Swing Trading Tips

There are various swing trading tips and tricks out there. In this guide, we run through our key recommendations, from starting out to improving and maximizing your successes. We also explain how to develop an effective swing trading strategy for forex, stocks, crypto and more. Use our list of swing trading tips for beginners, intermediate and advanced investors to get started.

Setting Up

For swing trading newbies, it’s worth spending time learning about key investing concepts and jargon, plus basic strategies. It’s also worth getting to grips with popular financial markets, such as forex and stocks. This will give you a basic understanding of what influences prices and market trends. Fortunately, many top brokers offer a suite of helpful training materials for beginners.

Choosing a Market

Deciding what to trade is typically one of the first decisions you will make. It will also influence other aspects of your swing trading journey, including what broker you will sign up with and which strategies you will deploy.

Importantly, every market is different, and each has its pros and cons. Forex for example often requires limited start-up capital with generous leverage opportunities while stock trading can demand more upfront cash alongside lower leverage rates.

For beginners, we’d recommend sticking to one market to start with. This will help you focus your efforts and refine your approach before you start also looking to generate an income from cryptocurrencies, for example.

Timing Trades

Choosing the right trading window is important. While intraday traders may be active all day, executing sometimes hundreds of positions, swing traders tend to focus their efforts on the periods that offer the best opportunities, such as at the beginning and end of the trading day. These windows typically offer the most volume and volatility alongside tight spreads.

It’s also worth noting that different markets have different opening times. Forex is available 24/5, for example, with the EUR/USD pair often seeing the most price action between 12:00 and 15:00 GMT. In contrast, cryptos like Bitcoin can be traded 24/7, with substantial volatility often seen throughout the week and weekend.

Strategies

The best swing trading strategies can help traders cut risk and boost profits across various markets. Systems can be tailored to specific assets, levels of experience, and particular market movements and trends. Popular examples include:

- Power strategies

- Setup strategies

- Shorting strategies

- Technical strategies

- Fundamental / news-based strategies

Technical strategies, in particular, use charts and indicators to identify patterns and trends. They often utilize various datasets and indicators, such as Bollinger bands. Importantly, you must also develop a careful approach to risk management, using stop-loss and limit orders to lock in profits and cap losses.

Another top swing trading tip is to ensure that strategies are devised using facts and logic. Emotions often guide humans, but you must let data and statistics inform your decisions. The success of a trading strategy can hinge on whether you can maintain your discipline.

To find a swing trading strategy that works for you, a useful trick is to check out guides online. While you often pay for the best guides, there are some practical free resources available, including:

- Tutorial videos on YouTube

- Detailed books and eBooks on Amazon

- Free PDFs on Google and other search engines

- Swing trading tips and tricks from other investors on forums like Reddit

Trading guides are available in many different languages, including English, Marathi, Hindi, Malayalam and more. Reputable strategy leaders include Charles Reis, Rayner Teo, Vikram Prabhu and Nitin Bhatia.

Demo Accounts

One of the best swing trading tips is to make the most of free demo accounts. By doing this, you can see how your plan works in a simulated trading environment with no risk to your capital. They are a great place to hone skills, practise strategies and get familiar with platforms. You can then upgrade to a real-money account when you feel ready.

Fortunately, many of the best brokers and platforms offer free demo accounts, including XM, Pepperstone and AvaTrade.

Hardware

Use a computer that meets the requirements of your trading platform, as well as a monitor (single or multiple) that can help maximize productivity. A fast and reliable internet connection is also important, ensuring you don’t miss opportunities or encounter crashes at key moments.

Software

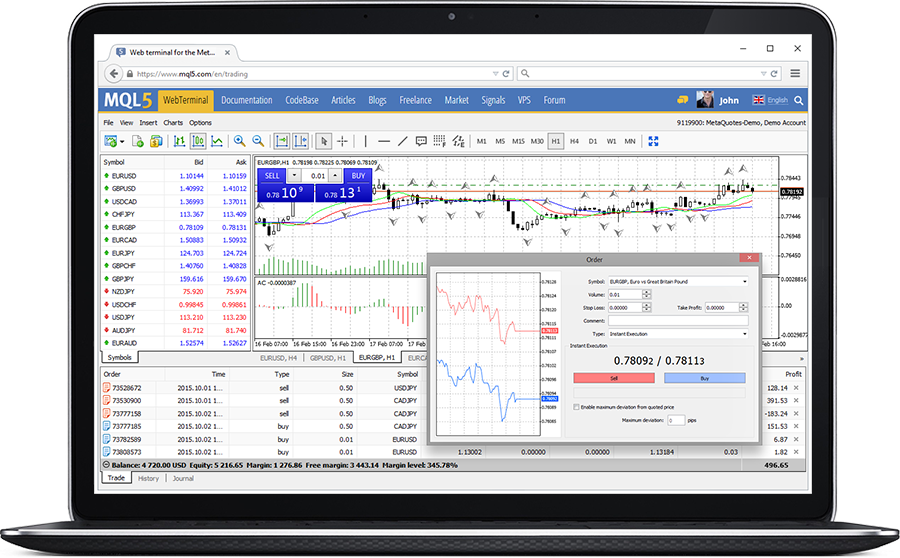

With many hours spent on the desktop or mobile terminal, finding a user-friendly solution is key. Test different platforms to find the right fit. Of course, bear in mind that most brokers only support a couple of terminals. Importantly, trading platforms should be stable, load rapidly and include the features you need to trade your chosen asset, such as binary options and futures.

The industry-standard solution is MetaTrader 4. MT4 provides a secure and seamless trading experience with advanced technical analysis, including 30 built-in indicators, 9 timeframes, automated trading capabilities, plus an integrated news feed. Some brokers also add bespoke features to the MT4 platform for an enhanced experience, including Autochartist, Myfxbook and PsyQuation.

MetaTrader 4

Other reputable terminals include MetaTrader 5 and cTrader.

Brokers

Online brokers offer varying assets, platforms, features, leverage, plus fees via spreads and commission. Providers also have different minimum deposit requirements and trade orders. Other key factors to consider include the payment options available, negative balance protection and additional tools, such as copy trading and automated trading.

One of our top swing trading tips is to open an account with a broker that is regulated in the jurisdiction you reside in. This will help protect against scams and give you peace of mind.

Ultimately, your experience level will help determine which broker to register with. For beginners, a useful trick is to register with a provider that offers educational and training materials. In contrast, experienced traders may prefer a broker with more advanced, data-driven tools.

Check out our online reviews to find the right platform for your needs.

Maximizing Success

Now that you’re ready to get started, there are useful swing trading tips to follow when you’re investing:

- Record progress – Keeping an accurate record of all your trades can help you improve. Track trade size, entry and exit points, profit and loss, any risk parameters used, plus the market you speculated on. Free software can also be used to automatically record this information and will help paint a picture of progress and areas for improvement.

- Tools & data – Countless other traders are attempting to make profits, including institutional investors. As a result, it’s important to make use of any available tools and technology. Advanced charts at TradingView, copy trading services and forex heat maps, can all help you assert an edge. Seasoned traders can also utilize programming languages such as Python to build their own algorithms and automated swing trading strategies.

- Emotions – Intuition can be your greatest strength but also your greatest weakness. In an environment driven by data and statistics, the failure to use conscious reasoning can lead to significant losses. Traders should resist being influenced by their emotions, be that fear or greed. Instead, stick to your trading plan and keep long-term profits in mind.

- Risk – One of our top swing trading tips is to limit your losses through the 1% rule. This essentially means never investing more than 1% of your total trading capital on a single trade. This will ensure that a few bad trades won’t wipe out all of your funds and will help you stay in the swing trading game for longer.

- Mix it up – If the strategy you are using isn’t working as hoped in the expected timeframe, don’t keep pouring funds into it. Go back to the drawing board, re-evaluate and improve it.

- Never stop learning – It takes time to develop your swing trading skills, and along the way, you will incur losses. This is part of the process and even the best traders lose money at times. The key thing is to learn from errors.

Crypto Trading Tips

Cryptocurrencies like Bitcoin and Ethereum can be extremely volatile. But while risky then can also lead to serious profits. They are considered an alternative investment and can diversify portfolios with safe assets like bonds and stock indices.

One of our top swing trading tips is to take the time to learn how the underlying blockchain works. This may help you predict long-term use cases and profit potential. Another useful trick is to consider crypto CFDs rather than buying, holding and selling BTC or LTC. Contracts for difference allow investors to speculate on the price of underlying assets without actually owning the asset itself.

The best crypto exchanges in 2025 include Binance and Coinbase.

Forex Trading Tips

The forex market is one of the largest and most liquid markets, with over 170 currencies traded worldwide. Retail traders make up a tiny proportion of global trading volume; most trades comprise banks and large financial institutions.

One of our best forex swing trading tips is to focus on major pairs, i.e. those paired with the US Dollar. Majors offer the most volume with the lowest fees at top brokerages. Minors and exotics, on the other hand, offer lower liquidity, more erratic price swings and higher trading fees. As a result, they are often more suited to more experienced traders.

Stock Trading Tips

Stocks are popular with swing traders worldwide. For beginners, we’d recommend focusing on the largest indices as you’ll find more market insights and free tips online. Key indices include:

- Dow Jones

- FTSE 100

- S&P 500

- Nifty 50

- NSE

It’s also worth bearing in mind anomaly days. For instance, on the 1st of the month, financial institutions such as pension funds will inject large sums of money, impacting the stock market.

When trading stocks and shares, the most volatile times are the few hours at the start and end of the trading session. As a result, newbies may want to focus their attention between 09:30 and 13:30 EST and 15:00 to 16:00 EST.

Final Thoughts

Use our swing trading tips and tricks to get started. These can be applied to multiple financial markets, including forex, stocks, cryptos and commodities. Alongside our tips and hints, it’s also important to sign up with a well-rounded broker. See our list of best brokers in Europe, US, UK, India and beyond.

FAQ

What Are The Best Swing Trading Tips And Tricks?

Some of our 3 proven tips include utilizing a free demo account to refine strategies, only risking 1% of your capital on a single trade, and keeping a detailed trading journal on an Excel sheet. For beginners, we also recommend exploring copy trading services to learn from seasoned investors.

Is It Possible To Make Money From Swing Trading?

Swing trading is risky and profits are not guaranteed. To increase your chances of success, sign up with a reliable broker and research the particular markets you’re interested in before investing funds.

How Can I Start Swing Trading?

To start swing trading, you first need to find a broker. During registration, you will likely need to submit basic contact details, including ID documents and financial history. Once your account is verified, you can deposit funds and start trading.

How Can I Maximise My Swing Trading Success?

There are several things you can do to maximize your swing trading profits. Record your past progress, use technology and data to hone your strategy, control your emotions, and stick to a plan. See our top swing trading tips for guidance.