Stocks Swing Trading Guide

Stock trading is a popular type of retail investing. Swing traders can use online brokers to speculate on shares at major exchanges, such as the Nasdaq and FTSE. This guide will explain how swing trading stocks works, from the pros and cons to strategies and tips for beginners. We’ve also covered how to compare the best stock trading brokers and platforms in 2025.

Brokers With Stocks for United States

What is Stock Trading?

Let’s start with a simple definition: Stock trading involves investing in shares of either one business or multiple companies with the expectation that the price of the stock will change – creating a profit. A trade is simply an order to purchase or sell shares in a company.

There are many intricacies when it comes to stock trading. Traders will often need to combine a mixture of technical (looking at graphs and using indicators) and fundamental analysis (looking at the underlying state of a particular company).

The primary reason why traders invest in stocks is to take advantage of profitable opportunities to earn a decent salary. Traders are also able to speculate on the value of companies that they know or are customers of, such as Apple, Google and Netflix. In addition, swing trading can bring added excitement as investors will often only hold on to shares for a few days or weeks.

Markets Explained

Aspiring stock traders can speculate on equities listed on major exchanges across the world, including:

- New York Stock Exchange

- London Stock Exchange

- Shanghai Stock Exchange

- Deutsche Boerse

If there is a particular company you are interested in, check the exchange on which it trades and confirm that your chosen broker offers it. Those looking for increased diversification may also want to consider investing in ETFs (exchange-traded funds). These track an index like the Dow Jones or S&P 500, meaning you’re not tied to the price fluctuations of a single company.

In addition, other derivative products allow you to speculate on the value of a stock without buying or selling the share directly. Popular retail derivatives include contracts for difference (CFDs) and futures & options (F&O) contracts.

Swing Trading Blue Chip Stocks

Typically, blue-chip firms have a long history with a relatively stable customer base. These companies tend to enjoy a significant market capitalization of over a billion dollars. As a result, blue-chip stocks offer good investment opportunities for swing traders with balanced portfolios.

Blue-chip stocks bounce back to normal from bearish markets quickly despite facing uncertainties. Therefore, if you’re looking for less volatile and lower-risk investment opportunities, you may want to consider blue-chip trading stocks.

Swing Trading Penny Stocks

Swing trading penny stocks is a potentially profitable strategy. However, you can also lose your investments easily, especially if you do it randomly, without considering critical aspects. Swing trading penny stocks generally involves purchasing small-cap stocks. Afterwards, you hold them for several days, weeks, or months, depending on your preference.

You can swing trade penny stocks by purchasing them at support levels and waiting until they are almost breaking out. So while fundamental research is important when trading penny stocks, the most essential thing is knowing when and where to purchase.

Important: when trading penny stocks, day trading is arguably a safer trading style than swing trading. This is because swing trading tends to hold a position for a longer period, making it risky, given that penny stocks are highly volatile.

Top 10 Swing Trading Stocks In 2025

Identifying the best swing trading stocks can be challenging, particularly because stock markets are in constant fluctuation. Plus, the shorter the holding period, the more careful you should be with your trading decisions. Fortunately, some stocks are more favorable to swing trade than others. The following are good options for 2025:

Apple (AAPL)

Apple has been a major beneficiary of the current stock market rally. The tech company made a tremendous run in 2020, making it the world’s first company to hit a market cap of $2 trillion. By early 2022, its value had jumped to more than $2.75 billion. Most stock swing traders identify AAPL as a suitable option because it strengthens its position with nearly all of its products.

Meta (FB)

The tech industry has been one of the key growth areas of the COVID-19 pandemic as more businesses shifted to digital solutions. Facebook’s current value is around $890 billion and it is ranked among the top ten largest companies globally. The firm recorded a whopping 12% growth in revenue between 2020 and 2021, despite the challenges many businesses faced.

Caterpillar (CAT)

Caterpillar Inc. specializes in manufacturing mining and construction equipment. Such equipment includes diesel-electric locomotives, natural gas and diesel engines, plus industrial gas turbines. What makes Caterpillar one of the best swing trading stocks is its high liquidity and volume. On average, investors trade over 2.1 million stocks per day.

Bank of Montreal (BMO)

A financial company that specializes in various services, including investment planning, wealth management, and commercial banking. It is among the top ten banks in North America, serving approximately 12 million clients. BMO’s great performance, high liquidity and volume have all made it a good target for stock swing traders.

Microsoft (MSFT)

The tech giant is another beneficiary of the increasing integration of digital solutions in the business sector. It experienced a drastic increase in sales and EPS over the past year. As a result, its stock comes with high trading volumes and liquidity, making it a favorite choice for swing traders.

Kohl’s (KSS)

Kohl’s is one of the most successful department store retailers in the US. It has more than 1,000 locations spreading all over the country. The company’s stock has multiple characteristics suitable for swing trading. For example, the company’s average daily traded volume amounts to around 14 million. This volume and high liquidity makes KSS a closely monitored stock by swing traders.

Kellogg (K)

Kellogg’s is one of the world’s leading marketers and manufacturers of crackers, cookies, and cereal, among other packaged foods. It manufactures products in 21 nations and markets them across 180 countries. Kellogg’s product mix constitutes renowned brands, like Pop-Tarts, Rice Krispies, and Frosted Flakes, to mention a few.

Stanley Black & Decker (SWK)

The company specializes in manufacturing power and hand tools. Its products are used for repairing electronic devices, homes, and vehicles. Importantly, its stocks have an average trade volume of approximately 459,000 shares a day. This volume makes it a perfect choice for swing traders.

Netflix (NFLX)

Netflix is one of the most successful streaming companies worldwide. Since its inception, it has introduced tremendous changes in the streaming industry, changing the way people watch television. The company also provides personalized content depending on user preferences. In addition, the COVID-19 pandemic meant that people spent more time watching films and series, leading to a surge in popularity and value.

Despite increasing competition, the company is routinely developing strategies to retain users so its share price will likely see continuous movement in the coming months and years.

Salesforce (CRM)

Some stock swing traders might avoid Salesforce in favor of high-growth stocks, which trade at higher valuations. However, the company’s takeover by one of the world’s leading collaboration organizations, Slack, warrants awareness. Salesforce is a tech-centered company specializing in cloud computing. By early 2022, its market cap hit $220 billion. The firm has excellent prospects given its rapid revenue growth over the past few years.

In addition to the individual stocks listed above, a couple of industries, in particular, could see serious growth this year:

- Artificial Intelligence – The industry is predicted to boom this decade, with AI entering more sides of the economy and becoming a bigger part of our day-to-day lives. Self-driving cars are just one example of where AI could have a transformational impact.

- Electrical Component Manufacturing – As technology creeps into more aspects of our lives, the demand for important electrical components increases. Whether it’s 5G or more technologically advanced vehicles, keep an eye on the big manufacturers of electrical components.

Stock Screeners & Picks

Fortunately, individual stock investors can often leave the task of stock selection to the experts. Many experts have an extensive team of analysts and resources to help them research the wide range of stocks available in the market. It may be advisable to do this, especially if you don’t have a high-quality stock screener to do this work on your behalf.

Stock screeners come with sophisticated technologies and can look through thousands of stocks listed globally within seconds. They can then find stocks that meet your specified investment criteria and risk appetite.

Essentially, working with stock screeners helps you narrow down your investment choices to those that meet your personal goals and requirements. This can make them an excellent swing trading selection partner. Stock screeners also provide a visual representation of the current stock market. Therefore, you can make your trading decisions based on actual volume data.

If you are looking for a stock screener, FINVIZ is one of the best stock screeners available in the market. It provides an ideal combination of tools, including a wide selection of technical and fundamental criteria, charts, and real-time quotes, to name just a few.

Swing Trading Stock Selection for Beginners

Stock picking is a crucial aspect of swing trading. The following are some things to consider when selecting stocks:

Market Direction

Traders tend to follow a concept that suggests whether a specific stock is falling or rising in value based on the present market situation. The case is so because it will continue progressing in the same direction if parameters do not change.

Liquidity and Volume

Stock swing traders usually focus on comparatively large and actively traded equities. The main goal is to select easy-to-sell, buy, and go short stocks. Since swing traders often hold their positions within shorter timeframes, traders must execute their orders as quickly as possible.

Unfortunately, the stocks with the highest trading volumes and liquidity are monitored closely by a large population of traders. As a result, it limits the profitability of these swing trading opportunities. That being the case, traders should look for opportunities on stocks with an average direction index (ADX) of more than 25. This will indicate that the stock is trending.

Volatility

Stock swing traders often rely on larger and more volatile stocks to gain profit. Therefore, look for stocks with a history of significant price movements within a short period. One popular approach is monitoring the average daily ranges (ADRs). This technique involves tracking simple moving averages (SMAs) to identify day-to-day disparities between a specific stock’s daily low and high prices.

Sector Selection

Swing traders target stocks in the most stable or strongest sectors. Conducting a comparative stocks analysis in multiple sectors allows you to identify the best-performing stocks. As a result, you can swing trade stocks from the industries that have excelled in the sector indices.

Tight Spreads

Swing traders closely monitor the difference between the ask and bid prices of stocks they are interested in to control spillage. Stocks with broad spreads limit swing trading profitability. Therefore, low-priced stocks are generally not good swing trading candidates.

Clear Uptrend

Swing traders often prefer less jumpy stocks. Stocks with clear uptrends are less susceptible to frenzied selling and violent pullbacks. Therefore, if you’re new to swing trading stocks, it could be worth sticking to stocks with less price action and without significant gaps in price lines.

What to Look For in a Stock Broker

There are many stock trading brokers and platforms to choose from, including eToro and XM. The key thing is to make sure the brokerage offers the shares you are interested in, whether that’s Yahoo, Coca-Cola or Shell. We’ve compiled a short guide of the key factors to compare below.

Instruments

Does the broker offer a wide range of stocks from multiple regions, exchanges and industries? Also, what stock trading products are available, such as spot trading, CFDs or fractional stocks? Does the brand also provide ETFs and mutual funds? For those starting out or with minimal capital, leveraged CFDs are a good place to start.

Fees

The best stock brokers for swing traders offer a transparent pricing structure. The most important fee to consider is the commission rate, typically charged per transaction or trade. Some brokers, including eToro offer commission-free investing, making them popular with beginners. Of course, remember that brokers need to make a profit, so fees are likely to be made up elsewhere, be that overnight charges, inactivity fees or deposit and withdrawal charges.

It’s also worth bearing in mind that fees often vary with the account type. Some top stock trading brokers offer specific zero-commission accounts which generally have wider spreads, and then an alternative raw spread account with zero pip spreads and larger commissions. As you move up account tiers, you typically get access to better trading tools, such as stock screeners, market research, and free mobile apps.

Note, if you require an Islamic or Halal account, check the broker offers this solution before making a deposit.

Leverage

Leverage allows traders to invest a greater amount than their actual capital deposit. It can lead to larger profits when stock trading, but also comes with greater risk as losses may also be larger. It is, in effect, a loan given to the trader.

Brokers offer different leverage ratios, so if you want to trade on margin, look at the broker’s requirements first. Some websites linked to stock trading may also offer a leverage calculator, which makes it easier to understand the margin required for a given position.

Educational Material and Market Research

Educational material and market research are important tools. Unsurprisingly, some brokers offer a more comprehensive package. XTB, for example, offers a good range of educational material and online stock trading courses, as well as an easy to follow market calendar so that traders can stay on top of major news events.

Having said that, not everything has to come from your broker. There are many 101 stock trading courses, including guides for beginners and more experienced traders, as well ebooks and general stock trading tips and strategies to improve your market knowledge.

Other sources of market and educational material include Yahoo Finance, YouTube channels, investing podcasts, plus trading journals. In addition, Quizlet has material that can test your stock trading knowledge.

Online forums, such as Reddit (popular in the US and the UK) or Quora, can also be good sources of information on swing trading stocks, though remember that many of the users posting may be beginners. Still, they can be useful for answering various questions, for example, cutting through jargon and terminology, explaining the basics regarding the current state of the market, or talking about joining stock trading groups on Discord.

Order Executions

Some brokers differentiate themselves through rapid execution speeds. An investor’s swing trading strategy may require a stock to be purchased at a precise point to maximise profit and slow order executions can hamper this. If timing is critical for your strategy, ensure that your stockbroker has a good track record of prompt order filling and no re-quotes.

Top brokers like Webull may also offer premier Level 2 market data from exchanges like the Nasdaq, giving investors additional transparency when placing orders. Note, Level 3 quotes are restricted to registered Nasdaq market makers.

Demo Account

Most reputable stock brokers offer a free demo account. A paper trading account essentially lets you trial a broker and refine swing trading strategies before risking funds. The online simulator is also a good place to practice leveraged stock trading and get familiar with particular platforms and apps, such as MetaTrader 4 and MetaTrader 5.

Trading Platforms

The desktop or mobile trading platform available is your gateway to the stock market. A user-friendly terminal will let you conduct technical analysis using interactive charts and drawing tools. The top platforms also offer a selection of instant and pending order types, plus integrated news streams and automated trading functionality.

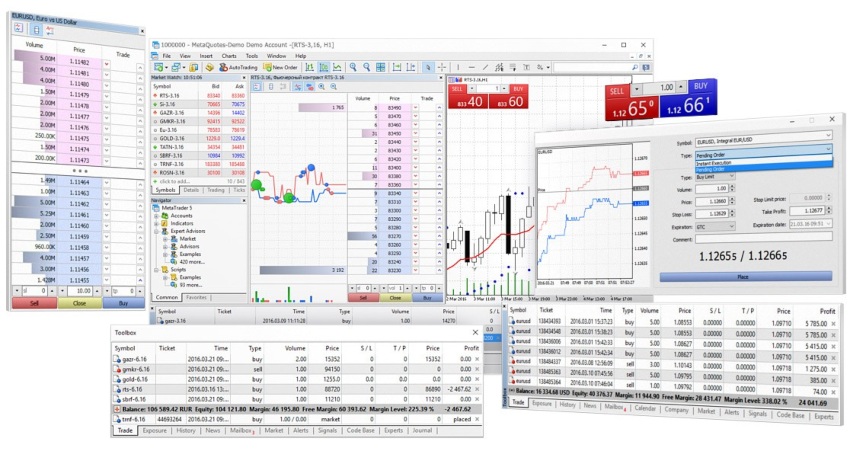

The MetaTrader 5 platform, available to download on Windows and Mac OS X is one of the top-rated platforms offered by retail stock trading brokers. It offers 38 technical indicators, 44 analytical objects, 21 timeframes, 1-minute history, plus an unlimited number of charts. Trading signals are also available so you can copy the positions and strategies of experienced investors.

Note, MetaTrader 4 is also a popular software but it’s primarily aimed at forex traders.

MetaTrader 5

TradingView is another useful trading tool for aspiring stock traders. It offers free stock market analysis without needing to sign up with a particular broker. This makes it a good additional resource.

Some stock trading platforms also offer robots (or bots) that can automatically conduct trades and implement strategies. Pre-built algorithms and software are available or you can build your own through programming languages like Python. More information and guidance on building a bot can be found on GitHub.

Note, a trading API (Application Programming Interface) allows investors to connect their own platforms to trading data. Also, the K-means clustering algorithm can be used in Python to interpret stock market data.

Stock Trading Tips

Swing Trading

Swing trading is a popular short to medium-term strategy that typically involves holding positions for a few days up to several weeks.

If you’re trading on fundamentals, it’s important to keep an eye on market news to identify the best entry and exit points. Brokers with real-time news streams and push notifications can prove helpful here. Other potential entry and exit points are when stocks are near a 52 week high or low, indicating that it’s potentially under or over valued and experiencing a bullish or bearish run. Of course, always supplement your research with P&L statements, investor relations insights, and wider industry data.

Dollar-Cost Averaging

Dollar-cost averaging is a common stock trading strategy that helps keep a handle on risk. Essentially, a trader will invest certain amounts at particular intervals, rather than just investing all their capital at one point. This helps spread risk and ensures you don’t lose all your capital in a few bad trades.

Let’s look at an example: say a trader wants to invest $1,000 in Netflix. Instead of investing that whole amount in one go, they may choose to invest in $100 portions every two days. This will help minimise the impact of a significant and unexpected price fluctuation.

Timing

Markets are more liquid at certain times of the day, usually during the first and last hour of the trading day. During this time, spreads will tighten and significant price action may take place. As a result, it’s important to time your trades to capitalise on trends and maximise potential returns.

Volatility

Volatility creates opportunities, as profit comes from price movement. How far the price of a stock is from its moving average can be a helpful indicator, so use a trading chart to plot fluctuations. It’s also worth remembering that higher volatility means increased risk, so ensure you have appropriate risk management alerts in place.

Note, extreme volatility or a sudden downward move may lead to a trading halt by the relevant stock exchange, which consists of a temporary trading suspension.

Economic Calendars

An economic calendar offers critical insight into how a country’s economy is progressing. As a result, stock swing traders can spot possible future trading risks and opportunities depending on a nation’s economic well-being. Fortunately, most top stock brokers offer a free economic calendar on their website or platform.

Benchmarks

The S&P 500 is widely seen as a strong indicator for the state of the overall stock market. Comparing performance to that of the S&P 500 is a good way to gauge progress with many hedge funds doing the same. For UK investors, the FTSE paints a good picture of the British stock market. Similarly, the Shanghai Stock Exchange is the key index in China.

Trading Hours

Unlike the crypto market which runs 24/7, stocks follow the opening times of their respective exchanges. For example, the main trading hours for the New York Stock Exchange in the US are 09:30-16:00 ET, Monday-Friday. For the London Stock Exchange in the UK, stock trading hours run from 08:00-16:30 UK time, Monday-Friday. Keep an eye out for stock trading holidays, when the market will be closed.

It’s also worth pointing out that some brokers and platforms offer pre-market and after-market trading sessions for additional exposure.

Pros of Stock Trading

- Market research – With stock trading popular with retail investors all over the world, there is a wealth of free market information and training materials online. This makes it relatively easy for swing trading beginners to get started.

- Competitive broker market – A wide range of retail brokers has led to competitive pricing for customers, including commission-free stock trading accounts and free stock screeners.

- Endless opportunities – Whatever your strategy or risk management approach, there will be opportunities in the global stock market. From some of the biggest brands in the world like Apple and Amazon to penny stocks and fractional shares, there are products to suit all types of investors.

Cons of Stock Trading

- Price of some stocks – Individual shares in companies like Amazon and Alphabet (Google) can cost several thousand dollars. This makes them inaccessible to many amateur traders. With that said, many brokers are introducing fractional shares, so investors can purchase 0.25 or 0.5 of a share, reducing the barriers to entry.

- Understanding technical analysis – Swing trade strategies that focus on technical analysis can feel daunting for beginners. As a result, stock investors will need to persevere and make the most of the online tips and training materials. We also recommend using a demo account to get familiar with charts and patterns before risking funds.

Swing Trading Stocks Vs. Day Trading Stocks

Swing trading on stocks involves holding positions for several days or weeks. On the other hand, day trading involves opening and closing sometimes multiple positions in a single trading session.

Day trading is best suited to active investors with the time to monitor the financial markets. Swing trading offers longer timeframes and arguably more opportunities to consider fundamentals.

Taxes

Traders need to ensure they stay on the right side of tax laws and regulations. How your trading income will be taxed will vary depending on where you’re based. For example, those looking to invest in US shares but who are not US citizens for tax purposes, will need to complete a W-8BEN form to benefit from the relevant tax exemptions. Active US investors who qualify for trader status may also be able to declare business expenses related to their activities on a Schedule C form.

For UK stock traders, investing through an ISA affords you a £20,000 annual tax allowance. With that said, regulators have cracked down on the ‘bed and breakfast’ share dealing approach, whereby individuals sell their assets just before the end of the tax year and then buy back the same stocks when the new tax year starts, utilising the capital gains tax allowance scheme. HMRC’s 30-day rule seeks to prevent this by requiring traders to wait 30 days before they can re-buy any shares recently sold.

The key thing is to check your tax obligations before you start trading. You can check online or consult a local tax advisor for guidance.

Bottom Line

Swing trading stocks has the potential to be a profitable hobby or profession. The growth of new industries and the emergence of technologies, such as blockchain and AI, means that there are plenty of opportunities for aspiring investors. But remember, whether you are starting with $100, $1000 or $2000, you will need to be patient – gains do not always come straight away. We also recommend utilising a free demo account if you’re just starting out.

FAQ

Is Stock Trading Halal Or Haram?

Trading shares is generally considered Shariah-compliant and, therefore, Halal. With that said, the company in which you invest should not engage in prohibited activities, so businesses involved in alcohol, tobacco or gambling, for example, are generally considered Haram. Equally, holding positions open overnight that incur interest or rollover charges, are usually prohibited. Fortunately, many top stock trading brokers offer Islamic-friendly accounts with swap-free conditions.

When Are The Best Times To Buy Shares?

There is usually increased volatility during the first hour of a trading session, which means greater price action and profit potential for switched-on investors. The period towards the end of a trading day can also see serious movement. As a result, many stock trading strategies focus on entry and exit points during these periods.

Do All Stock Brokers Charge Commission On Trades?

No – some of the best online stock brokers offer commission-free accounts. With that said, fees are usually made up for elsewhere, typically in higher spreads or withdrawal charges. As a result, it’s important to compare all trading and non-trading fees before signing up for an account. Avoid brokers with unclear pricing structures with hidden stock trading fees.

How To Find The Best Swing Trade Stocks Under $5?

Different swing traders have different trading budgets. Finding stocks below $5 should no longer stress you. Stock screeners can help you find stocks below the $5 mark. These tools are designed to filter stocks depending on specific user-defined metrics. Therefore, you can filter the price to $5.

How To Find The Best Swing Trade Stocks Under $10?

If you’re looking to trade stock below $10, performing research would be helpful as you can learn about the latest stocks within the $10-dollar mark. Stock screeners can also help you sort through a long list of stocks below $10, enhancing your ability to select those that fit your swing trading methodology. Equally, you can apply this approach to find suitable stocks under $20.

Can Swing Trading Stocks Make You Rich?

Often people ask, can swing trading stocks be profitable? Swing trading can earn you a living only if you do it safely and consciously. Importantly, it may offer faster profits than typical investments. This is because you enter and exit trades relatively quickly, unlike long-term investors who often wait for years to gain significant profits.

Is Swing Trading Stocks Legal?

There are no legal restrictions against swing trading stocks. But while there are no limits to the amount you can begin to swing trade stocks with, some brokers set a minimum figure that you should maintain. It’s also worth checking local rules and regulations before registering for a stock trading account.

Is Stock Trading A Zero Sum Game?

Although many transactions in stock trading are not zero sum games, the trading of futures and options contracts is considered zero sum because if one side profits from the contract, it follows that the other side loses.