This guide will help you choose the best online brokers. Our guide breaks down key definitions and provides important comparison points. We have also listed the top platforms for trading stocks, forex and other markets in Europe, the UK, the USA and beyond. Use our comprehensive online broker reviews to start swing trading today.

Online Brokers Explained

Trading brokers connect retail investors with popular financial markets, such as stocks and shares, forex pairs, precious metals such as gold, plus cryptocurrencies like Bitcoin. Some platforms offer sophisticated trading tools and hands-on support while other brands, such as discount brokers, simply execute your trades to keep costs down. Ultimately, the ‘best’ online broker will depend on your individual trading requirements,

Importantly, finding the right online broker can make or break your trading experience. Get it wrong and you can pay high fees that eat into your profits, or worse, you may fall victim to online scams run by unregulated providers. Fortunately, the rewards for choosing wisely are plenty, from competitive trading conditions and powerful investing tools to enticing sign-up offers and user-friendly mobile features.

Comparing Online Brokers

Reviewing trading platforms based in Australia, India, Canada, the UK and beyond, can feel daunting. Some are aimed at beginners while others focus on particular assets like stocks or currencies. Equally, some online brokers offer automated trading bots while others provide high leverage rates and zero commissions. But to help you make the right choice, we have compiled a list of key considerations:

Trading Fees

Costs are one of the most important factors. Some online brokers offer a floating, market spread where they apply a mark-up to make a profit. Other platforms offer zero-pip spreads with fixed commissions instead. The key thing is to check that the pricing schedule is transparent and that there aren’t hidden charges, such as inactivity fees and mutual fund rates. It’s also worth pointing out that certain countries, such as India, typically charge an annual account maintenance fee.

Finally, swing traders should consider rollover rates, also known as overnight fees. This is a charge for holding positions open over night and it can erode profits.

Minimum Deposits

Another aspect to consider is the minimum deposit requirement. While you can get started at some online brokers with just a $10 payment, other brands require deposits exceeding $1,000, with Interactive Brokers enforcing a $10,000 minimum deposit. For beginners, in particular, we recommend signing up with a platform that has a low minimum deposit requirement.

Market Access

The best online brokers usually define a few asset classes that they specialize in, such as forex or equities. Importantly, make sure that the platform offers exposure to the markets that you are interested in, for example, stocks listed in New Zealand, Hong Kong, Japan, Mexico or Singapore. It’s also worth considering the financial instruments available, from leveraged CFDs and ETFs to spot trading.

Finally, an emerging class of retail investors are increasingly interested in cryptocurrencies and DeFi products. These traders may want to register with a provider that offers a mix of traditional and modern assets, such as eToro.

Security

Safety and security and paramount. Your online broker should protect your funds and personal data through website encryption, two-factor authentication at the login stage, plus segregated client accounts.

It’s also worth checking whether the trading platform offer negative balance protection, meaning you can never lose more than your account balance. Fortunately, many of the top brokers offer this service, including Pepperstone and XTB. All EU regulated brokers are also required to offer negative balance protection.

Regulation

With so many online brokers and trading platforms available in 2025, it is inevitable that some may be untrustworthy and running scam operations. As a result, you should always trade with a broker that is licensed by a reliable regulatory authority. This should be clearly stated on each broker’s website, along with their respective license number.

Of course, some financial agencies are more highly regarded than others, with top watchdogs including the Cyprus Securities and Exchange Commission (CySEC), the UK Financial Conduct Authority (FCA), and the Australian Securities and Investment Commission (ASIC). The best trading companies, such as Pepperstone, usually hold licenses with several top-tier regulators.

See further below for more guidance on regulations.

Customer Support

If something goes wrong with your account or the platform is down, a reliable support team can prove invaluable. It is also important to know when the team is available. Plus500, for example, offers help 24/7 through email and live chat. Some of the top platforms now also provide assistance through social media channels, as well as traditional avenues like telephone.

Depending on where you are trading from, you may need support in a different language to that of the country the broker is located in. If this is the case, look for a brokerage with a multi-lingual support team. AvaTrade, for example, offers support in 15 languages.

Deposits & Withdrawals

The quicker a deposit is processed, the sooner you can start trading. The same applies for withdrawals, though these tend to take at least one working day at most brokers. Providers that accept payment methods like PayPal and Skrill tend to offer the fastest deposits, with instant account funding.

Importantly, the top online brokers offer a decent range of payment methods, from traditional solutions like wire transfer or debit card to e-wallets like Neteller. Some brands, such as FXTM, also offer local payment solutions like M-Pesa for traders in South Africa.

Note, some swing trading brokers impose a daily or monthly limit on deposits and withdrawals. This means you can only deposit or take out a certain amount of money. This can be useful for keeping a cap on losses, but it may deter high volume traders.

Education

The top online brokers offer comprehensive educational materials that can teach you about new markets, how to refine trading strategies and how to manage risk. Sometimes these training packages are free and sometimes you have to pay. With that said, the best platforms usually offer a decent selection of educational resources for beginners at no charge. Binance, for example, runs its own training academy to help upskill new traders.

Bonus Schemes

Some online brokers offer sign-up deposit bonuses and account promotions. These can help you earn extra capital when you start trading. FBS, for example, offers loyalty programmes with cash rebates and trading rewards. Other firms run raffle promos and offer no-deposit bonuses.

Despite this, registration bonuses have been banned in some jurisdictions with the European Securities and Markets Authority (ESMA) preventing EU-regulated brands from offering welcome offers. Equally, the UK Financial Conduct Authority has cracked down on sign-up offers citing misleading withdrawal terms and conditions.

Trading Platforms

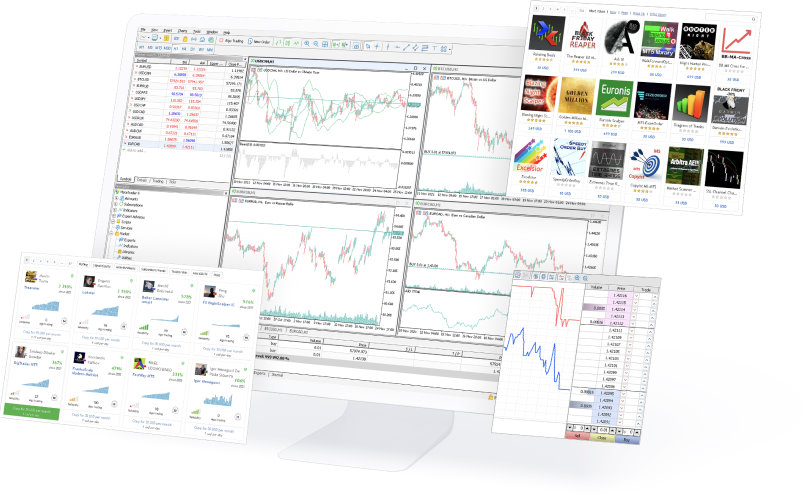

Behind every great broker is a trading platform facilitating trades and providing analysis tools. The software is used for all aspects of trading, including opening, managing, monitoring and closing positions. It is essentially your gateway to the financial markets. Some brands offer bespoke trading platforms while others use independent, third-party software packages.

Importantly, the platform should be easy to use and navigate. It should also offer a generous selection of technical analysis and drawing tools, plus instant and pending order types. The most popular trading platforms for retail investors in 2025 are MetaTrader 4, MetaTrader 5 and cTrader. All are reliable and suitable for beginners.

MetaTrader 4

Ask these questions to find a platform that works for you:

- What charting tools and indicators does the terminal offer? Look for interactive charting and one-click trading. Also check which technical indicators can be overlaid onto graphs and the level of customization on offer.

- Can you use automated and online copy trading systems? Automated copy trading comes in many forms, from EAs and robots to manual, custom-built scripts. AlgoTrader, for example, is designed to accommodate algorithmic and automated trading.

- Can you access historical market data? Price history can help inform future trading decisions. Rich data that shows previous trends can prove useful. cTrader, for example, offers eight years’ worth of historical data.

- Is there a news feed or economic calendar? Prices and technical data are not the only elements you need to consider. News and economic events can have a significant impact on the prices of various assets. The MT4 and MT5 platforms and top brokers come with a built-in news stream to help you keep on top of real-time events.

- How quickly are orders executed? Slow executions can lead to price slippage and missed opportunities. The best online brokers offer ultra-fast, high-quality order executions in less than a second.

Mobile traders may also want to check that the broker’s terminal is available as a free mobile app, compatible with either iPhone (iOS) or Android (APK). MT4, MT5 and cTrader can all be downloaded from the respective app store.

Trading Regulations

Regulations establish requirements that online brokers must adhere to. Regulatory authorities are effectively financial watchdogs. They ensure brokerages comply with rules that aim to protect financial market participants, such as retail swing traders. Each body supervises brokers within its jurisdiction. The Financial Conduct Authority (FCA), for example, supervises UK-listed brokers, as well as any overseas companies that want to operate in the UK.

If an online broker wishes to obtain a license, they must demonstrate that they can comply with the rules and regulations in place. If they are granted a license, they must continue to comply with all regulations. Failure to do so could result in fines or the license being revoked.

Online brokers can operate without a license if they wish. These are known as unregulated brokers, but traders should take caution before registering for an account as these firms do not offer the same level of protection, such as investor compensation schemes, leverage caps and segregated client accounts.

Some of the most highly respected regulators include:

- Financial Conduct Authority (FCA) – The FCA is the regulatory body for the UK and British traders.

- Monetary Authority of Singapore (MAS): MAS covers the majority of trading markets in Singapore.

- Securities and Futures Commission (SFC): The SFC oversees all trading regulations in Hong Kong.

- Financial Sector Conduct Authority (FSCA): The FSCA is the main regulatory authority in South Africa.

- Federal Financial Supervisory Authority (BaFIN) – The BaFIN is the regulatory authority in Germany and it complies with all EU laws.

- Malta Financial Services Authority (MFSA) – The MFSA regulates firms in Malta. It is popular among overseas brokers as an MFSA license covers all EU countries.

- Cyprus Securities and Exchange Commission (CySEC) – The CySEC regulates firms operating in Cyprus. Like the MFSA, a CySEC license covers all EU countries, making it popular amongst overseas providers.

- Australian Securities and Investments Commission (ASIC): ASIC is Australia’s main regulatory agency, covering everything from forex to futures.

- Commodity Futures Trading Commission (CFTC): The CFTC is a US regulatory authority that focuses on forex brokers.

- Financial Industry Regulatory Authority (FINRA): FINRA regulates stocks in the US, setting trading regulations and rules for firms like Robinhood.

In some cases, a license will cover an online broker in multiple countries. Firms regulated by a European Securities and Markets Authority (ESMA) approved authority are free to trade legally in any EU country, such as Luxembourg, the Netherlands, Cyprus, Ireland, Belgium, Germany, Spain, Greece, Sweden, Bulgaria, Slovenia and Poland. Essentially, with an ESMA license, brokers can trade in almost any country in Europe.

Not all countries have a well-regarded central financial authority. In these cases, trading brokers are free to operate if they obtain a license from one of the above bodies or an offshore watchdog. This is the case in the Philippines, Nigeria, Pakistan, Switzerland, Ghana, Zambia, Thailand, Egypt, Dubai, the UAE, the Bahamas, Oman, Qatar, Korea, Kuwait, Kenya, and Malaysia, among others.

Online Accounts

Brokers often offer a range of trading accounts. Once you have found a good provider, you will need to choose the right account for your needs. Below is a breakdown of the most popular account options.

Cash Accounts

A cash account is the standard account offered at most online brokers. They allow you to buy and sell assets with the capital you currently have. This is usually the default option at many brokers. The main benefit of a cash account is that it is easy to open, understand and maintain. In addition, there is less risk as you do not trade with leverage or margin. On the downside, you usually have to wait for funds to settle before you can trade again.

Margin Accounts

Margin accounts are available at many of the top trading brokers. They allow you to increase your position size and trade with borrowed capital. Whenever you place a trade, you will have to put down a margin requirement or deposit, and then you can trade with additional funds loaned from the broker. The main benefit here is that you can increase your returns on winning trades. Of course, the drawback is that losses are also amplified.

Note, most regulated brokers offer leverage up to 1:30.

Managed Accounts

With a managed trading account, you provide the capital while a professional trader makes the investment decisions. This means you do not have to worry about researching potential trades, making them popular with beginners and those with less time.

There are two main types of managed accounts: Pooled funds accounts place your capital in a pot with other traders’ capital, and returns are then distributed between investors. With individual accounts, on the other hand, your personal capital is individually managed by another trader.

With both options, you can choose a level of risk that you are comfortable with. On the downside, managed accounts can require a significant capital outlay.

Islamic Accounts

Islamic accounts, also known as swap-free accounts, are created with Muslim traders in mind. This type of account is compliant with Sharia Law, ensuring you can trade without overnight charges. However, with this account option, you may be limited as to the assets and markets that you can trade.

Demo Accounts

Most retail brokers offer free demo accounts or virtual trading. This type of account is a great way to test a broker or trading platform. You do not risk real capital, instead, you trade with virtual cash. These accounts are also a great place to practise any strategies you may wish to implement.

How Online Brokers Work & Make Money

Online brokers have different business models, though there are two main types: Over-the-counter (OTC) brokers and Market makers

Online OTC Brokers

OTC brokerages are the most popular providers around and most discount brokers fit into this business model. These firms are primarily attractive because they tend to have low costs with sometimes no commission. Of course, this begs the question, how do they make money?

OTC brokers are essentially always betting against you. They take the opposite side to your trade. For example, if you were to speculate that the price of Apple stock will rise, they would take a short position. This is the why you don’t have to pay a commission or fees – the broker is trading against you and makes money when you lose.

Market Makers

Market makers are the key other business model. Each asset is given two prices, the bid price, which is slightly lower than the actual price, and the ask price, which is slightly higher. Traders buy assets at the ask price and sell at the bid price and the broker makes money through the difference, also known as the spread. When thousands of trades take place, the spreads add up and can generate decent returns for online brokers.

Market makers typically use two forms of spreads; fixed and variable. Fixed spreads do not change regardless of how the market is behaving. As a result, they are usually wider. Variable spreads, on the other hand, move with the market. Increased liquidity means spreads tend to get tighter, while if liquidity decreases then spreads will widen.

Online Brokers Verdict

It’s worth devoting time to comparing and researching the best online stock and forex brokers in the USA, UK, Europe and beyond. This will ensure you can invest with competitive trading conditions and in a relatively secure and regulated environment. One useful tip is to sign up for a free demo account to trial a broker’s services before registering for a real account.

FAQ

Can You Have Two Online Brokers?

Online brokers have, in part, become popular because you can open accounts with two or more providers. There is essentially no limit on how many trading platforms you can register with. Instead, you are more likely to be restricted by your trading capital and the assets on offer. For example, do you want a broker that trades Canadian penny stocks? Alternatively, do you need a platform offering fractional shares?

Are Online Brokers Good?

Most global trading brokers are reliable and offer a relatively secure service. The top 3 or 5 online stock and forex brokers offer competitive trading conditions with the lowest fees and sign-up offers to entice new customers. Of course, as with any industry, there are some bad eggs so read our detailed reviews to avoid getting caught out by the ‘cheapest’ brokers.

Which Online Brokers Offer Free Trades?

Some trading platforms may offer free trades to incentivise new investors. These trades can usually be placed on select stocks and assets and may come with specific withdrawal conditions. See our reviews to find the top brokerage promotions.

Which Is The Best Online Broker?

There is no simple answer to this as different brokers will suit different investors. As a result, it’s important to take your time researching each provider while considering our comparison points above. You can also see our list of the top online brokers in 2025 to get started today.

Where Can I Find Broker Reviews?

Our website contains detailed reviews of the best online brokers and trading platforms. We break down fees, margin rates, payment options, market access and regulatory licenses. Our reviews help traders make an informed decision about which brand to open a live account with.