TradingView Brokers

TradingView brokers are an ideal option for swing trading enthusiasts of all experience levels. The platform is one of the best charting and analysis tools available, with a select few brokerages supporting its use for integrated trade executions. This 2025 TradingView brokers guide will break down the key functionalities of the platform and help you choose the right supporting provider.

Best Brokers For TradingView for United States

What Is TradingView?

TradingView is a platform for viewing and analyzing market data for a wide range of assets, such as forex, futures, cryptos, bonds, stocks and indices. It is a world-leading tool that has been adopted by many brokers and is accessible for all experience levels due to its vast educational support and charting capabilities. With over 30 million users registered, TradingView also provides a community where traders can share ideas, strategies and indicators.

How Can TradingView Brokers Improve My Experience?

Charts

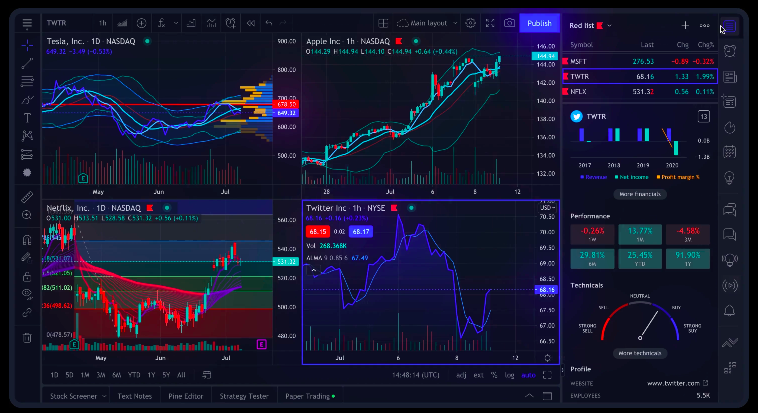

The charting of an asset’s historical data can be key for planning future trades. With TradingView brokers, you can create a screen with several synchronized charts that show as much information as you could need at one time. There are 12 different types of charts, such as candlestick and area, so you can select the one that is best for you. Most platforms do not offer advanced charting options like Kagi and Renko charts, setting TradingView brokers apart.

Screeners & Heatmaps

Using TradingView brokers means that you will also have access to screeners and heatmaps. Screeners are a filtering feature through which you can arrange stocks, forex pairs and cryptocurrencies according to certain metrics such as market cap and volume. Additionally, the platform includes a technical rating allocated to each asset to show recommendations for buying or selling.

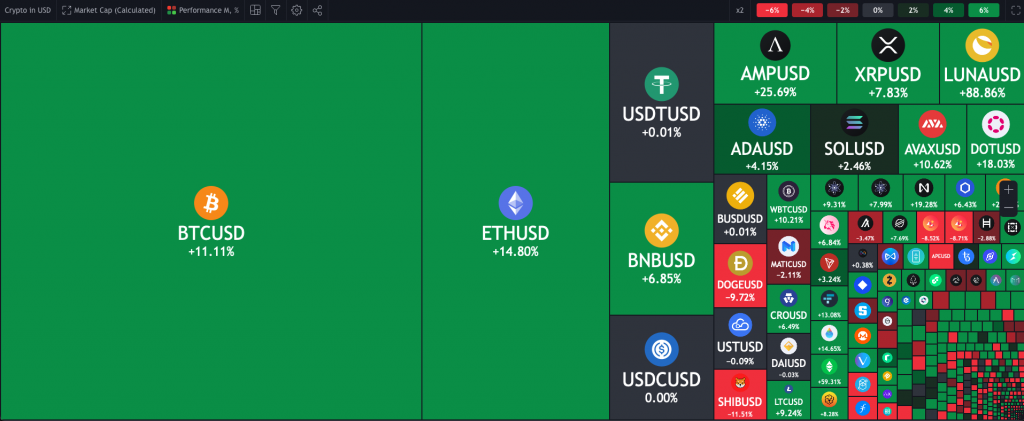

A heatmap is a tool to visualize the current markets for stocks and cryptos. Assets are split into tiles, where the size of a tile represents either the market cap or traded volume. The colour of the tile represents an asset’s performance over a given period, with green signifying growth and red signifying a decline.

TradingView

Indicators

TradingView provides hundreds of indicators to help you strategize, plan and execute your trades. An indicator collects historical data and presents information that can be used to make predictions for future asset performance. Included in the package are some popular indicators such as Bollinger Bands, moving average convergence divergence and several types of Relative Strength Indices.

Alternatively, you can opt for one of the many indicators created by other customers on the TradingView network. One of the most popular of these is the Bjorgum Key Levels indicators, which identifies breakouts, false breakouts and back checks.

Community

TradingView brokers also provide access to a massive network of registered users. In this community, many share algorithmic trading scripts built using Pine, TradingView’s programming language. Already, over 100,000 indicators and strategies have been created and shared on the network, many of which have come from the top authors called Pine Wizards. Additionally, you can find scripts with automated trading bots that can execute trades on your behalf, such as the 3Commas Bot.

There are also several ways to access technical analysis tips on TradingView. Firstly, there are many pages on which users can discuss anything from potential strategies and helpful indicators to risk management methods and long-term trading plans. For quick and easily-digestible information, there are 20-second snippets that cover current news that can impact your trading. If you prefer video tutorials rather than reading, then you can watch one of the many analysis live streams. Frequently, users are streaming their trading sessions and market analysis techniques.

Paper Trading

Another key TradingView feature is the paper-trading option. This function is similar to the demo accounts that many brokers provide, offering a practice environment. The paper trading option allows you to practice trading with up to $100,000 of digital funds in a simulated, real-time market. This is a perfect opportunity to try out different strategies, assets and charting options before risking real capital.

Pricing

The trading platform has four different subscription models, though some TradingView brokers include access to the software for free. For the full feature breakdown between account types, see the TradingView website.

Basic

- Free

- One saved layout

- One chart per tab

- Three indicators per chart

- No direct customer support

- Seven years of financial data

Pro

- Five saved layouts

- Two charts per tab

- Five indicators per chart

- 20 years of financial data

- $14.95 per month or $155.40 annually

Pro Plus

- 10 saved layouts

- Four charts per tab

- 10 indicators per chart

- 20 years of financial data

- $29.95 per month or $299.40 annually

Premium

- Eight charts per tab

- 25 indicators per chart

- Unlimited saved layouts

- 20 years of financial data

- Second-based time intervals

- $59.95 per month or $599.40 annually

Trial

If you are unsure which TradingView plan is right for you, there is a free 30-day trial period option. Using this, you can try all the different services available to determine which you would use and pick the best account according to your needs.

Real-Time Data

Investors using TradingView brokers can access real-time data from exchanges across Europe, North and South America, Asia, the Middle East and Africa. Some of these are accessible free of charge, such as the Johannesburg Stock Exchange in South Africa and the National Stock Exchange of India. The real-time data of cryptocurrencies from platforms such as Binance is also free. Some other exchanges, however, incur a fee. For stock exchanges in countries such as Canada (TSX), Nigeria (NSE), Malaysia (MYX) and Australia (ASX), charges range between $1 and $20 per month.

TradingView Crypto Heatmap

How to Compare TradingView Brokers

Market Access

One of the most important considerations for comparing TradingView brokers is the range of assets you can trade. For example, if you want to speculate on foreign exchange, ensure the firm offers an array of forex instruments.

Fees

Some TradingView brokers charge monthly fees for their services, on top of any software costs you must pay for TradingView. There are “free” brokers but the spreads they offer are usually much wider than paid-for services. Other brokerage charges to take into account are deposit and withdrawal fees, overnight swaps, dormancy charges and margin rates. While any charges can easily cut away at your trading profits, you should also consider the potentially higher quality service that comes with a brokerage you have to pay for.

Payment Methods

It is often helpful to have quick and easy methods for depositing and withdrawing funds from your brokerage account. E-wallets such as PayPal and Neteller are popular due to their speed in transferring funds and ease of creating an account. However, if you are used to more traditional methods, most firms accept wire transfers, payment cards and cheque payments.

Regulation & Security

The best TradingView brokers will be licensed by a recognized regulatory authority, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). Regulation guarantees a level of trustworthiness, as well as additional security measures like negative balance protection and separation between user and brokerage funds. Also, look out for brokers with protections such as two-factor authentication in place.

Customer Support

The customer support team of TradingView brokers can greatly impact your trading experience. It is important if you have any technical issues or brokerage problems that could prohibit you from trading optimally that the broker’s customer service is knowledgeable and responsive. This can not only minimize frustration but also maximize the amount of time you can be analysing the market and executing trades. Check that the support on offer is available via a convenient method, such as a live chat window, telephone hotline or email address.

How To Use TradingView

TradingView can be accessed via a mobile app, desktop client or a web browser like Chrome or Edge. The mobile platform can be downloaded for both Apple iOS and Android APK devices from the bottom of the TradingView website. This is also where you can find the desktop application download link, which runs on Windows, macOS and Linux.

Trading directly through the platform requires you to have an account setup with one of the many supported TradingView brokers. Once registered, you will need to login to your broker account and connect with the platform. If your brokerage is not yet supported, you can use the TradingView REST API for integration.B

Benefits of TradingView Brokers

- 12 charting types

- Active community

- Screeners and heatmaps

- Access a wide range of markets

- Large amount of historical data

- Customizable trading experience

- Large library of indicators and strategies from other clients

Drawbacks of TradingView Brokers

- Real-time data from some exchanges require additional payment

- Not all supporting brokers offer TradingView for free

- Some features are locked behind a paywall

- Limited number of supporting brokers

Bottomline on TradingView Brokers

TradingView brokers offer access to a highly effective and useful charting tool that is used by many experts and beginners throughout the industry. The software package is accessible via a range of devices and offers a customizable experience with advanced and unique analysis functionality. However, not all TradingView brokers are made equal, so ensure you compare the rest of the fees and features of each firm against your personal needs and goals before opening an account.

FAQ

How Do I Access The Platform Through TradingView Brokers?

Clients of TradingView brokers can access the platform via mobile app, browser platform and desktop application. Find download links on the Apple App Store and Google Play Store for the movie versions, while the desktop and browser options are available on the TradingView website.

What North American Exchanges Do I Have Access To With TradingView Brokers?

There are 17 exchanges across North America that you will have access to via TradingView. These include four Canadian exchanges, such as the TSX and the CSE, as well as 13 in the US, including the NASDAQ and NYSE. Be sure to check with your broker that it offers instruments in these markets.

Can I Create An Indicator With TradingView Broker?

Yes, you can. If you have an idea for an indicator but have not found anything in the community library, you can use Pine to create your own. After you finish building the indicator, you can backtest using historical data to assess its accuracy before implementing it in live markets.

What Are The Top TradingView Brokers?

TradingView has a list of all the linked ECN and other brokers on its website. Some of the best supported TradingView brokers include FXCM, Pepperstone, CQG, ByBit, Tiger Brokers, and Interactive Brokers. FBS and Coinbase are two popular brokers that are not supported. You can keep up to date on news regarding future partners and integration via social media like Twitter, Facebook and Reddit. If you use a brokerage that does not support TradingView directly, you can link the two via the platform’s REST API.

How Do I Choose From TradingView Brokers?

There are several things to consider when finding the best TradingView brokers. Keep in mind your goals when you compare the features and functions of each firm, ensuring that your choice conforms to your needs. We recommend comparing trading fees, software charges, asset range, customer service, payment methods and regulatory status.