international

- $500 minimum deposit

- Spreads from 0.0 pips

- $3 commissions

Pro ECN Account

International clients can open a Pro ECN account by depositing at least $20,000, whereas UK and EU traders must apply for one and provide sufficient evidence of certifications, employment or experience. These accounts boast very low slippage rates, which is great for scalping and hedging.

- Leverage 1:500 UK & international

- $20,000 minimum deposit

- Spreads from 0.0 pips

- $2 commissions

Vantage FX Fees

Spreads are competitive on Vantage FX, with the option for ECN-type raw spreads or commission-free STP accounts that start at 1.0 pips. Commissions on ECN accounts are $3 or $2 per lot per side, depending on the account level.

Most payment methods are free and there are no inactivity fees. However, Pro ECN accounts in the UK must hold a minimum of £500. CFDs are also charged overnight swap fees.

Payments

Deposits

Deposit methods include domestic and international bank transfers, Visa and Mastercard payment cards (credit and debit card), broker-to-broker transfers, Skrill, Neteller, BPAY, POLi, JCB, UnionPay, FasaPay and AstroPay. Processing times range from instant up to five business days. China UnionPay funding transactions incur charges of 1.3-2.5% and wire transfers may also incur a cost. International clients can be charged for Skrill and Neteller deposits too.

Withdrawals

Withdrawals can be made using all the same methods. Vantage FX charges a 1% flat fee for Skrill withdrawals while levying a 2% fee on Neteller transactions. Other withdrawal fees vary by method and location, so check out the broker’s website for more details.

Note, PayPal is not a supported method for deposits or withdrawals.

Vantage FX Regulation

Vantage FX is a legitimate, regulated broker. The UK’s Financial Conduct Authority (FCA), a top-tier financial agency, authorises and regulates the broker’s operation in the UK. The firm also holds client funds in segregated NatWest bank accounts and protects your capital for up to £85,000 through the FSCS in the event of bankruptcy.

The Vanuatu Financial Services Commission (VFSC), Cayman Islands Monetary Authority (CIMA) and Australia Securities and investments commission (ASIC), regulate the international branches of the firm. While the VFSC and CIMA have faced scam criticism in the past for lack of regulation and enforcement, the presence of the FCA and ASIC suggests that reliable protective measures are in place.

Security

In addition to substantial regulation, Vantage FX protects customer accounts with a secure login portal, shielding private information and payment details from prying eyes. Unfortunately, additional security factors such as two-factor authentication (2FA) and mobile app touch or face ID are not currently available. KYC verification procedures and negative balance protection are in place to further keep client data and capital safe.

Education & Analysis Tools

Vantage FX offers signals, educational content and several other tools to help clients make informed trading decisions.

Alongside a substantial section on its website covering forex trading and market analysis, Vantage FX provides free sentiment indicators on several markets. The broker also provides tutorials for its MT4 and Pro Trader platforms. Clients can keep up-to-date on upcoming events and news with the free economic calendar that tracks global events.

Copy Trading

Additional signals and trade ideas can be accessed by traders that fund their accounts with £1,000 or more. An AI market buzz indicator is also offered, as are daily forex market previews and insights.

Vantage FX Promotions

Vantage FX provides international clients with promotions and bonuses to reward active traders and encourage new customer sign-ups. These can come in the form of a standard bonus or a demo contest. Be sure to check out the terms and conditions of each promotion before signing up.

The broker offers new customers a deposit welcome bonus of credits matching 50% of their first deposits. The upper limit of this deal is $1,000 (a bonus of $500), after which point the credit reward drops to 10% of any additional funds, up to a maximum of $20,000 total.

Vantage FX also offers an active trader program, through which STP account holders can access rebates based on their net deposit amounts. Clients can receive a $1.50 rebate per lot if their net deposit exceeds $10,000, after which point the bonus increases incrementally. The maximum value an investor can earn with this is a $6 rebate per lot for a deposit total of $300,000.

Advantages

Benefits of trading on the Vantage FX platform include:

- Free VPS

- Strong regulation

- Multiple promotions

- Competitive leverage

- Good variety of assets

- Internationally recognised

- MT4, MT5 & TradingView

- Range of payment methods

- ECN & STP execution models

Disadvantages

Drawbacks of trading with Vantage FX include:

- No spread betting for international clients

- Not available in the US and Canada

- Some negative customer reviews

- No crypto trading

Trading Hours

Vantage FX follows standard trading hours, with forex and precious metals available 24 hours a day, 5 days a week. Other commodities, shares and indices follow specific market opening hours that depend on their respective exchanges. However, clients can access the broker’s platform and client portal 24/7. Weekend trading is not available.

Customer Service

Vantage FX operates several customer service departments with head offices in Vanuatu, London and Sydney. Support is available through a live chat service on the website or via email. Unfortunately, there is no phone number provided. See below for email contact details.

- UK Email: support@vantagefx.co.uk

- Australian Email: support@vantagefx.com.au

- International Email: support@vantagefx.com

Vantage FX Verdict

Vantage FX provides CFDs and spread betting on forex, major indices, commodities and shares through either STP or ECN trading accounts. The broker’s login portal is secure and trading platforms on offer include MT4, MT5 and TradingView. While the ESMA and FCA restrict UK and EU clients, international customers can access competitive leverage rates. Trading conditions are good, with STP spreads starting from 0.3 pips and commissions as low as $2 per side.

FAQ

Is Vantage FX Available In Canada?

Unfortunately, Vantage FX is not available in the United States or Canada due to regional regulations prohibiting CFD trading. However, clients from across the world, such as in Melbourne or Singapore, can open trading accounts.

Is Vantage FX FCA-Regulated?

The FCA regulates Vantage FX in the UK, while the VFSC, ASIC and CIMA oversee international trading services.

Is Vantage FX An ECN Broker?

Vantage FX offers Raw ECN and Pro ECN accounts, in addition to a standard STP account. These provide a choice between raw spreads plus commissions or commission-free spread markups.

Is Vantage FX A Market Maker?

Vantage FX holds a license that allows market making. However, it follows a no dealing desk (NDD) straight-through processing (STP) business model. Therefore, the firm does not act as a market maker.

What Is The Vantage FX Withdrawal Time?

While withdrawal times depend on the withdrawal method used, Vantage FX aims to process all withdrawals on its end within one business day.