Webull is an online broker based in the US. It offers trading on a range of global stocks from the US, UK and other markets, including popular companies like AMC and GME, as well as options, ETFs and cryptos. The firm’s instruments are suitable for swing trading or day trading and its investing conditions are competitive. This 2025 Webull review will run through everything there is to know about the broker, including its desktop trading platform, mobile app, pricing and account types.

What Is Webull?

Company Details

Webull Financial LLC is a securities brokerage based in the United States. It is owned by Fumi Technology, a Chinese holding company that was given a valuation of around $1 billion by Bloomberg in 2021.

The broker receives oversight from the US Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), and the Hong Kong Securities and Futures Commission (SFC), all of which are top-tier financial bodies.

Webull can only be used in the United States (US) and Hong Kong (HK). If you are a resident of the UK, all countries in Europe, Canada, Japan, Kuwait, Kenya, Malaysia, Qatar, Jordan, Zambia, New Zealand (NZ) and most other countries, you will not be able to open a live trading account.

History

The company has been operating since 2017 and has its headquarters in New York, USA. The number of Webull users has been steadily growing since its inception and, as of December 2020, the firm had over 2 million brokerage accounts registered. This is still a way off of its primary competitor Robinhood, though the gap is closing.

Webull made the news recently as it announced a huge jersey patch deal with the Brooklyn Nets.

Markets

Webull clients can trade a variety of products, including US stocks, ETFs, options, GTC orders and more. Unfortunately the broker does not provide forex, bonds or funds.

Instruments on offer include:

- Stocks: More than 5,000 company shares, including popular stocks like TSLA, SNDL, BBIG, XELA, IRNT, 88 Energy, OCGN, VLTA, MICT, ZM, XSPA and XEV.

- ETFs: A range of exchange-traded funds, including trackers like the S&P 500 index fund.

- Options: Contracts including ODTE, available on products like gold (XAU/USD). Note, clients must first fill out a questionnaire and be approved for trading before opening positions.

- ADRs: Several ADRs relating to foreign stocks. Dividends are paid in USD, so clients do not need to worry about changing exchange rates.

- Crypto: Popular cryptos and altcoins, including Bitcoin, Shiba Inu and Stellar. Coins like Loopring, Kishu Inu, Zilliqa, SafeMoon, Ripple and Jasmy are not supported.

Webull also offers penny stocks, several of which are under $1, though fractional shares, S&P futures and e-mini futures are not available. With zero forex instruments and limited crypto offering, the broker does lack slightly in its asset range. However, by providing lists like the top gainers and the popularity list, it helps separate itself from the crowd.

Stock trades operate on a T+2 settlement basis, so they are settled two days after the trade date (the two-day rule), which is suitable for swing trading. Options settle one business day after (T+1). Even though this is not T+0, it does not mean users cannot day trade.

Note, users must have enough buying power to purchase cryptos.

Trading Platforms

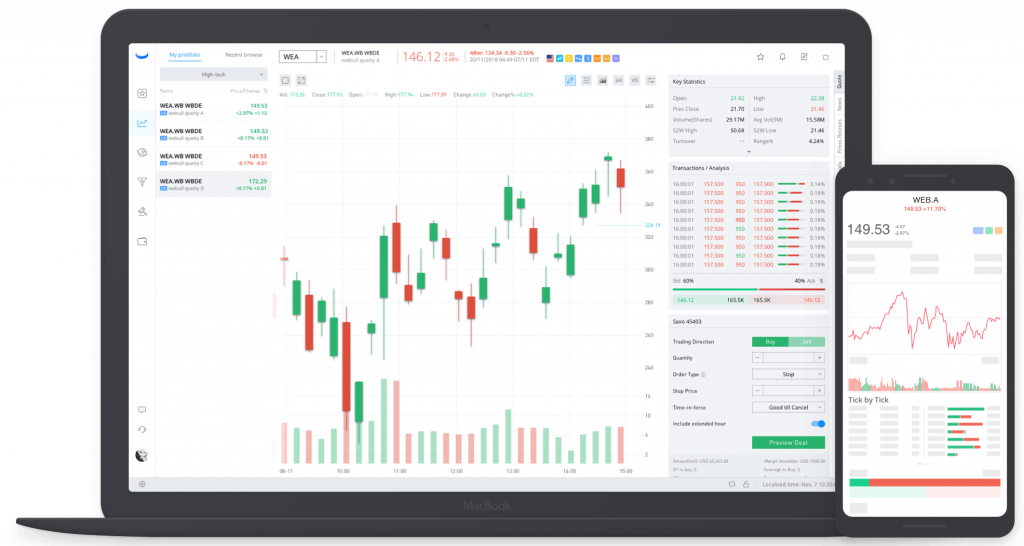

Webull uses a bespoke trading platform that is available both as a web trading app and a desktop program. The web platform can be accessed through the Webull website, while the software client is available to download for free on Windows, Mac and Linux.

Once you are signed in with your login credentials, you gain access to a range of features in place to improve your trading experience. The platform is loaded with charting tools, including 10 second, 1 minute, 2 minute, 1 day, 50 day or 200 day moving average charts. Traders can also view realized and unrealized P&L.

The terminal features over 50 technical indicators, such as the KDJ indicator. Clients can view real-time stock quotes and prices, as well as open and close trades easily with the quick trade system or by setting up hotkeys and keyboard shortcuts.

Webull Trading Platform

Mobile App

Webull provides its own mobile trading app for customers who want to trade on the move. The application is packed with helpful features including the ability to open and close trades using voice commands. Users can also set up price alerts so they don’t miss out on deals.

Webull Mobile

Trading Accounts

Webull customers have the option to open a cash account or a margin account. Cash account members are required to pay in full for any assets they purchase, and they cannot day trade, use leverage or short sell. With the margin account, clients can trade with leverage. If the account has less than $2,000 in funding it is subject to a 3-day trade limit, though this is not relevant for swing trading. Up to $25,000 (25k), clients can margin trade and short sell. Above $25,000, the account is unlimited.

Customers can also open an IRA account. Webull does not offer youth accounts or joint accounts.

Demo Account

Webull offers a demo account for US and UK stocks and options. This paper trading account gives users the ability to learn how to buy stocks for free, using virtual money. Upon starting, users are credited with $1 million in virtual funds.

The practice account allows customers to view their simulated holdings portfolio and track the progress of stocks. If the demo solution keeps crashing or it states that your account is not supported, has been restricted or your settings are incompatible, contact customer service.

Webull Leverage

Webull customers can use up to 1:4 leverage/margin. Trading with leverage of 1:4 means a client can put down $10 and trade with $40. While this can increase winnings, it also increases losses, so caution must be taken.

Fees

Webull does not charge an inactivity fee and there are no fees for financial ACH transfers. It also offers zero (0) commission trading for customers. Instead, Webull makes money via an annual margin rate which varies according to the debit balance of your account. The rate starts at 7% and decreases down to 4% when your account debit balance is over $3 million.

Payments

Deposits

There is no minimum deposit for any Webull accounts. All clients have a set maximum instant deposit limit that cannot be changed. If you want to learn how to open an account and deposit, visit the help centre. Webull only supports wire (bank) or ACH transfer deposits. ACH is free but has a cap at $50,000 per day. Wire transfers charge $8 per transaction.

Withdrawals

Webull withdrawals can be made via the same methods as deposits. There is no withdrawal fee and transactions are typically processed within five business days. Customers must complete know-your-customer (KYC) verification before they can make a withdrawal.

Webull Regulation

Webull is regulated by multiple bodies in the United States, as well as the Hong Kong financial agency. These include the US Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA) and the Hong Kong Securities and Futures Commission (SFC). All these bodies are top-draw financial regulators, so customers can put a level of trust in the broker.

Security

Webull customers can set up two-factor authentication (2FA) for additional account protection while signing in. It is also possible to set up QR code logins. Webull does not provide negative cash balance protection. However, the firm encrypts all data and information and the company’s regulators require certain standards of cybersecurity to be in place.

Customer Support

Webull customers can access 24/7 help from customer service. Good support levels are always important in case you encounter any issues or simply want help closing a Webull account.

You can contact the team via the following methods:

- Live Chat: Lower-right corner of the broker’s website

- Email Address: customerservices@webull.com

- Phone Number: +1 (888) 828 0618

Education & Analysis

Webull includes a host of additional features designed to improve the trading experience:

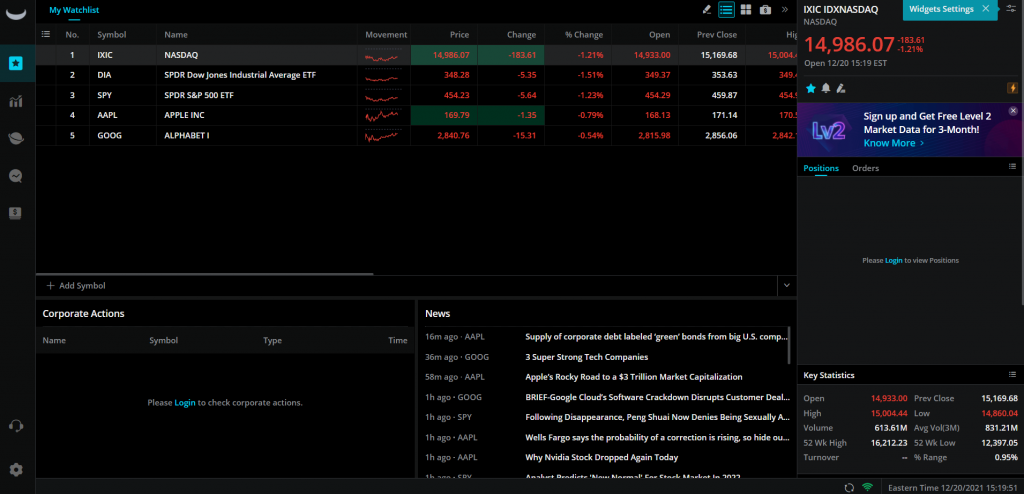

- Stock Screener: Clients can set up a stock screener to help analyse any stocks, shares and ETFs they have an interest in.

- Social Media: Webull has a YouTube channel that posts tutorial videos and answers common questions. It also runs gift card giveaways on its Twitter page.

- Dark Mode: Those that prefer to work with less blue light can set the Webull desktop and web trading platforms to dark mode.

- Watchlist: Customers can set up a watchlist that tracks stocks they wish to keep an eye on.

- IPOs: The broker gives customers access to initial public offerings (IPOs). Upcoming IPOs are available on the website.

Webull Web Platform

Promotions

If you are wondering how to get free stock on Webull, look no further. New customers can access a sign-up bonus with which they receive five free stocks, as seen on Reddit. To get the joining bonus, customers simply need to open an account. Next, they will receive one free stock, valued between $3 and $300. After funding the account, the user will be the beneficiary of another four free stocks.

Advantages

Benefits of trading with Webull include:

- Commission-free stocks

- Reliable trading platforms

- No minimum deposit

- Free stock rewards

- No inactivity fees

- Options trading

- Crypto trading

Disadvantages

Drawbacks of trading with Webull include:

- Only bank transfer payments

- Day trading limited

- No forex products

Trading Hours

Swing trading with Webull requires some understanding of the broker’s trading hours. Cryptocurrencies are available 24/7, while options and many other products will vary with their market or exchange opening times. Clients can also participate in extended-hours trading, which tends to consist of premarket hours (04:00 to 09:30) and after-hours (16:00 to 20:00), whichever time zone the market is in.

Webull Verdict

Webull is a popular online broker based in the United States. It offers trading on a modest range of products and assets that are perfect for swing trading, including stocks, ETFs and cryptocurrencies. The broker boasts a unique and effective trading platform, as well as no minimum deposit or commissions on its online trading. This makes it an attractive prospect for many traders, so check out its demo account if you want a free trial.

FAQ

What Is A Webull Cash Account?

A Webull cash account only allows you to trade with settled funds. You cannot trade with leverage on this account.

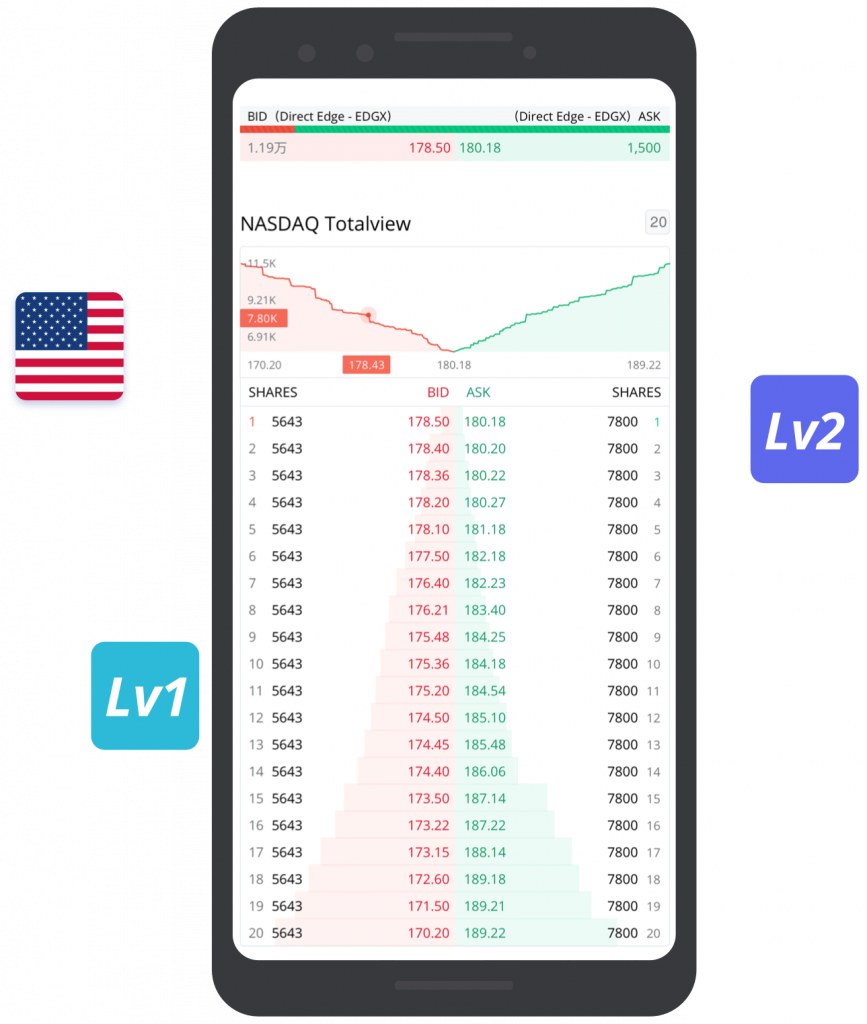

Is Webull A Direct Access Broker?

Webull does not offer direct market access. This makes it more suited to position and swing trading over day trading.

Is There An Alternative To Webull In The UK And Europe?

There are similar equivalent brokers to Webull for clients from or near the UK. A good alternative that works in the UK and Europe is Freetrade, which offers commission-free trading.

Is Webull A Crypto Wallet?

Webull does not offer a crypto wallet. Users cannot withdraw funds in crypto and must exchange any gains in fiat currency.

Is Webull A Good Broker?

Webull is a well-established broker. It has positive reviews on Trustpilot and Reddit and several regulatory agencies in the US and Hong Kong regulate its activities.