PAMM Brokers

PAMM accounts allow investors to generate profits without having to carry out or research trades themselves. Brokers essentially employ account managers who trade forex or other assets on behalf of the account holder.

Read this guide to learn the definition and meaning of a PAMM account, how the system works, plus the pros and cons. We also list the top brokers offering PAMM accounts in 2025.

PAMM Brokers for United States

PAMM Accounts Explained

PAMM stands for Percentage Allocation Money Management or Percentage Allocation Management Module. These trading services are primarily used in forex markets, but some companies do trade other assets as well, such as stocks and cryptos.

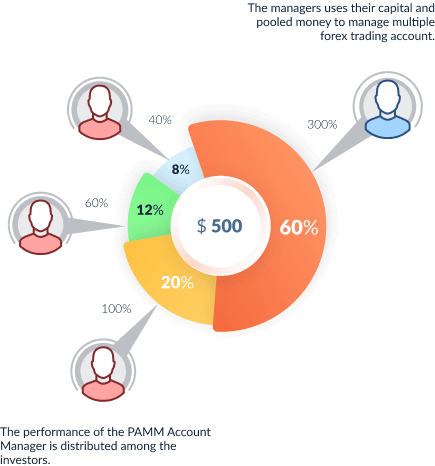

Importantly, a PAMM account is a type of managed account, in which the holder allocates a portion of their funds to a professional investor who trades on their behalf. In many cases, the manager handles multiple accounts simultaneously, trading with the pooled funds.

PAMM accounts can be opened in many countries including the USA, UK, India and Australia. Some of the best PAMM brokers today include InstaForex, HotForex and Dukascopy. For investors interested in cryptocurrencies like Bitcoin, Alpari offers a good solution.

How PAMM Accounts Work

PAMM accounts can be explained through a straightforward example…

Let’s say three traders (trader A, B and C) want to profit from forex trading, but do not have the time to research and execute trades. They choose to open a PAMM account, which is run by a money manager. This manager trades with their funds as well as any of their own capital. The traders do not have to put in equal amounts of money – any profits will be split according to how much each investor put in.

PAMM Accounts at LegacyFX

Importantly, when the traders sign up for a PAMM account, they sign an agreement known as Limited Power of Attorney (LPOA). This states that they agree to take the risk of any trades when they give capital to the money manager. This manager is then free to implement their own trading strategy to generate returns. The manager will normally charge a commission which is stated in the agreement.

Roles

With a PAMM account, there are three important roles to understand:

Broker

- The broker provides a reliable platform that allows investors and managers to interact

- The broker facilitates trading for the money managers

- The broker facilitates deposits and withdrawals for investors and managers

- The broker allows for transparent reviews of PAMM account managers through ranking and feedback systems

Investor

- The investor allocates funds for the money manager to trade with

- Generally, the investor does not get a say in which assets are traded by the manager

- The investor carries the risk of losing their capital if the money manager’s investments do not work out

Money Manager

- The money manager can only access capital that has been allocated to them. If trader A has allocated them $3,000, while having $6,000 in their account, the manager can only trade with the $3,000

- The manager is free to set a minimum or maximum amount criterion for investors

- The money manager can accept or deny new traders as they please

PAMM Vs MAM

With a PAMM account, profits and losses are split between investors as a direct proportion of the funds they put in, less any fees. A Multi-Account Manager (MAM) account is very similar to a PAMM account. However, the primary difference is increased flexibility for investors. Not only do they get to choose how much money they allocate to the manager, but they also get to choose the level of risk, i.e. to what extent leveraged trading is used. As a result, clients can end up with different returns that are not directly proportional to the amount they invested.

Pros of PAMM Brokers

The key advantages of PAMM accounts include:

- Managers invest their own funds and receive commission payments, creating an effective incentive

- Clients can leverage the experience of established investors

- Saves time spent researching the financial markets

- No prior trading knowledge needed

- Wide range of managers available

Cons of PAMM Brokers

Our review did also find potential drawbacks of PAMM accounts:

- Less transparency around the trading strategies used by money managers

- No autonomy over trades placed

- Risk of losing funds

How To Compare PAMM Brokers

There are several key considerations to take into account:

Account Conditions

Brokers typically have various conditions that need to be met by the investor before they can open a PAMM account. For example, a minimum deposit requirement. For those on a budget, FXTM offers a cent account that trades in cents rather than dollars. Professional traders may prefer the service from Tickmill, which requires a minimum deposit of $5,000.

Some brokers also offer practice accounts, otherwise known as demo trading. Dukascopy, for example, allows traders to open a PAMM demo account so they can learn about the system and see whether managers suits their needs before investing real cash. Location is another consideration.

US residents, for instance, are slightly more limited in their options. Forex.com and LQDFX accept clients in the US, but Pepperstone and Oanda do not.

Money Manager

The success rate of your money manager will often be the deciding factor in how much profit or loss you make. In theory, your broker should be transparent, allowing you to clearly view each manager’s past performance, strategy and user rating. Other things to consider are the length of time the manager has been trading for, and how much commission they charge. PAMM brokers that are well-known for being transparent include FXPrimus and FXOpen.

Regulation

Regulation is another important factor when comparing online brokers offering PAMM accounts. You should always look for a provider that is regulated by a top-tier body such as the UK Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC) or the Cyprus Securities and Exchange Commission (CySEC).

For example, IG and AxiTrader are both regulated by the FCA.

Bonus Schemes

Some forex brokers with PAMM accounts also offer a welcome or sign-up bonus. This could give you a boost when you start trading and will increase the funds you can allocate to your money manager. One such broker offering a bonus is AvaTrade. Just make sure you check terms and conditions before getting started.

How To Start A PAMM Account

Follow this step-by-step guide to open a PAM trading account:

- Register with an online broker. Use our comparison points above to help and read our reviews

- Sign in to your PAMM account with your login credentials and deposit funds via your preferred payment method

- Choose how much money you wish to allocate to the account manager. Remember, some managers may have minimum or maximum limits

- Once you have allocated the money to your manager, simply track the progress of the account. You should receive regular updates and be able to view profit and loss

Bottom Line on PAMM Brokers

PAMM accounts are a good option for new traders who lack the knowledge of other investors, as well as those who don’t have the time to research and execute trades. Importantly, when you open a PAMM account, you allocate funds to a money manager who trades on your behalf with a pool of funds and earns a commission from successful trades.

Note, PAMM accounts do not guarantee profits. There is still a level of risk so only allocate an amount that you can afford to lose.

FAQ

Which Brokers Offer PAMM Accounts?

Many top brokers offer PAMM accounts, including IC Markets, VantageFX and Pepperstone. Note, Interactive Brokers, XM, Tradersway and eToro do not offer PAMM trading accounts.

How Do I Become A Forex PAMM Account Manager?

If you want to become a PAMM account manager, you need a successful trading strategy and you need to be able to prove your investing history to attract clients. At most brokers, you will also need to make a minimum deposit of at least $1,000. Note, there may also be rules around account liquidation.

Which PAMM Brokers Accept US Residents?

There are not many brokers with PAMM accounts accepting US residents. With that said, one good option is a regulated brokerage like Forex.com.

What Is A PAMM Broker?

A PAMM broker provides investors and the best money managers with the opportunity to interact. They essentially act as a middleman, facilitating trading, payments and resolving any issues.

Who Is The Best PAMM Broker?

There is no simple answer as to which broker offers the best PAMM account. Having said that, IG and Pepperstone are two popular options. Use the comparison points above and read our reviews to find the right option for you.