Margin Trading

Margin trading involves borrowing funds from your broker in return for a small capital outlay. These loaned funds can then be used to increase position sizes, magnifying potential profits. On the downside, trading on margin also increases your risk exposure, making it unsuitable for most beginners.

This guide to margin trading explains how it works with examples. We also break down the benefits and drawbacks for forex and stock investors.

Top Brokers With Margin Trading for United States

Margin Trading Explained

The simple definition of margin trading is borrowing money from an online broker to increase your position in the stock market, for example. Also known as leverage trading, margin strategies can be used on most asset classes, including forex, commodities like gold, cryptocurrencies such as Bitcoin, plus futures and options.

Importantly, the amount of capital you can borrow will depend on your broker’s margin requirements. This can be influenced by regulatory restrictions in the region, whether you qualify for ‘professional’ trader status, plus the markets you want to trade in. Cryptos are notoriously volatile, for example, so most brokers offer limited margin investing opportunities.

How it Works

Let’s say a trader wants to invest in an emerging technology stock, but can only afford to buy $100 in shares. The trader signs up with an online broker that offers a 1:2 margin on stocks. This means that if they put $100 down, the broker will lend them another $100, giving them $200 to speculate on the new stock.

If the trade is successful, the investor has doubled their potential profit, and after repaying the broker the loaned amount, plus any interest charged, can pocket the remaining returns. However, if the market moves against the trader, the investor must repay the firm which will typically charge interest on the borrowed amount until it is fully repaid.

Note, the interest rate charged usually depends on various factors, including whether it’s a short or long term loan, the amount of capital borrowed, plus any other lending rules the broker enforces.

Importantly, margin trading offers investors greater purchasing power. This can prove particularly useful for beginners or investors with less start-up capital. However, with great purchasing power comes great responsibility because any losses are also amplified. To avoid the risk of liquidation, most brokers do not lend more than 50% of the value of a position or your account balance. Some traders may also have to meet credit check requirements.

Example

Let’s look at another, more detailed example to bring the approach to life…

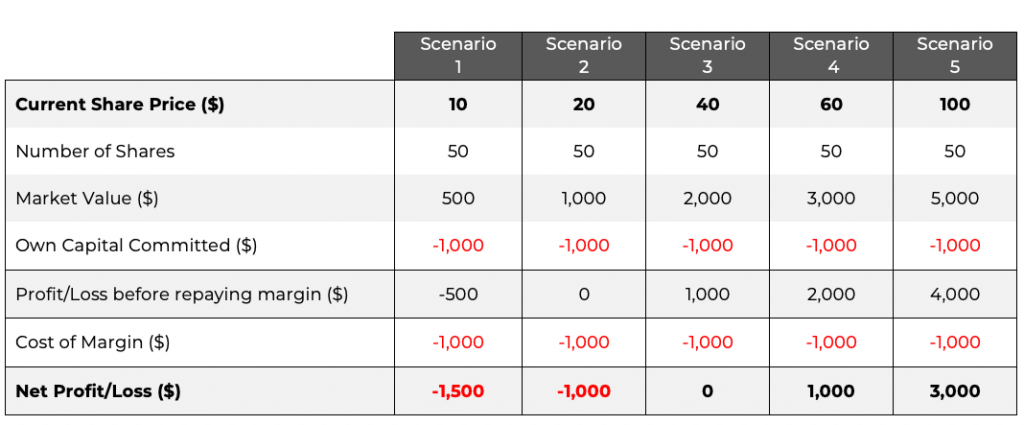

After reading the trading tips section on a social media channel, Tring Swader (a new investor) wants to buy 50 Apple shares at $40 per share. Currently, Tring only has $1,000 in their live account but using a margin trading calculator, Tring realizes he can borrow up to $1,000 from his stock and crypto broker. With this in mind, Tring borrows the $1,000 from the broker and buys 50 Apple shares at $40 at a total cost of $2,000.

Now, let’s look at the potential outcomes depending on how the market behaves:

When the share price rises above the initial purchase price of $40, a profit is realized despite having to pay back the broker the $1,000. And the more the price rises, the greater the return as the repayment amount remains flat (with some interest payable). In this scenario, Tring Swader has realized a healthy profit while only risking $1,000 of their own funds.

In scenario 2, where the share price falls to $20, the trader can cover their initial investment, however, they still owe the broker the $1,000 margin. If the share price falls further to $10 (scenario 1), the proceeds from the sale of the shares no longer cover the initial investment plus the $1,000 borrowed. In this scenario, Tring Swader has lost more than their initial investment. Fortunately, the best brokers in 2025 offer negative balance protection so you cannot lose more than your account balance.

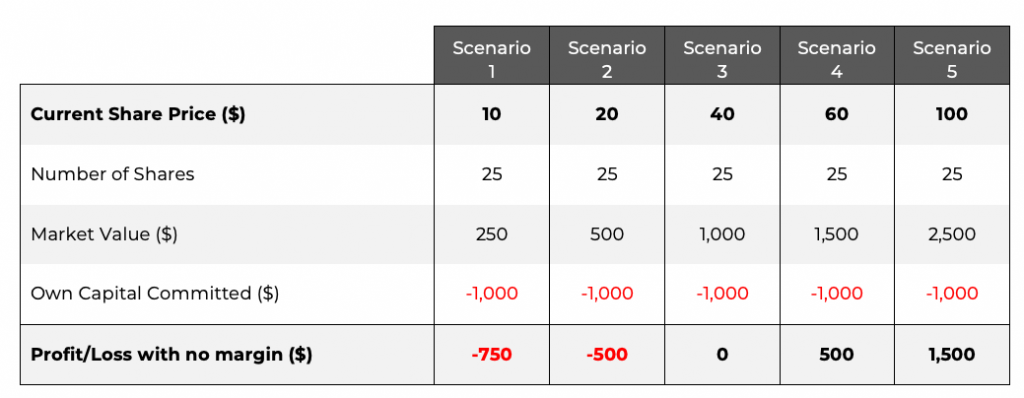

But while the example above paints a helpful picture of the benefits and risks associated with margin trading, let’s also look at what could happen if you were to approach the same opportunity without trading on margin:

As you can see, the potential profit and loss are essentially halved. The capital committed by the trader remains the same as in the original example, with $1,000 invested, but the potential returns are lower. Of course, the trader’s risk exposure is also lower.

Note: the examples above do not include the interest rate charged by some brokers which enhances profit and loss.

Pros of Margin Trading

There are several advantages to trading on margin:

- Available On Most Asset Classes – Brokers offer margin on most markets, meaning leveraged trading opportunities on currencies, equities, commodities, cryptocurrencies and more

- Potential Upside – By borrowing funds, margin investing offers good scope for returns. Regardless of gains and losses, the initial cost of the loan remains the same, though consideration should be given to interest rates

- Easy To Understand – Margin trading vs other strategies is relatively straightforward to get your head around. Implementing margin investing systems is also relatively easy with most platforms offering the hassle-free monitoring of positions through a mobile app or trading terminal

- Low Capital Requirements – Traders only need to risk a percentage of their initial investment. With that said, if the trade doesn’t go to plan, clients may have to pay back the loan plus interest, which could result in losses that exceed your account balance

- Negative Balance Protection – The top brokers and platforms regulated in the EU and UK, among others, offer negative balance protection to cap losses at your account balance

Cons of Margin Trading

There are also some key risks to consider before trading on margin:

- Potential Downside – Margin is one of the few investing strategies where the risk of losses could be greater than your initial investment. This can leave traders indebted to online brokers

- Capped Margin – Brokers usually only match the capital put in by the investor. Therefore, customers looking to borrow 3x, 5x or even 50x their initial investment, will not be able to do so with regulated and reliable providers

- Less Control – Brokers normally set a margin call to prevent both parties from heavy losses. Whilst this can be a useful safety measure, if the equity level of your portfolio drops and you are unable to add additional funds to your account, the broker may automatically close out your position

How to Start Trading on Margin

Choose a Broker

Since margin trading is a popular strategy, many brokers offer leveraged investing opportunities. Top platforms like eToro and AvaTrade both offer margin with various rates and fees. We recommend signing up with a brand that offers wide market access, user-friendly trading tools, plus leverage capped within regulatory guidelines. Also avoid brokerages with unclear information about margin rates.

Understand Margin

Whilst there is no ‘Margin Trading for Dummies’ book out yet, there is a library of information online. Margin is one of the few strategies where traders could lose more than the initial investment, therefore, watching a tutorial and making use of a free demo or simulator account could be valuable. There are also guides on key topics such as ‘how to calculate margin in trading’ at top brokerage sites.

Note, to stop using margin, speak to your broker’s customer support team or head to the account area to amend your preferences.

Risk Management

Whilst risk management is important in all investing, it is particularly true with margin trading given the risk of magnified losses. Many brokers will issue a margin call if you don’t have enough capital to cover your exposure, however, you may also want to follow the one percent rule, which suggests risking no more than one percent of your total capital in a single position. This will help mitigate the impact of a series of losing trades. Stop losses can also help.

Fund Your Position

Once you have decided how much of an asset you wish to buy, you need to fund your account as collateral for the loan. The funds in your account will normally need to represent at least half of the investment. Once the cash is reflected in your account balance, the broker will provide additional funds so you can increase your position size.

Bottom Line on Margin Trading

Margin trading involves borrowing funds to buy more securities than your personal capital will allow. This offers investors the potential for higher returns, however, it also brings with it increased risk. So while the upside can be magnified, losses can accumulate quickly. For this reason, we only recommend trading on margin for experienced investors. In addition, we suggest using trusted, regulated brands like eToro and AvaTrade.

FAQ

Is Margin Trading Worth It?

Margin trading is a popular strategy that can lead to hefty rewards and capped losses through an effective risk management plan. However, without a sensible approach to managing your exposure, trading on margin can lead to serious losses, including those that exceed your existing account balance. You should also consider how trading profits and losses will affect your taxes.

Is Margin Trading Halal Or Haram?

Margin trading is often considered haram under Sharia law. With that said, there are some instances where the use of debt is permitted, especially if there are no interest charges. For this reason, many brokers now offer Islamic-friendly trading accounts. You can also speak to a local religious leader for guidance.

Is Margin Trading The Same As Leveraged Trading?

The methodology and process for margin trading and leverage are the same. The key difference between the two is that leverage represents the value of a loan as a ratio whereas margin is often presented as a percentage.

Is Margin Trading The Same As Short Selling?

Margin trading is the process of borrowing funds from your broker to buy assets in the stock market, such as the S&P 500, or the cryptocurrency space, for example, Ethereum. Short selling is the process of borrowing assets to sell them when you expect the price to fall.

Which Assets Can I Margin Trade With?

Margin trading is available on most markets, however, this usually depends on the broker. Common assets include stocks, forex, options, futures, cryptocurrencies and commodities.

Is Margin Trading Options Trading?

Margin trading is the process of borrowing funds from a broker that you pledge to return to increase your market exposure. Options contracts give you the right but not the obligation to buy a particular asset, such as a stock, at a specified time in the future. They are different, however, you can use margin when trading options contracts.