Best High Leverage Brokers For Swing Trading 2026

Swing trading can be exciting, but when you add high leverage, the stakes get higher. Leverage can accelerate profits, but it can also wipe out an account just as quickly.

See our list of the best swing trading brokers with high leverage, tested by traders with real experience in swing trading.

What Swing Trading With High Leverage Means

Swing trading means holding trades for a few days to a few weeks. You’re not glued to the screen every second like day traders, but you’re not investing for years either. The goal is to catch ‘swings’ in price.

Leverage lets you trade with more money than you have. For example, if a broker gives you 1:50 leverage, you can control $5,000 with only $100 in margin. If the market moves in your favor, profits grow fast. If it moves against you, losses do too.

This mix—holding trades for days plus using borrowed capital—means you need to be careful. Overnight moves, interest costs, and sudden news can all hit your trade.

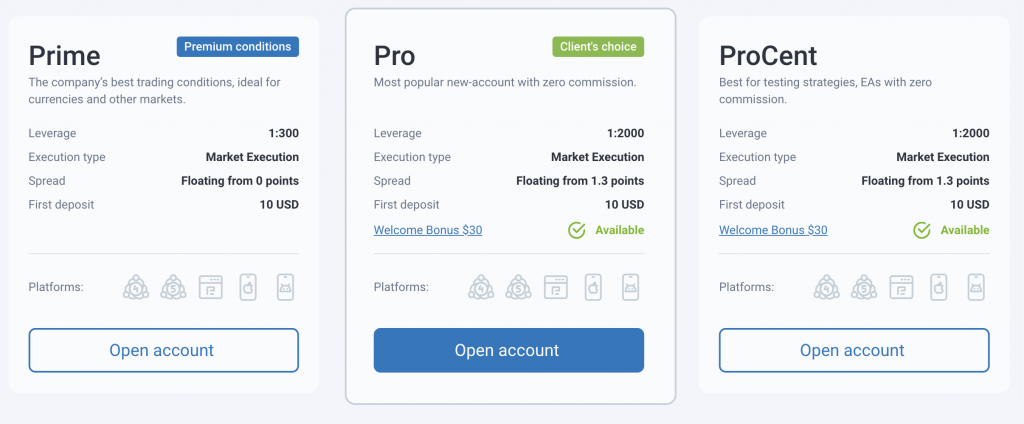

RoboForex’s high leverage is useful for swing strategies, but risky if unmanaged

Key Features To Check In High-Leverage Swing Trading Brokers

When you choose a broker for this style, here are the main things to look at:

Maximum Leverage Offered

Not all brokers give the same leverage. Some regions limit it (for example, 1:30 in parts of Europe), while offshore brokers may go as high as 1:100 or even 1:2000.

- Example: Say you spot a swing trade on EUR/USD with a stop loss 100 pips away. With 1:30 leverage, you may only be able to open a smaller position. With 1:500, you could open a much larger one. But if the trade moves against you overnight, the loss also multiplies.

Margin Requirements

Margin is the amount of money the broker reserves to keep your trade open. Different brokers calculate margin differently.

- Example: With 1:100 leverage, opening a $10,000 position requires $100 in margin. If your account balance is only $200, you’ve already tied up half your funds.

Overnight Financing (Swap Fees)

Swing traders hold positions overnight, sometimes for weeks. This means you’ll pay (or earn) swap fees daily. High leverage increases your position size, which in turn makes swaps larger as well.

- Example: A $50,000 leveraged position might cost $5 in swap fees per night. Hold it for 10 nights, and that’s $50—enough to eat into profits from small swings.

Risk Management Tools

Leverage makes risk sharper. Brokers should offer tools like stop-loss and take-profit orders that actually work as intended, even in fast markets.

- Example: You place a stop-loss on a GBP/JPY trade. If the market gaps overnight, will the broker honor your stop-loss order, or will you incur additional losses beyond your planned amount?

Available Instruments

Not all brokers let you swing trade the same assets with high leverage. Some may restrict leverage on stocks but allow higher leverage on forex or crypto.

- Example: A broker may let you trade EUR/USD at 1:500 but limit Tesla stock CFDs to 1:20. If your strategy depends on certain assets, check these limits first.

Account Protection

With high leverage, losses can exceed your deposit if the market experiences significant price gaps. Most regulated brokers offer negative balance protection, meaning you can’t lose more than your account balance.

- Example: A shock event, such as the Swiss franc spike in 2015, wiped out accounts and left traders owing money to their brokers. Those with negative balance protection were safe.

Minimum Trade Sizes

Some brokers let you open tiny trades (micro-lots), while others force you into larger ones. This matters a lot when using high leverage.

- Example: If the minimum trade size is 0.1 lot ($10,000 position), using 1:500 leverage requires only $20 margin. But each pip is worth $1, which can add up fast on a swing.

Example Swing Trade With High Leverage

Let’s walk through a simple trade.

- You have $200 in your account.

- Broker offers 1:500 leverage.

- You open a 0.1 lot ($10,000) trade on the EUR/USD pair.

- Margin required: $20.

If EUR/USD rises 50 pips, you earn $50. That’s 25% of your account in one move.

But if it drops 50 pips, you lose $50. A 200-pip drop would wipe out your account. And that’s not rare in swing trading, since trades can run for days.

High leverage magnifies swings in both directions. It can feel like a shortcut to fast profits, but it also means faster blow-ups.

I’ve swung high-leverage trades myself—using 1:500 or more on forex pairs and major indices. Gains can build fast, but a 50–100 pip move against you can wipe out margin. Careful stops, position sizing, and swap management are key—risk control is everything.

How To Approach High Leverage Safely

- Start small. Use the minimum trade size. Don’t max out your leverage right away.

- Set stops. Always have a stop-loss in place.

- Check fees. Know the swap costs before holding overnight.

- Don’t overtrade. Just because you can open 20 trades doesn’t mean you should.

- Test first. Try demo accounts with the leverage settings you plan to use.

Final Thoughts

When choosing the best swing trading broker with high leverage, focus on the features that directly affect how you trade: leverage limits, margin rules, overnight costs, order execution, and protections. Don’t get blinded by the most significant numbers on a broker’s website.

A broker that aligns with your strategy, keeps costs transparent, and safeguards your downside is preferable to one offering ‘unlimited’ leverage.

Swing trading with high leverage can be effective if you respect the risks—but it quickly punishes carelessness.