Demo Accounts

A demo account allows you to practise investing in real-world markets without any risk to funds. Importantly, traders can learn swing trading methods with a range of different software and apps. This review of online demo accounts explores why you should use one, how to optimise your experience, plus the benefits and drawbacks.

Brokers With Demo Accounts for United States

Demo Accounts Explained

A demo account is a simulated trading environment where users can practise their skills without investing real money. There is a vast offering of online platforms and brokers, such as Plus500 and IG, which facilitate free demo trading. Investors can experiment with a range of different markets, techniques and tools, suitable for both beginners and experienced traders.

When you open a demo account, you are given a sum of virtual money; usually anywhere from $10,000 to $100,000. With these funds, you can execute any type of trade in accordance with the platform rules.

As you are exposed to real markets with genuine data, demo accounts are a fairly accurate imitation of live trading with real funds. The key difference is that profits or losses are both completely simulated. Often, platforms will provide you with full access to the features of a live account. This might include technical information, price history, indicators and signals.

Why Use Demo Accounts?

Demo accounts are a great way to learn about trading and the stock market, for example. If you are a novice trader, then jumping straight into live trading with your own funds can be daunting. Creating a demo account first can be the perfect solution to understanding how trading actually works.

In addition, it can help if you are unfamiliar with particular platforms or interfaces. For example, if you have no experience with trading cryptocurrency, you can open a demo account with eToro and experiment with a range of different coins. Through doing this, you can see how news and events impact such volatile assets.

Another reason to use a demo account is to trial a strategy. Following a strategy when swing trading can help you to stay focused and avoid making potentially erroneous trades. Remember, however, that a solid strategy does not always guarantee consistent profits.

Opening a Demo Account

Opening a free paper trading account is simple. Typically, you will need to provide personal information including an email, name, phone number and potentially your country of residence. You will rarely be asked to provide details such as home address and ID documents, as you would with a live account.

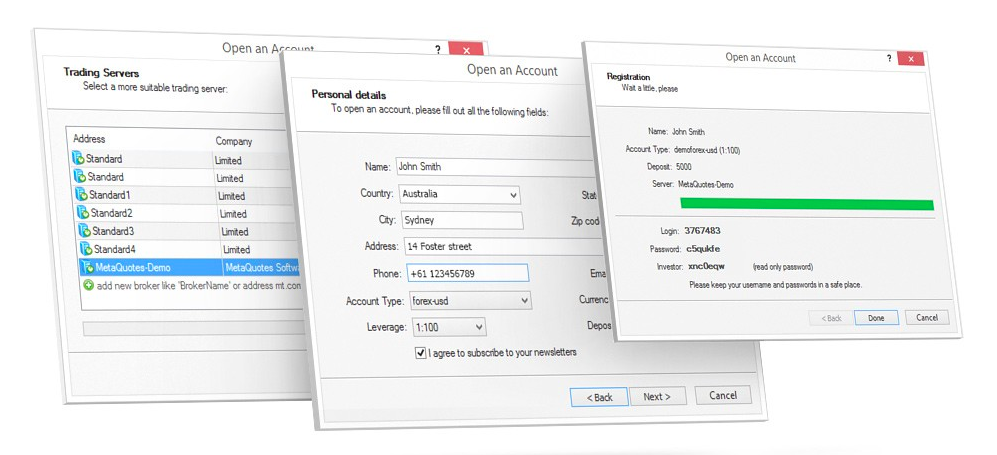

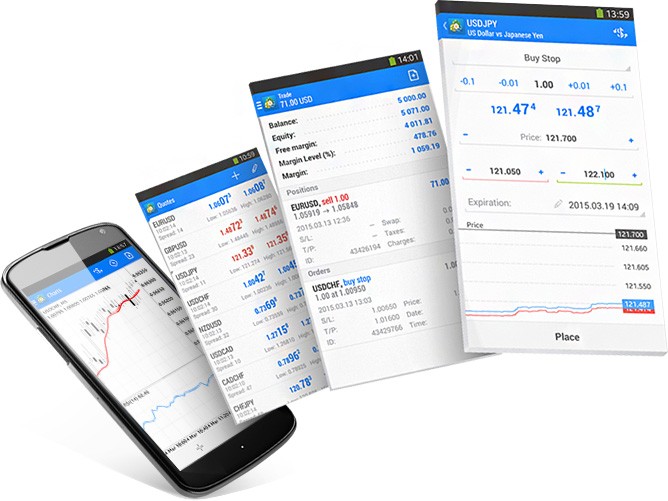

You may need to download an app either on your iOS or Android mobile device or on your computer, however, this is not always the case. For example, with the MetaTrader 4 and MetaTrader 5 platforms, you can just use their Web Trader. Note that for platforms like MT4 and MT5, may need to register with a broker before setting up your demo account login and password.

MetaTrader 4 Demo

Making the Most of Demo Accounts

The objective of a demo account is to help you to prepare for live trading and to optimise your strategy. Traders should look to create a clear plan to indicate the progression from a demo to a live account. Sticking to this plan also ensures that you are not spending more time than necessary making virtual trades.

Markets

If you already know what area of the market to focus on, start by practising with the relevant instruments. For example, if you are interested in short term binary options, then there is not much point starting with swing trading commodities. For this, you would want to find a broker that facilitates binary options trading with a platform that has a trading view as short as 60 seconds.

Of course, if you are unsure what markets you want to trade in, then your plan should include experimentation with a range of different instruments and methods. This will help you to build a broader knowledge of the markets before focusing on a specific asset.

Platform Selection

When you are searching for a demo brokerage to register with, you should consider which you want to use for a live account as well. You won’t need to learn a new system if you use the same platform for both accounts, meaning you can spend more time practising strategies.

The MetaTrader Suite is one of the most popular software choices. Available for forex demo account customers around the world, including the USA, Canada and UK, it offers world-leading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). On MT4 and MT5, you can trade forex (FX), stocks and shares, precious metals such as gold and silver, amongst others.

When you create an account with a broker, you will need to use the same username and password for the download and login. Alternatively, if you do not wish to download an app, you can use the web trader platform.

With a broker such as IG, you can use the MT4 platform for an unlimited time as a demo account does not expire. As there is no time limit, you will have ample opportunity to review your trading strategy. Note, if you download the MetaTrader 4 or 5 app, ensure you have the correct server address and name for your broker.

Comparing Demo Accounts

To decide which platforms provide the best demo account service, you should consider the following comparison points:

Features

A good demo account will offer a range of accessible features. Key things to look for include the variety of instruments, technical analysis and education. If you are new to trading, you may wish to choose a simulator account that facilitates many different assets. This could include stocks and shares, forex, plus commodity and precious metals trading, such as gold and silver.

In addition, you should consider whether you will be able to practice different types of trading such as CFDs, binary options and futures. For users who want to add some excitement to trading with a demo account, some brokers host trading competitions and contests. Winners are often rewarded with real capital for completing the most successful simulated trades within a certain time frame.

Cost

Almost all platforms will let you create a full-access demo account without a deposit, but you should be aware that some do. This could be either as a deposit, a limited-time free trial, or as a one-time fee enabling access to certain platform features. Nonetheless, you should be able to find a free platform offering the same features as those that charge.

Time Limit

Some platform demo accounts will expire after a given time period. This could be as little as one week, although usually, they offer at least a month. This may be an issue for those who wish to trial forex swing trading strategies, for example, so it’s worth looking for a paper account with no time limit. It may also be possible to find MT4 brokers offering demo accounts that don’t expire.

Support

The support provided by a platform is important. If you have any problems such as login issues, feature definitions, account reset requests or need general advice, the support teams will provide the solutions. Most demo account platforms have email addresses to contact, but this method can sometimes be slow. Ideally, you want access to an online chat option, phone number or even social media accounts. Examples of platforms with these features include Plus500 and eToro.

Mobile App

A mobile app can significantly enhance the trading experience. For those who are busy during the day and cannot spend hours looking at charts, on-the-go trading is ideal. With a mobile application, trading during your daily commute or while waiting for food at a restaurant is possible.

On a broker’s website, you can usually find the application link to the Apple App Store or Google Play Store.

MT4 Mobile App

Virtual Funds

Typically, demo accounts are supplied with at least $10,000 of virtual money upon the first login, although this can sometimes be as high as $1,000,000. This is not always the most important feature as it may be possible to reset your funds back to the starting point if things go wrong. Furthermore, such a large amount of funds can be unrealistic as you could be executing trades that you would never replicate in a live forex account, for example.

Regulation

Even with a demo account, ensuring the platform is regulated is important. Whilst you do not need to worry about fund compensation rules in a simulator, you still want a safe and reliable platform for when you transition to live trading. Regulation helps to provide proof of these qualities. For example, the forex broker, IG, is regulated by the Financial Conduct Authority (FCA) in the UK and the Monetary Authority of Singapore (MAS).

Other prominent regulators include the Australian Securities and Investments Commission (ASIC), the Securities and Exchange Commission (SEC) in the USA and the Investment Industry Regulatory Organisation of Canada (IIROC).

Reviews

The reviews and opinions of demo account users can be valuable in determining the best platform or iOS/Android app to download. These will often cover important details including fees, ease of use and time limits. You can find demo account reviews discussing anything from spread betting to binary options, or from forex to penny stocks trading. This principle applies to platforms from around the world including South Africa, Malaysia, Singapore and Indonesia.

Advantages

Whether you’re a swing trader or scalper, practising your strategies in a demo account comes with considerable benefits:

- Risk-free – Any losses you make using simulated funds are completely irrelevant. They allow you to familiarise yourself with the platform and your strategy whereby any mistakes will not have any repercussions.

- Opportunity to learn – There is only so much you can learn about trading from watching video tutorials and reading online guides. The best way to gain experience is through practical learning and observing the process first-hand.

- Test your strategy – Before you implement a strategy, you may not know how successful or viable it is. Trialling your strategy with a demo account can highlight any tweaks or alterations you should make.

Disadvantages

There are some drawbacks that you should be aware of before opening a demo account:

- Replicability – Demo accounts can lull you into a false sense of security. Even if your strategy has been successful with your demo account, this may not be replicated when trading live.

- No emotional investment – Whilst trading with live funds requires discipline, using a demo account will not have the same effect. This could lead to bad habits and spur-of-the-moment, reckless trades.

- Misrepresented trading – Trading on live accounts involves slippage, which is the difference between the advertised price and the purchase price. Demo accounts only trade at the exact price advertised. Furthermore, the entry and exit process for a live account vs a demo account is different. For example, if you want to sell a stock on a demo account, it is accepted and processed immediately. In reality, your sale requires a buyer and if no one wants to purchase your stock, then you cannot sell it.

- Access to features – Sometimes, platforms use demo accounts to advertise their services. When you move to a live account, you may not have free access to the same services such as indicators and signals.

Final Word on Demo Accounts

While there are some drawbacks to using a demo account, they are outweighed by the benefits. Opening a demo account is a perfect opportunity to gain vital experience within tricky markets. As there are plenty of options for platforms or brokers, you should always conduct thorough research. This is because the trading experience you have with a demo account can help to influence your success or failure with a live account.

FAQ

What Can I Trade With Demo Accounts?

Almost every type of financial instrument that can be traded is available on demo accounts. While they will not all necessarily be available on the same platform, it is possible to engage in binary options, futures, CFDs, crypto and commodities trading. If you wish to try a range of trading instruments, look for a broker with an unlimited demo account.

What Is The Difference Between A Demo And Live Account For Forex?

Live forex accounts use real capital vs a demo account which uses simulated funds. In addition, no registration is required for most paper trading accounts, but this is very rare with live accounts. Finally, forex demo accounts sometimes have an expiration, whereas live accounts can be used for an unlimited time.

What Are The Best Free Day Trading Demo Account Platforms?

The best day trading demo accounts will depend on a range of factors. Among personal preferences, traders should consider fees, time limits, features, regulation and ease of use. Before you start swing or day trading, you should research the most suitable software for you.

Is It Possible To Trade On The National Stock Exchange Of India With A Demo Account?

Yes, there are platforms such as GCI where you can trade the NSE Nifty Index, for example. This makes it possible to open a demo account for stock, share, commodity or even crypto trading in India as well as around the world.

Is A Demo Account Helpful Or Not?

Yes, demo accounts are useful ways to practise and experiment with markets. If you are inexperienced or you feel nervous with live trading, then it could be worth opening one.