Best Brokers For Third-Party Trading Software

Brokers with third-party trading software provide extra tools to improve the online investing experience. Popular add-ons include signals, copy trading solutions and technical analysis aids. Additional software can be provided at a charge or integrated for free alongside the broker’s existing platforms and tools. This guide explains how to get the most out of third-party trading software and the leading solutions available.

Third-Party Trading Software Explained

Trading software is essentially a program that supports digital investing activities. It could help identify particular patterns and trends or facilitate the mirroring of trading strategies and positions across multiple accounts. Some solutions specialize in particular markets, such as forex and stocks, while other services are asset-agnostic.

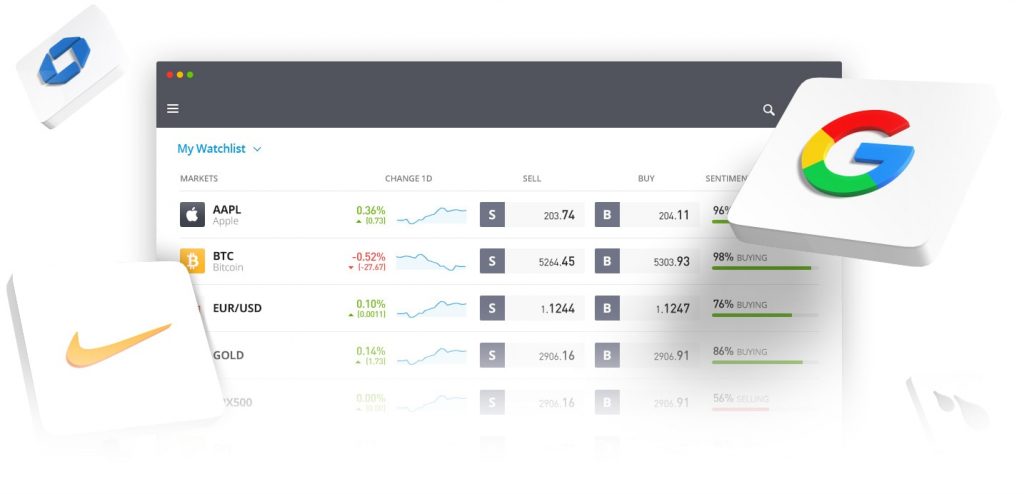

The most popular form of trading software is the desktop and/or mobile terminal provided by your broker. eToro, for example, offers its own proprietary platform which offers social investing on 3,000+ assets. Alternatively, many firms integrate the popular third-party MetaTrader 4 and MetaTrader 5 platforms, which can be used to research and execute positions.

eToro Trading Software

Applications

Among the most common uses for third-party trading software is:

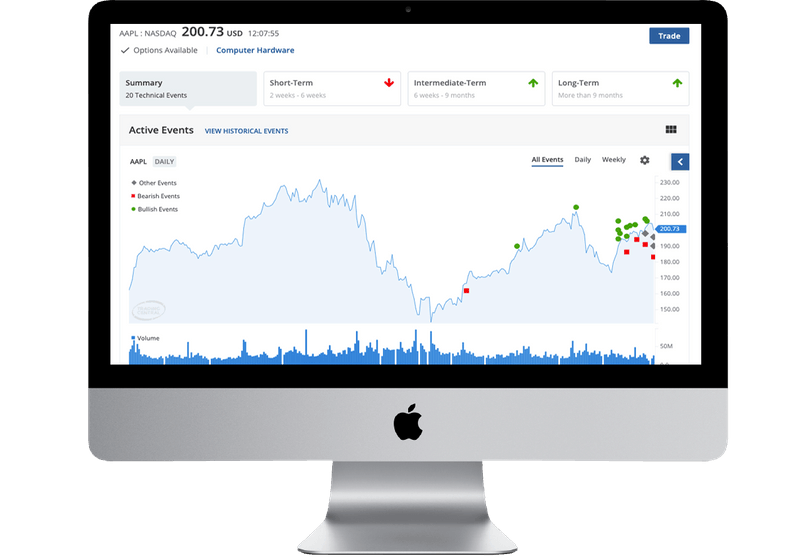

Analysis

Technical and fundamental analysis plays a key role in identifying trading opportunities. Of course, a broker’s existing platform may offer dozens of charts, multiple timeframes and a string of technical indicators. However, some brands like SuperForex provide access to third-party software such as Pattern Graphix which offers advanced technical analysis and pattern recognition tools. TradingView is another popular third-party add-on that is home to a library of user-developed indicators charting options. Trading Central, which is offered by Admiral Markets, is also a leading standalone application that provides economic analysis and news sentiment.

Trading Central

Importantly, the existing charting tools available on most standard platforms will meet the needs of beginner traders, but veteran investors may want more powerful software to aid trading strategies.

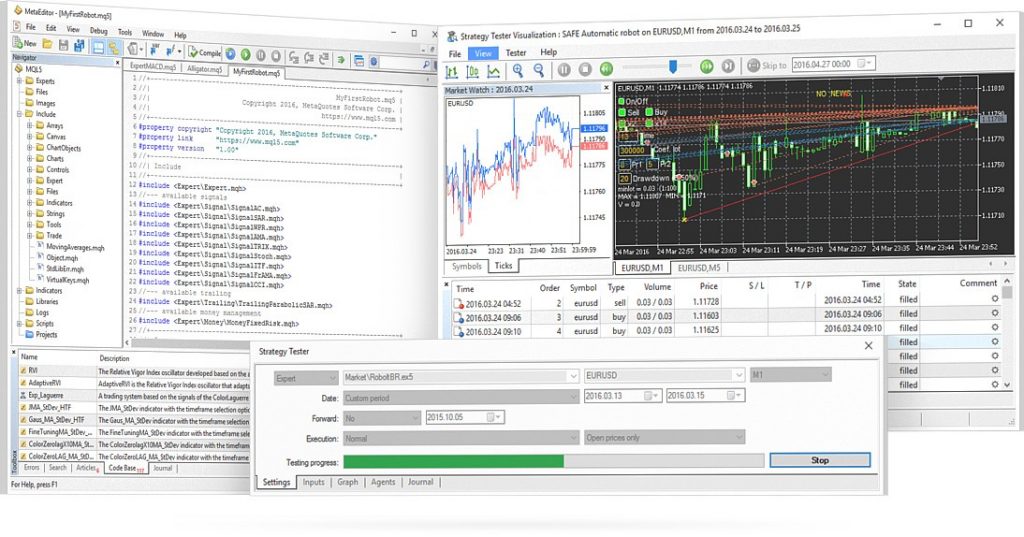

Automated Trading

Automated trading algorithms and bots are on the rise. In fact, algorithmic trading has accounted for over 70% of trades in US equity markets in recent years. And while robots were primarily used by large institutional investors, there is a growing number of tools to support retail traders.

Automated trading software essentially scans the markets and executes trades based on specific instructions and criteria. This removes much of the manual research and execution for traders as well as offering around the clock access to markets and freeing up time to focus on other investment activities. Automated copy trading then takes it one step further and allows retail investors to mirror the positions of established traders.

Brokers like AvaTrade offer tools such as DupliTrade and ZuluTrade which automatically follow other traders’ signals and strategies in real-time. The former is also compatible with the MetaTrader 4 terminal.

MetaTrader Automated Bots

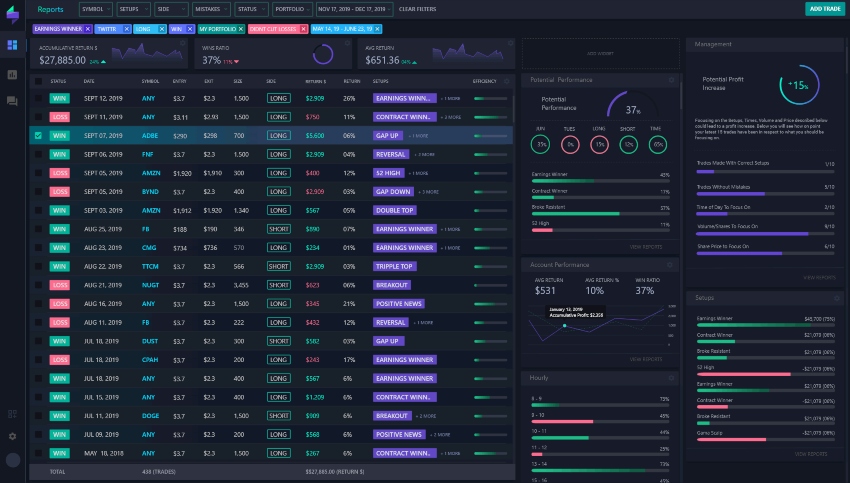

Recording

Brokers with third-party trading software may also offer recording or journalling software. This is particularly useful for experienced, high-frequency traders looking to analyze their performance or collate information for tax purposes. Integrated tools can track all relevant order information including:

- Profit and loss

- Position size

- Leverage

- Asset type

- Entry and exit times

- Spreads and commission charges

Among the best brokers that offer this type of third-party software are Forex.com and Plus500 which both provide access to TraderSync.

TraderSync

Arbitrage

Arbitrage software can be used to generate returns from the lack of a centralized exchange in forex and crypto markets. Tools essentially capitalize on the price discrepancies quoted on different platforms. Unsurprisingly, this requires powerful hardware that can scan the markets before buying and selling positions over a short period.

The top brokers that provide third-party arbitrage software also offer a free virtual private server (VPS) so trading can take place 24/7 without delays or interruption.

VantageFX and PrimeXBT both support arbitrage trading.

Complete Trading Packages

Many of the best brokers with third-party trading software use platforms that combine several functions. This is so that customers can carry out all their trading and information collection on one platform.

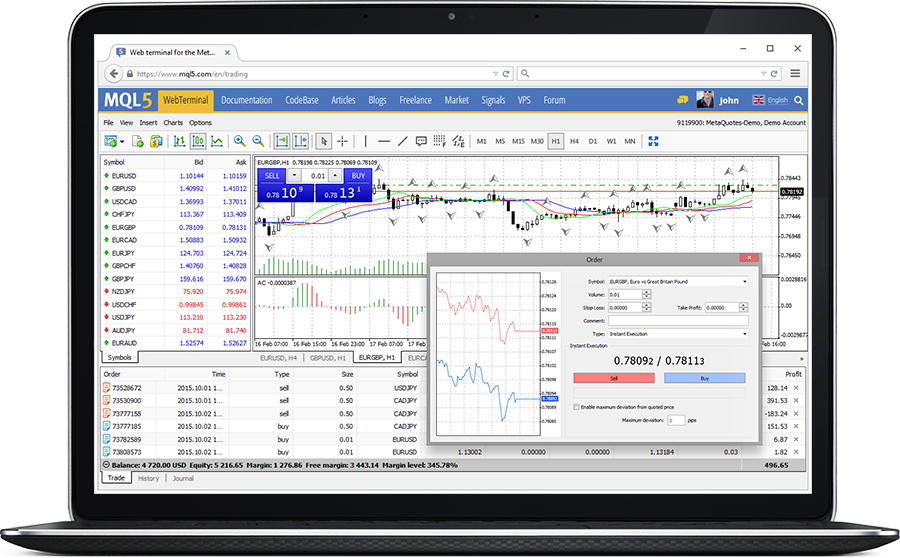

Software such as MetaTrader 4 and MetaTrader 5 are two of the world’s leading platforms where retail traders can conduct their own technical analysis and execute trades. Clients can view years of historical data on customizable charts and overlay various built-in and custom indicators. The platforms also offer trading signals, mobile alerts, news feeds, and automated trading capabilities.

Pepperstone and Eightcap are popular firms that offer access to both MetaTrader 4 and MetaTrader 5.

MetaTrader 4

What to Look For in Trading Software

Consider the following factors when choosing between brokers with third-party trading software:

- Function – What do you need from a tool? Do you need advanced charting capabilities? Do you want to automatically capture all trading information? Perhaps you need a social trading application where you can discuss strategies with veteran traders?

- Features – Consider what makes this particular piece of software different from an integrated platform. For equity trading, does it offer an advanced stock screener, for example? For automated trading, does it offer deeper and more extensive historical data and back-testing capabilities?

- Capacity – If provided for free by your broker, there may be a limit to the amount of data you can extract or the extent of features available. Some brands sign up for a basic package rather than the full suite of tools, tips and tricks offered by some software solutions.

- Cost – The top brokers with third-party trading software provide free access to additional tools. However, some brokerages charge extra for bespoke software. This could include a one-off fee for unlimited access or a weekly or monthly subscription charge. Importantly, make sure you factor in any costs when calculating potential returns. A useful tip for automated trading is to head to websites like GitHub where you can find free, open-source scripts.

- Reviews & ratings – It can be difficult to know how reliable or useful third-party software is before using it. However, if it comes with a hefty price tag, it could be worth looking for customer reviews and ratings online. Alternatively, check whether there is a trial period.

Benefits of Third-Party Trading Software

- Choice of brokers – Because popular third-party trading software is available at many brands, you have more choice and freedom to find a provider that meets your requirements. There is a long list of online brokers that offer the cTrader investment platform, for example, including IC Markets.

- Community library – Many charting software packages, in particular, are home to a vast library of community-created indicators, signals and alerts. These libraries are populated with tools from thousands of aspiring and established traders spanning multiple markets and strategies.

- Advanced tools – Compared to brokers’ proprietary programs, third-party software usually offers more powerful and sophisticated features. Additional solutions also tend to offer more customization and can be tailored to specific markets, such as major forex pairs. So for investors needing a bit more than their broker’s existing tools, third-party trading software can be a big draw.

Drawbacks of Third-Party Trading Software

- Cost – Using closed-source third-party software can come with large subscription fees, with some services costing several hundred dollars a month. These will likely be out of reach for many beginner traders.

- Compatibility – You may encounter compatibility issues when integrating third-party add-ons with your primary trading platform. There may also be specific hardware and software requirements. With this in mind, it’s worth checking compatibility requirements before downloading any new software. Fortunately, the top brokers provide detailed how-to guides and tutorials to help you get set up with new software.

- Complexity – Advanced algorithms and high-frequency trading applications, in particular, can be complicated to understand. They can require a steep learning curve and a great deal of upfront investment in terms of time. This means they aren’t suitable for many novice traders.

Bottom Line on Brokers With Third-Party Trading Software

Brokers for third-party trading software are perfect for clients looking for advanced customization and specialization. Additional charting and analysis packages are particularly popular, though copy trading terminals are also on the rise. But before buying and downloading any new software, it’s worth checking if your broker’s existing package doesn’t provide you with the tools you need. We also recommend looking for integrated software packages and free trial periods to reduce costs and upfront setup challenges.

FAQ

What Is The Best Third-Party Trading Platform?

Is Third-Party Trading Software Safe?

Most of the well-known and reputable software providers provide a relatively secure service with a large user base and positive reviews. That includes solutions like MT4, MT5, cTrader, TradingView, Trading Central, DupliTrade and ZuluTrade. For tech-savvy traders, open-source software can also be inspected to make sure it will perform the intended function.

How Do I Integrate Third-Party Software With My Broker?

Brokers that accept third-party trading software will provide integration instructions on their website. This may be in the FAQ section if there is no dedicated area for platforms and tools. If you cannot find any information about integration, contact the broker’s support team. It is also worth pointing out that the top brands integrate tools automatically so minimal input is needed from you, as the investor.

Is It Possible To Code My Own Trading Software?

Some experienced traders with a good coding background develop their own custom software. This can be time-intensive and costly, but if successful, you can sell your indicators, signals or other trading solutions to investors on the MetaTrader Marketplace, among others. Alternatively, you could pay a freelancer to design and build software for you.

Should I Use Third-Party Trading Software?

Third-party trading software is typically more complex and specialist than integrated tools. For example, you could get access to advanced pattern recognition technology or arbitrage software to enhance your trading results. Despite this, the majority of third-party trading applications are geared toward experienced traders while the standard tools provided by online brokers will meet the needs of most beginners.